While Global Navigation Satellite Systems (GNSSs) are dominating the scene for outdoor Location-Based Services (LBS), including automotive navigation and smartphone applications, new technologies, commonly called Real-Time Location Systems (RTLS), are making inroads to support new high-accuracy location use cases, such as asset and material tracking, personnel tracking, vehicle and fleet tracking, tool and equipment tracking, indoor navigation, and proximity services. Typical end markets that will benefit from RTLS solutions include manufacturing campuses, airports, hospitals, warehouses, oil & gas sites, and other smart building spaces.

While many existing RTLS deployments require different technologies for indoors and outdoors, 5G positioning is emerging to make LBS more accurate, precise, reliable, and seamless across both indoor and outdoor environments. This article assesses the market opportunities and challenges of key RTLS technologies. Particular attention is dedicated to 5G positioning as a technology that could potentially disrupt the market and cater to large-scale deployment across multiple industries.

The Current State of the RTLS Market and Use Case Requirements

The market for RTLS infrastructure is expected to approach a staggering US$13 billion in revenue by 2025. The market has, so far, attracted hundreds of startups and small players developing various location software algorithms and hardware technologies, including Bluetooth, Wi-Fi, Ultra-Wideband (UWB), Visual Light Communication (VLC), acoustic sensors, and geomagnetic sensors.

Each RTLS use case has its own requirements. Applications that include Automated Guided Vehicles (AGVs) and mobile robots, worker safety applications, tool tracking, forklift location, access control, and high-value production monitoring and compliance can all benefit from Centimeter (cm)-level precision technologies, such as UWB, whereas other less precise technologies can be leveraged for broader logistics and asset tracking applications, lower-value assets, and more scalable implementations that require less stringent accuracy.

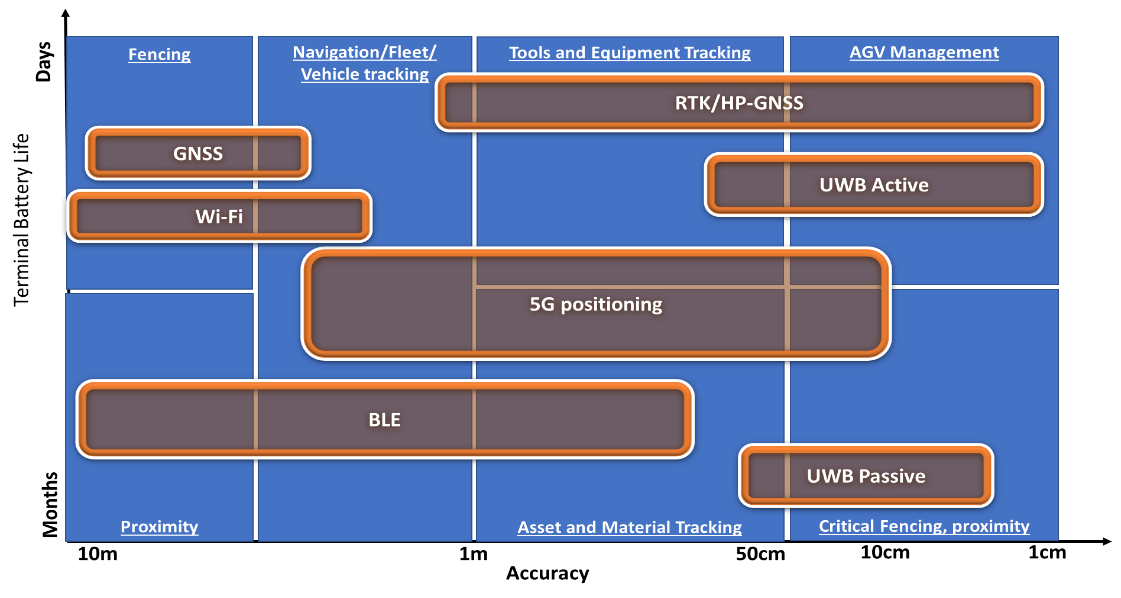

Mapping Different RTLS Technologies by Power Consumption and Accuracy Performance

Source: ABI Research

Although RTLS equipment (e.g., anchor-points, tags, and gateways) are now offered at relatively acceptable price points, a lot needs to be done to overcome some major barriers, including technology complexity, fragmentation of enabling technologies, and the still high cost related to installing RTLS infrastructure and its maintenance. The power consumption of RTLS tags and end devices is also a key priority that has not been properly addressed for all existing technologies so far. These energy-constrained terminals are supposed to sustain battery life for several months or years, not just weeks or days.

All of the barriers mentioned above are constraining the RTLS ecosystem from developing and flourishing. Players addressing this market are struggling to generate scale for their products. The spread of COVID-19 has worsened the case for these players as lockdown measures have made it difficult for them to implement their equipment in the marketplace.

This is exactly where 5G positioning could make a difference. This standard-based approach, inherently anchored in 5G telco infrastructure, will enable 5G positioning to benefit from the global and large-scale deployments of 5G, making it hard for alternative technologies to compete in terms of cost and performance. In addition, 5G will be able to address all RTLS use cases by using a single simplified infrastructure, rather than deploying numerous RTLS solutions (e.g., UWB, Bluetooth Low Energy (BLE), Wi-Fi, etc.) that are often use case-specific and require heterogeneous equipment (e.g., tags, anchor points, and gateways).

Market Horizon for 5G Positioning

Standards Evolution and Market Deployment

By leveraging the advantages of 5G communication, 5G positioning can potentially achieve low-latency, up to cm-level horizontal accuracy, and up to floor-level vertical accuracy. The technology promises to handle asset tracking and communications functions under the very same cellular infrastructure. The first wave of 5G positioning specifications, dealing with above meter-level location accuracy, is now frozen under the 3rd Generation Partnership Project (3GPP) Release 16 framework, while sub-meter-level accuracy specifications are currently being studied under 3GPP Release 17.

Countries ahead of the curve in deploying 5G infrastructure will see the first commercial applications of 5G positioning by 2022, with the first use cases to include workers’ safety, emergency rescue, and vehicle management.

Once Release 17 is frozen, 5G positioning will be able to entrench progressively into indoor environments starting from 2023. This new wave will unlock one of the largest potential markets: industrial and warehousing applications. Industrial applications can only take place after Ultra-Reliable Low-Latency Communication (uRLLC) and Massive Machine-Type Communications (mMTC) become widespread, with local private 5G networks for machine automation, Internet of Things (IoT) sensor monitoring, and digital factory cloud services serve as stepping stones to 5G positioning.

Opportunities and Challenges

5G positioning will inherit many advantages of 5G infrastructure that could potentially enhance its accuracy, including:

- Large cell site density to enable better positioning accuracy through rich and diversified anchor points available for generating and processing positioning.

- The deployment of massive Multiple Input, Multiple Output (MIMO) and beamforming, which could enhance the direction accuracy for algorithms like Angle of Arrival (AoA) and Direction of Arrival (DoA).

- The use of high-frequency channels by 5G networks, which could contribute to better accuracy trough reduced channel sparsity due to better array gains.

- Large bandwidth provided by a 5G network could offer better multipath resolution and, therefore, high accuracy for measuring distances, which again could contribute to improving the accuracy of positioning measurements.

- Single infrastructure handling positioning and telecommunication functions, which will not only help in lowering the overall infrastructure cost, but could open the doors to a plethora of new geo-information applications.

These assets will enable 5G positioning to follow the overall 5G steps and create brand new opportunities in industrial asset tracking and commercial automation applications. These two applications are core for composing the Industrial IoT (IIoT) picture that will allow business owners to monitor and locate workers, assets, and tools in real time with a high level of accuracy. Coupled with IIoT software platforms, this can empower businesses to increase automation and enhance the efficiency of their factory processes.

What Are the Challenges?

While opportunities lie ahead for 5G positioning, the industry needs to address several challenges to tap into the full potential of the technology, and chief among them are the following:

- Power Consumption: The industry has set a strong foundation for 5G positioning standards through several 3GPP Technical Specifications (TSs) addressing various service-level requirements, including horizontal and vertical accuracy, network availability, User Equipment (UE) velocity, and service latency. However, 5G positioning standards are lacking an important framework dedicated to low-power specifications. For example, it will be highly desirable to introduce new 5G study items specifying the frequency and energy required for producing and processing position-related data and how the processing of this data should be distributed and shared between the anchor points and the terminal to preserve the terminal battery life without compromising the overall positioning accuracy. Without such specifications, the value proposition of 5G positioning could be eroded and its market opportunities restricted to a very limited number of use cases. Early 5G tags and positioning terminals, anticipated for commercial deployment in 2022, may not be optimized to meet the stringent low-power requirements of certain RTLS use cases, such as material management or asset tracking. This could make the use of these terminals almost non-practical for these use cases because they are required to offer months, not weeks of operation without the need for charging or upgrading the device battery.

- Infrastructure Cost: 5G positioning will present a strong value proposition to large enterprises with strategic plans to transform their businesses and digitize their operation processes. 5G will enable them to rely on a single infrastructure for both communication and positioning needs. However, 5G could be cost-prohibitive for Small and Medium Enterprises (SMEs) that cannot afford to upgrade their infrastructure to wholly-digitized operation processes all at once. These players may instead choose to deploy more cost-efficient radio-in-the box equipment tailored to their specific requirements, such as enabling 5G positioning, provided by smaller system integrators that may be lacking expertise in radio systems. Any unspecified protocol stacks under 5G standards, such as low-power positioning, will be a challenge for them to integrate without compromising the terminal battery life, the system accuracy, or both.

Low-power specifications are essential for extending the deployment of 5G positioning to power-constrained devices, including tags and less intelligent terminals that require months of battery life. Without these specifications, vendors of 5G terminals may face a serious challenge in balancing between the level of accuracy required for RTLS use cases and the overall power consumption of these terminals. ABI Research recommends that key contributors to 3GPP standards address the low power 5G positioning issues, so solution providers can compete adequately with short-range wireless technologies that currently support RTLS tags and provide months or even years of battery life. Once the terminal power consumption issue is addressed, the value proposition of 5G positioning will be strengthened across a variety of applications; otherwise, business opportunities for the technology could be jeopardized and its market potential could be limited to a handful of use cases and markets.

About Malik Saadi: Malik Saadi, Managing Director and Vice President, Strategic Technologies, is focusing on technology innovation across various industries, including telecommunications, consumer electronics IoT, and other emerging industries.

With more than 16 years of experience in the telecommunications and computing industries as a technology expert and analyst, he guides his research team toward uncovering the impact of technology innovation on different industries and markets, with the ultimate goal is to provide clients with both quantitative and qualitative vision of the overall market development and how the various technologies involved will empower this development.