Smart home technolgies have traditionally been offered by providers to homeowners in the Business-to-Consumer (B2C) space. However, within the last 5 years, there has been a shift toward offering smart devices and software to apartment owners/managers, with a Business-to-Business (B2B) marketing angle. The age of smart apartment solutions is well underway.

The National Apartment Association reports that 84% of renters want to have smart home technologies within their units, exemplifying the potential for anyone in rental property management to attract and retain more occupants. And based on ABI Research’s findings, the number of smart apartment solutions being installed will grow at a Compound Annual Growth Rate (CAGR) of 54.2% globally between 2022 and 2030.

Revenue Model for Players Offering Smart Apartment Solutions

For now, the greatest beneficiaries and adopters of smart apartment solutions are large-scale Multi-Dwelling Unit (MDU) owners and investors, as these rental properties will yield the most immediate results. The major players offering smart home technology, such as iApartments, are focused on Monthly Recurring Revenue (MRR) for each apartment.

Rental property managers often choose to bundle the US$8 to US$15 cost for the technologies into the rental charge for tenants. But when non-essential services are being offered, an additional subscription-based package to residents between US$25 to US$50 per month is typically the norm.

How Are Smart Apartment Solutions Being Used by Consumers and Property Managers?

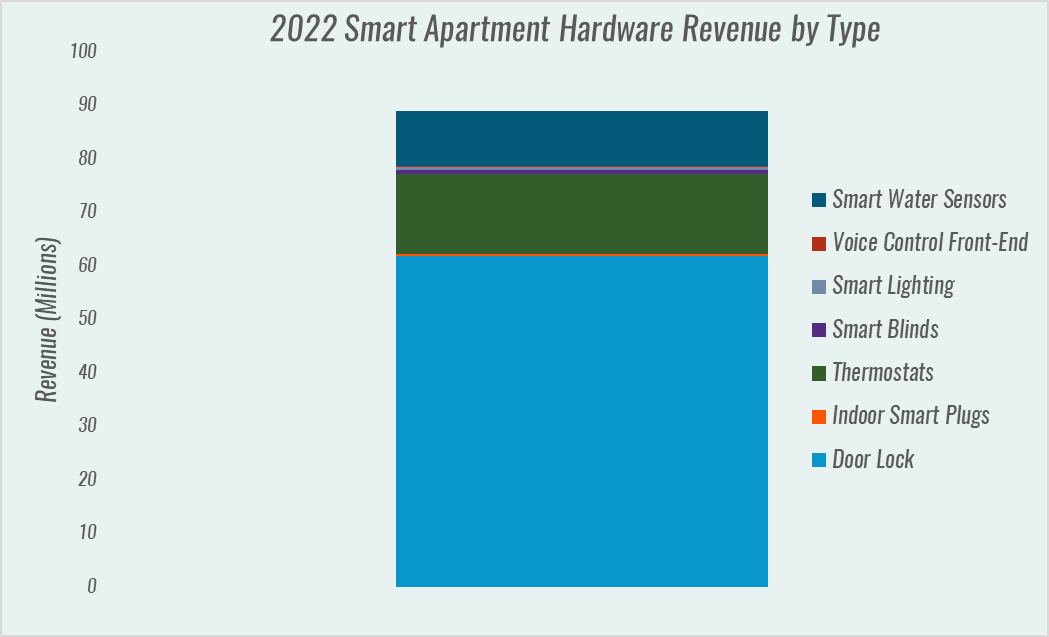

Smart apartment solutions serve the same purpose as any smart home application—enabling people to control various aspects of their residency using technology. Security is, by far, the biggest area where smart technologies are being applied in apartment buildings/MDUs, with smart locks accounting for 69% of all hardware sales in 2022. Smart locks allow users to lock and unlock a door remotely without the need for a physical key. Not only is this solution helpful for residents, but also for building management purposes to access various rooms.

Residents of MDUs can control their energy usage through smart apartment solutions as they can manage thermostats, radiator controllers, smart blinds, smart lighting, smart appliances, and more. Apartment owners and managers can optimize heating/cooling needs by the number of occupants. Moreover, energy isn’t wasted on vacant units. Relatedly, hotel chains are also leveraging these technologies to reduce their energy footprint and attracting customers.

Given the concerns that came along with the COVID-19 pandemic, some focus has been turned to three key areas that smart apartment technologies can potentially resolve:

- Remote property viewings

- Health management through air quality and waste sensing

- Touchless access control

Benefits of Smart Apartment Solutions for Rental Property Managers

First and foremost, smart apartment solutions cut down on operational costs for rental property managers. Automating Heating, Ventilation, and Air Conditioning (HVAC) and water leak sensors can help control energy costs associated with an MDU, and lower insurance rates. At the same time, owners don’t need to rely as much on attracting and retaining trained operational staff members.

With the growing preference for smart home technologies, implementing smart devices in apartments increases property value. These technologies also allow the possibility for virtual self-guided tours, allowing potential tenants to view the property at their convenience.

Smart systems will be key to the future of apartments as it becomes more common for local and national authorities to require residential housing owners to report their environmental impact. This type of smart apartment solution can record building environmental factors, such as air quality and energy consumption stemming from connected devices in the smart apartment. That way, owners and managers can take action and provide full transparency on their carbon footprint.

Connectivity Options to Consider Before Deploying Smart Apartment Solutions

In the United States, Z-Wave is the preferred option when it comes to connectivity for a smart apartment solution. Z-Wave is already well-established and trusted by industry players and there’s already a significant number of Z-Wave-enabled devices on the market. Going forward, the acceptance of Matter—the new interoperability protocol that allows many smart home devices in different ecosystems to work seamlessly with one another—will make Z-Wave, and Thread for that matter, major factors in the coming years. A great benefit of Z-Wave and Thread is that they use a lower radio frequency, which reduces congestion.

Although Z-Wave is and will continue to be the preferred connectivity solution for smart apartment connectivity, Wi-Fi and Bluetooth are not going anywhere. Whereas Z-Wave will reach US$48 million in annual revenue by 2030 in the device segment, Bluetooth and Wi-Fi will reach US$19 million and US$33 million. For controllers, Wi-Fi and Bluetooth edge out Z-Wave and it will remain that way.

Why Smart Apartment Solutions Are a Win-Win

At the end of the day, homeowners and renters are not any different. Everyone is open to making their own lives easier—and smart home technologies do the trick. Rental property managers are beginning to realize the potential in investing in smart apartment solutions as property value will increase and operational costs will decrease. Further, there’s an excellent opportunity to upsell tenants with add-on connectivity services through a monthly SaaS-like pricing model.

As renters, like homeowners, seek properties with smart devices, MDUs that don’t include these technologies may see high rates of vacancy as potential tenants choose apartments and apartment buildings that do. But the good news is that investment in smart apartment solutions is taking off rapidly and the market has become a lot more competitive, which provides customers with more options at more budget-friendly price points. To learn about who the key smart apartment players are, how their solutions are being used, and where the market is going, download ABI Research’s Smart Apartments and Multiple Dwelling Units analysis report.