Update: All ABI Research forecasts in this article have been revised to reflect 3Q 2025 estimates.

When it comes to the robotics market, automation-enabling devices like cobots and 5G robots tend to garner a lion’s share of the attention. However, there is one technology that has flown under the radar yet is poised to make just as big of an impact – exoskeletons. By 2030, global revenues will reach more than US$2 billion in this emerging market, with industrial use cases being a major catalyst.

What Is an Exoskeleton?

Exoskeletons are a type of augmented technology designed to bolster human performance in physically demanding tasks by supporting body parts like the hands, lower back, legs, and upper body. This reduces the energy needs of workers when lifting, transporting, and holding tools, boxes, and other industrial assets safely. With this deployment, the frequency of musculoskeletal disorders is significantly reduced.

Now consider the astounding monetary loss that work-related musculoskeletal disorders (WMSD) can cost a company. According to Injury Facts, injuries cost companies US$163.9 billion per year collectively. It can be broken down into the following:

- US$44.8 billion for wage and human performance loss

- US$34.9 billion in medical expenses

- US$61 billion in administrative expenses

Because an exoskeleton supports and protects the body, it can save manufacturers, logistics firms, and other enterprise users a substantial amount of money on the loss of productivity and injuries.

Figure 1: Warehouse worker using a wearable exoskeleton device for lifting a pallet, relieving the hands, arms, legs, and back from strain.

Types of Exoskeletons and How They Work

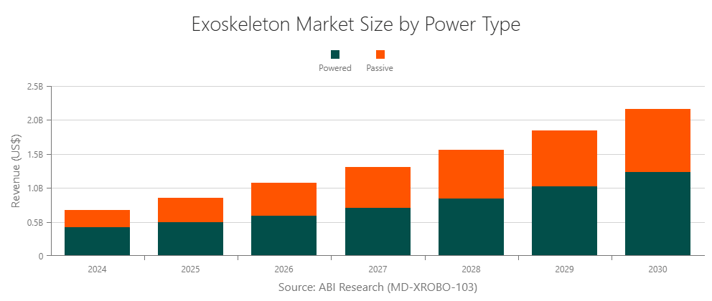

There are two distinct types of exoskeletons – passive and powered. The passive variation do not have any power source, and they serve mainly to increase strength and provide stability to end-users. On the other hand, active (powered) exoskeleton technology utilizes some form of energy to power sensors, actuators, and other tools. Most currently in use are passive, mostly because they are more affordable and they address specific challenges or use cases.

The future of exoskeleton design is to integrate them with the Internet of Things (IoT) to capture data and provide insights to leadership teams. Eventually, this technology will need to integrate with robotic arms, collaborative robots, and mobile robots through advanced location technologies, haptics, and gesture control.

Table 1: Passive vs Active (Powered) Exoskeletons

| Passive | Active |

| Mechanical, springs, etc. | Pneumatic, hydraulic, servo, and batteries. |

| Cost-effective, wide availability and adoption. | Sophisticated and come at a cost. Often require rental and RaaS model. |

| Assistive and gradual improvements to worker health. | A more ambitious and transformative technology. |

| Some concerns that passive suits create resistance that leads to discomfort. | Huge research expenditure and long time frames. |

Related Content:

Exoskeletons for Industrial Use Cases

Robotic Exoskeletons: Classes, Markets, and Applications

82 Technology Trends That Will And Will Not Shape 2024

Augmentation Over Automation

While most warehouse robots focus on automation, exoskeletons can help human workers by enhancing safety and productivity, especially in the industrial space. However, that sometimes goes hand-in-hand.

To that end, organizations such as NASA, Boeing, and GM have already started deploying passive exoskeletons and making them a standard part of their warehouse operations. Toyota is another company betting big on the technology, as they have deployed hundreds of suits designed by Levitate Technologies in manufacturing plants around the United States.

An Aging Workforce

Labor shortages were bad enough before the COVID-19 pandemic. The manufacturing workforce is considered quite old, meaning young people are not inclined to take warehousing jobs. To keep operations sustainable into the future, industrial and manufacturing companies need to try and increase the productivity of each worker. They also have to protect workers who are at high risk of musculoskeletal disorders. Fortunately, a human exoskeleton can help solve both these problems.

As warehouses and industrial work environments become more digitized, managers want to get their hands on more data points that can be used for strategic decision-making. Exoskeletons serve as the bridge between robotics and smart wearables placed on the human body, providing a holistic view of the performance of workspaces.

Advantages

Here are the advantages of exoskeleton technology in warehouse/industrial operations:

- Lumbar support in the form of chairless chairs and leg support

- Shoulder support

- Limb and ligament support via supernumerary robotics

- Tool holding with zero-gravity arms

- Motor movement (actuators and fuel cells)

The greatest advantage of these suits and components is the promised increase in human performance (workplace productivity). With less bodily fatigue and reduced energy needs, each individual worker can complete more tasks during a shift. Besides that, many tasks can simply be automated, which saves time and energy.

How Much Do Exoskeletons Cost?

ABI Research has looked at the Average Selling Price (ASP) of four key exoskeleton categories:

- Heavy Lift Powered Exoskeletons

- Medium Lift Powered Exoskeletons

- Light Lift Powered Exoskeletons

- Passive Exoskeletons

Then, we broke each category down into three types: lower body, upper body, and full body. As you’d expect, powered exoskeletons cost significantly more than passive exoskeletons. Indeed, in 2022, the ASP for a heavy lift exoskeleton for lower body support is US$40,207. For a passive exoskeleton of the same type, that price falls to US$5,393. Similarly, a medium-lift powered exoskeleton serving full body support costs US$65,567, while passive varieties typically cost US$16,086.

Fortunately for enterprises looking to invest in these robotics technologies, the ASPs will fall. While a full body powered suit for heavy lifting costs US$65,567 today, the ASP will decrease by 7% through 2030—to reach a US$39,035 price point. Or take upper body exoskeletons of the light lift variety as an example. The current US$14,172 price will fall to US$11,722 by 2030.

To get a broader overview of the costs of exoskeletons, reference the table below.

Table 2: Average Selling Price (ASP) of Exoskeletons (2025 Forecasts)

| Type | Lower Body | Upper Body | Full Body |

| Heavy Lift | US$34,473 | US$28,284 | US$116,956 |

| Medium Lift | US$22,581 | US$30,650 | US$44,303 |

| Light Lift | US$18,760 | US$13,304 | US$30,458 |

Emerging Exoskeleton Providers

The deployment of exoskeletons must come with a fully technologically integrated approach. For example, tracking KPIs of a worker’s performance will require a visualization software platform. With an eye toward the future, two major suppliers are making inroads in the present. German Bionic Systems (GBS) and Sarcos are staking out a foothold in the industrial market. GBS has developed an IoT platform and will continue ramping up production now that it has a new factory.

Sarcos is beginning to test its products for military infrastructure through a slew of contracts with the U.S. government. The Japanese market is thriving through companies like Cyberdyne and Panasonic Atoun, while the opportunity presented by China is still in its infancy.

There are also other companies like Fourier Intelligence that have developed EXOPS, an open-source platform that helps reduce the time-to-market for manufacturers building from scratch. The EXOPS platform can also connect the exoskeletons with wearable devices like headsets and smart glasses.

Regional Expectations

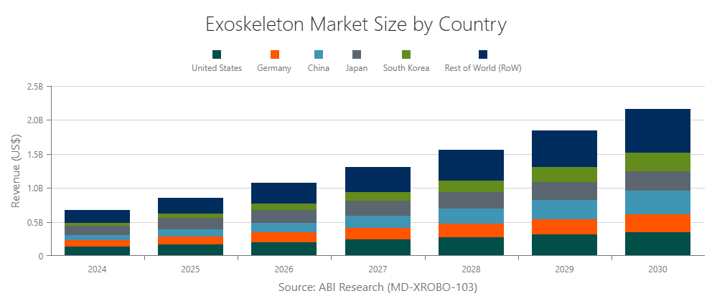

Worldwide, exoskeleton revenue is growing at a CAGR of 18 % between 2024 and 2030. The United States, Germany, China, South Korea, and Japan are the regions adopting exoskeletons the most, accounting for 73% of global revenue (US$850 million) in 2025. By 2030, that number will go down to 70% of global revenue (US$1.5 billion) as later adopters in some other countries cut into the market share. But that’s not to say these regional leaders aren’t going to continue growing their deployments.

Industrial Exoskeletons Lead the Way in Revenue Forecasts

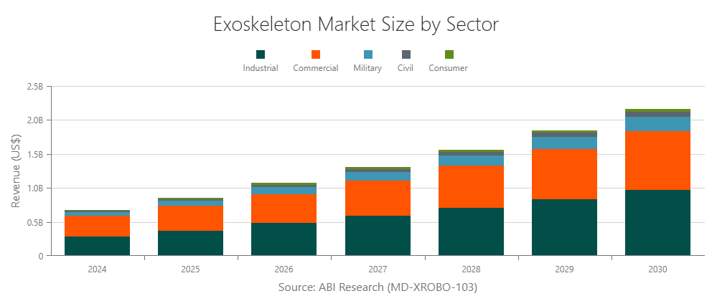

If you look at the chart down below, you'll see that investments in industrial exoskeletons are going to be explosive for the foreseeable future. According to ABI Research’s most recent market update, industrial shipments will hit 97,000 units in 2030, and revenue will be about US$971 million by the end of the decade. This makes the industrial market segment the biggest adopter of wearable robotics, closely followed by the commercial segment, then to a lesser degree, the military segment. Until 2026 comes around, the commercial market will hold the largest revenue potential, before the industrial space overtakes it.

Within the industrial segment, manufacturing (notably automobile and aerospace manufacturing) accounts for 68% of all exoskeleton shipments and revenue, followed by Construction, Oil/Gas, Energy/Utilities, Agriculture, and Mining.

Passive Exoskeleton Forecasts Versus Powered (Active) Exoskeleton Forecasts

Although passive exoskeleton shipments significantly outpace powered ones, it’s the latter that generates a greater amount of revenue across all verticals due to higher ASPs. For example, in 2025, there will be 50,000 passive shipments and just 17,000 powered shipments. Yet revenue for the latter will be US$143 million more than the former. As depicted in the next chart below, by 2030, powered revenue will reach US$1.2 billion, which is US$309 million more than passive revenue.

Challenges for Early Adopters

Between the added weight and the technical difficulty of implementing zero-gravity arms, exoskeletons can be difficult to deploy en masse, and it can even cause anxiety for workers. Companies may also find the investment in robotics and software technology a difficult pill to swallow as advancements in mechatronics is slower-paced than software innovation, hindering the maximum potential of exoskeleton deployment.

Another key challenge facing the market is the complication of calculating an ROI. How do you measure ROI? Is it fewer work-related injuries? Increased productivity? If it’s the latter, it can take years before seeing tangible results, making key stakeholders skeptical.

Infrastructure shortcomings will be the main issue for the Small-to-Medium Enterprises (SMEs) who are potentially the target mass market for exoskeleton products. To make sure that SMEs are capable of receiving and storing exoskeleton suits and components, vendors will need to strike up partnerships with ecosystem integrators or turn to in-house solutions.

Now, let's take a look at several examples of exoskeletons to provide a better overview of how the technology works.

Exoskeleton Example #1: Esko Bionics EVO

EVO, developed by Esko Bionics, supports the weight of a worker’s arms, which takes the load off of the worker’s shoulders and arms when lifting something overhead. Between 5-15lbs of lift assistance per arm can be achieved with the EVO vest. All the worker has to do is wrap the vest around the waist, allowing for a full range of motion when standing.

Figure 2: EVO Vest (Source: Esko Bionics)

Exoskeleton Example #2: Ottobock's Paexo Thumb

The Paexo thumb, made by another German company called Ottobock (who has acquired SuitX), reduces thumb strain by as much as 70% by diverting much of the forces to other parts of the hand. This exoskeleton example also highlights the need for protecting fingertips from mechanical impacts like clipping and plugging.

Figure 3: Paexo Thumb (Source: Ottobock Paexo)

Exoskeleton Example #3: Laevo FLEX and V2.50

Dutch-based company Laevo offers two products to support the back: Laevo FLEX and Laevo V2.5. FLEX is the better of the two iterations as it delivers 2x higher peak support torque and 3x more energy return than the Laevo V2.5. Laevo FLEX is designed to let workers walk kilometers every day without having to play with the on/off buttons. Further, Laevo FLEX enables dynamic lifting, it’s comfortable and flexible for all body shapes and is resistant to dust and water.

Figure 4: Woman wearing a Laevo FLEX suit while lifting a box (Source: Laevo)

Exoskeleton Example #4: Hyundai's VEX

Hyundai’s wearable Vest Exoskeleton (VEX) is designed to be much lighter than similar suits and uses a multilink lift assistant module to mimic human shoulder joint movements. With the VEX suit, production line workers gain more load support, mobility, and adaptability when performing tasks that deal with overhead (i.e; bolting the underside of a vehicle, fitting brake tubes, and attaching exhausts). Equipping a worker with the VEX suit is easy as can be because it’s worn just like a backpack.

Figure 5: VEX Exoskeleton Suit (Source: Hyundai)

Steps to Success

Many industries are facing a unique set of challenges, including labor shortages and an aging workforce. While exoskeletons have the potential to help combat these issues, technology providers must make sure that companies and other organizations can see the potential ROI of investing in the technology.

There must be a viable business model, increasing adoption of Robot as a Service (RaaS), and a demonstrable ability of both providers and end-users to draw insights from collected data. Establishing partnerships with the cloud providers and industrial platforms that will ultimately enable the value add-on needed to differentiate providers will also be key. Furthermore, organizations like the association for exoskeleton industries (VDEI) are important for developing standardization when it comes to best practices.

Many industries are facing a unique set of challenges, including labor shortages and an aging workforce. While exoskeletons have the potential to help combat these issues, technology providers must make sure that companies and other organizations can see the potential ROI of investing in the technology.

The focus now should be on creating a business model that supports Robot as a Service (RaaS), as it provides flexibility for end customers. Moreover, finding a way for vendors and end-users to use extracted data from their robotics is of paramount importance. Another key action to take is to strike alliances with cloud providers for enabling industrial platforms. That's because, in the end, new revenue streams from add-on services are not possible without the proper software infrastructure in place. Finally, standardization is crucial for developing best practices, with organizations like The Association for Exoskeleton Industries (VDEI) at the forefront.

Interested in more content on industrial robotics? Subscribe to our Industrial, Collaborative & Commercial Robotics service to gain access to our latest technology findings.