Forecasting where exactly the Electric Vehicle (EV) supply chain is going is a nearly impossible endeavor, with a wide range of unpredictable factors to consider, such as fuel prices, attitudes toward green energy, government policies, availability of charging stations, vehicle range, and vehicle affordability. One thing that can be concluded is that Original Equipment Manufacturers (OEMs) are going to focus on providing flexibility to consumers in order to gain market share. But the rapid development of so many new car models will place a tremendous amount of pressure on ecosystem partners that can’t meet demand in such a short time span, resulting in inevitable issues with the EV supply chain.

Why the EV Supply Chain Will Become Constrained for OEMs

Basically, what’s happening in the EV supply chain is that OEMs are ramping up EV production faster than suppliers can handle. Moreover, most OEMs with plans to introduce electric vehicles are also rolling out new Internal Combustion Engine (ICE) models simultaneously. Making matters worse, EV models require powertrain variants that are completely separate from existing ICE models. As an example, component scarcity has led to Tesla's halt of new vehicle production in 2022.

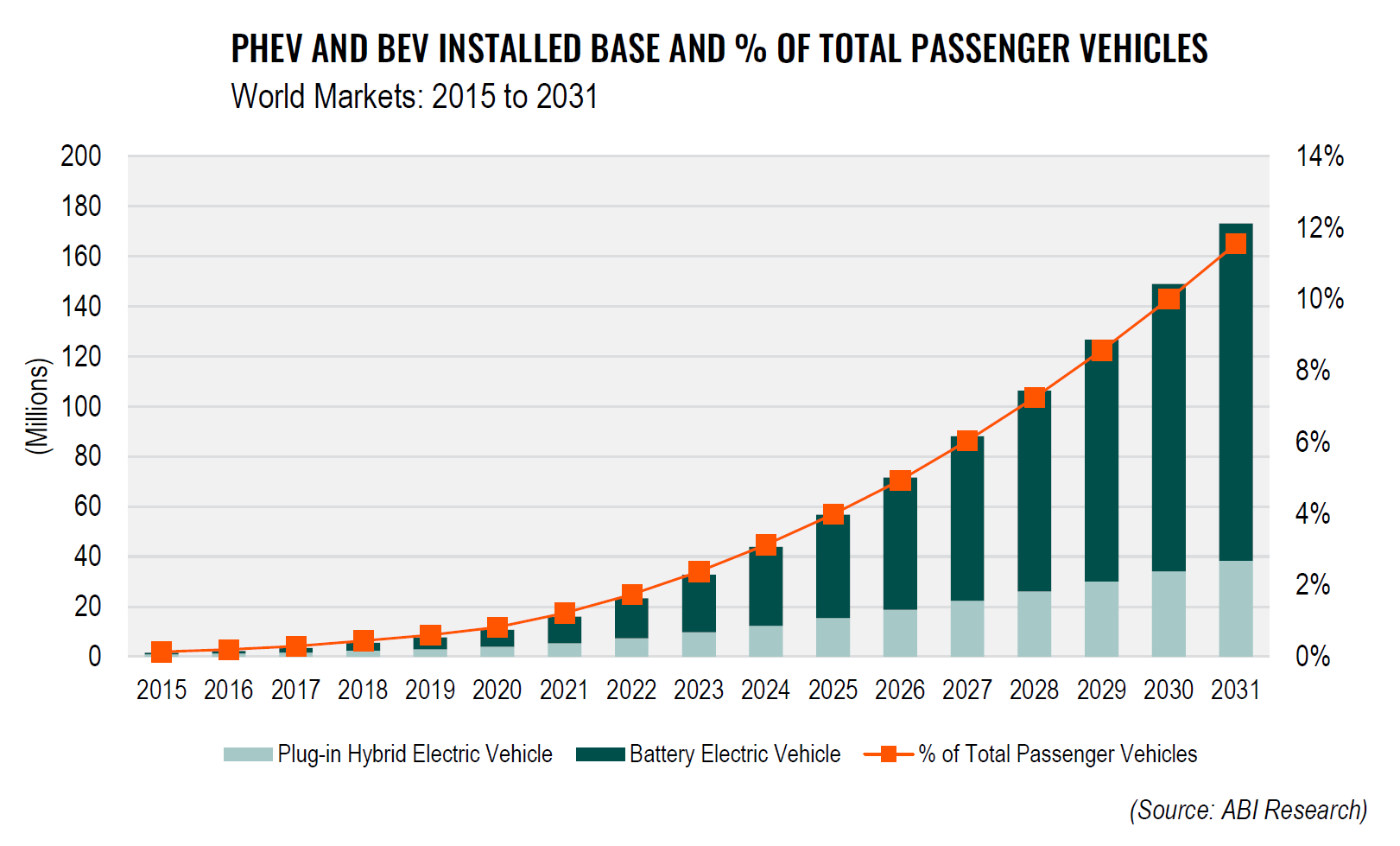

It could be as soon as 2030 that OEMs fully transition to production for EVs as the markets for Plug-in Hybrid Electric Cars (PHEVs) and Battery Electric Vehicles (BEVs) are expected to grow at a Compound Annual Growth Rate (CAGR) of 26.9% between 2021 and 2031, according to ABI Research.

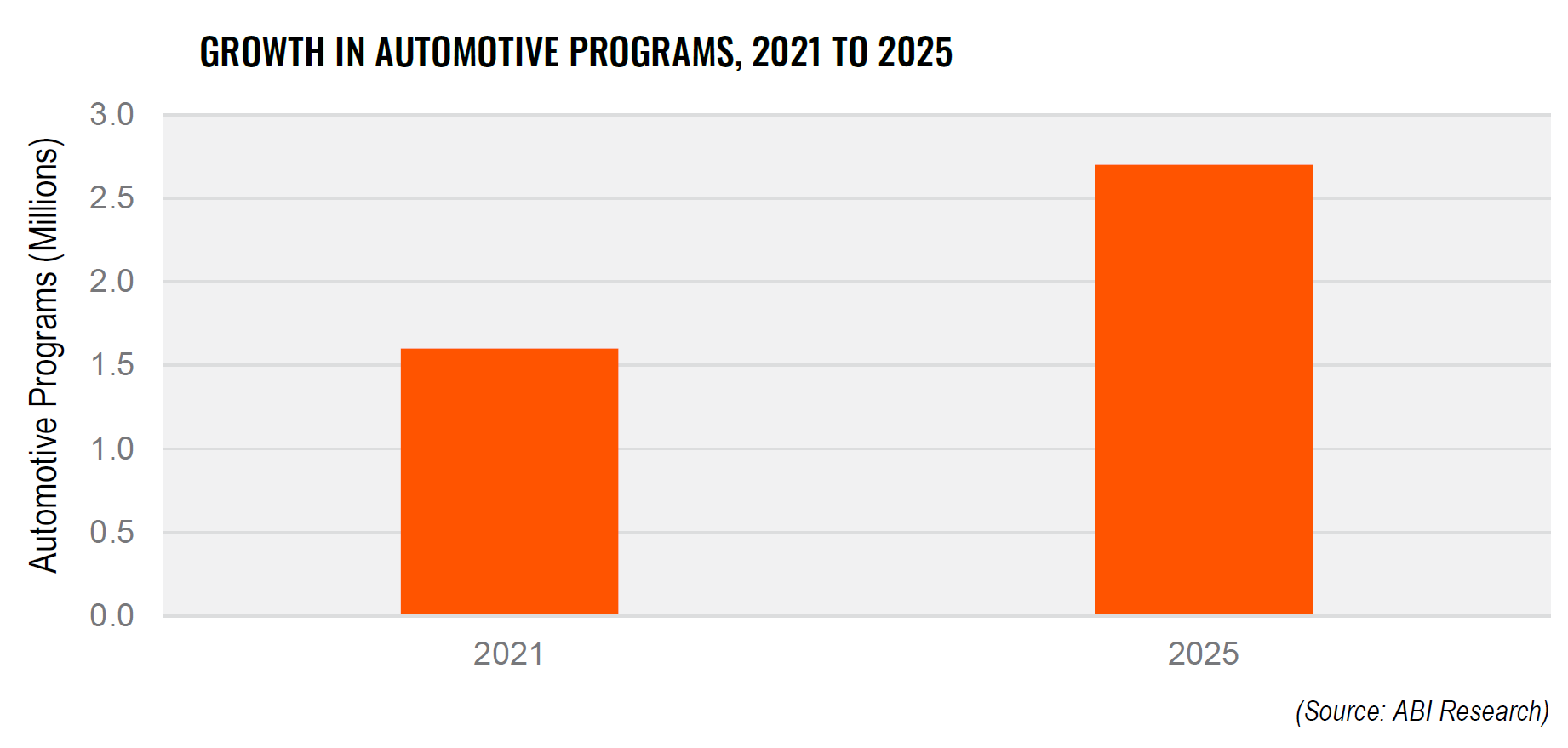

The first two things that come to mind with this growth are battery technology (e.g., lithium ion battery) and battery capacity. Although battery manufacturing is integral to electrifying the automobile market, OEMs have largely failed to understand the automotive supply chain challenges they will encounter with the rapid production of EVs. ABI Research finds that there will be about 66% more automotive and parts programs established between 2021 and 2025, bringing the total to 2.75 million programs in 2025. As a result, this places an impossible ask on suppliers already operating at full capacity.

Possible Solutions to the Automotive Supply Chain Issues

As stated in ABI Research's recent 2023 technology trends whitepaper, the transfer to EVs is going to require digital transformation.

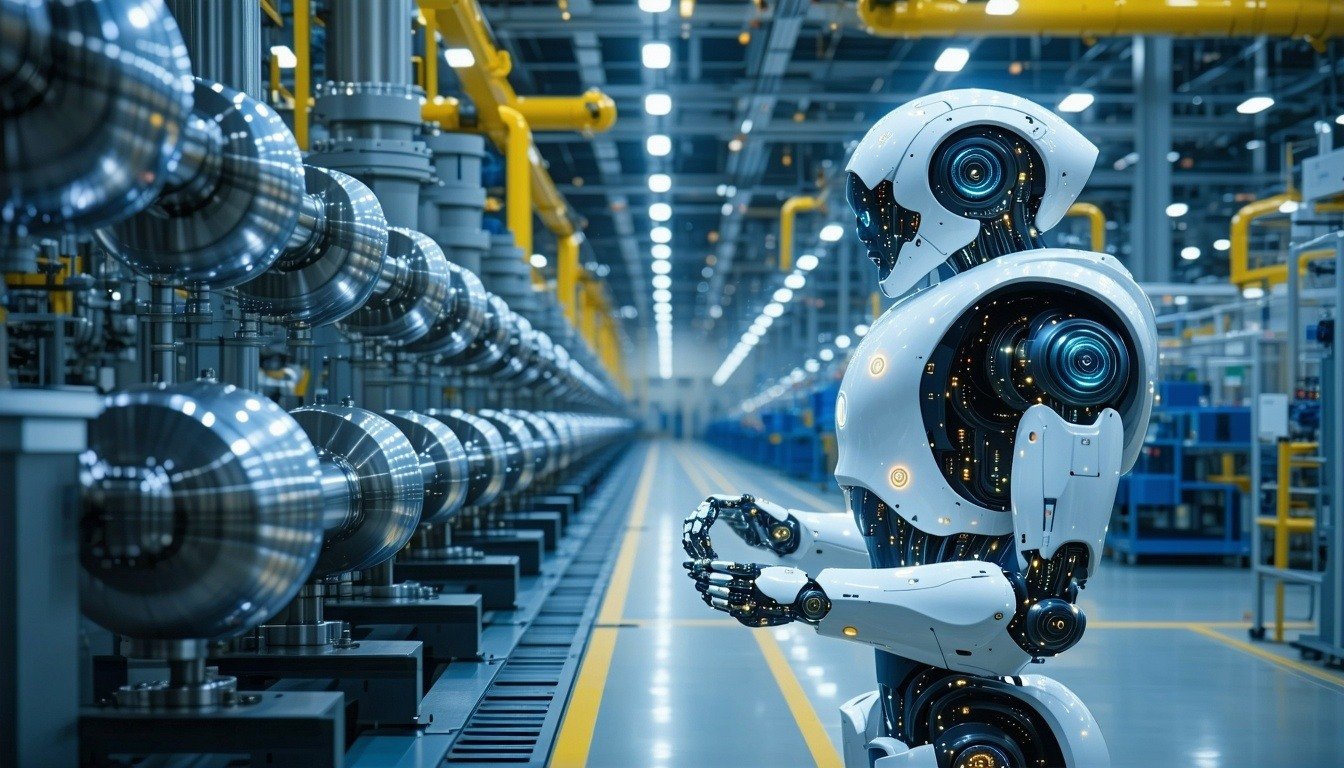

OEMs may believe their EV supply chain can be improved by simply hiring more workers, but that’s currently not a feasible option, as employee retainment has proven difficult in the wake of the COVID-19 pandemic. Plus, it takes about a year before a new hire will even start operating at full capacity.

With hiring frenzies being an unsuitable option to ameliorate the EV supply chain, OEMs should rethink how operational processes are carried out. Specifically, automation is a key enabler of a more efficient automotive supply chain. Program managers would no longer have to manually collect personnel and system statuses, communicate updates, and track progress. By implementing automation, ABI Research estimates a 15% to 20% increase in productivity for program teams, and 50% for program managers specifically. These significant gains in productivity will greatly benefit any EV supply chain that is experiencing bottlenecks.

Facing the EV Supply Chain Head-On as an OEM

Historically, OEMs have had most of the leverage in their supply chain relationships because of an outsourced model. But now, suppliers are becoming more disciplined when choosing OEMs to partner with because their capacity is already maxed out and they will strategically choose their deals. Therefore, OEMs that manufacture electric cars should demonstrate a willingness to share the supply chain risk and find ways to reduce costs for suppliers if they are to maintain long-term relations.

Innovation is a game changer in every industry, often helping companies solve common problems. The automobile industry is no different, so OEMs can’t be afraid to take some risks and change the way they view the EV supply chain. Experimenting with internal vehicle components, investing in new technologies, and meeting suppliers halfway are just a few actions OEMs can take to catapult out of the conundrum.

Lessons for Supply Chain Leaders

The transition to electric vehicles is destined to cause logistical friction, as forecasting demand is not straightforward and major pivots will need to be made in the EV supply chain. What remains to be seen is how flexible OEMs are willing to be when it comes to negotiating deals with suppliers, with some already showing an inclination to go the supplier-friendly route, while others prioritize short-term EV sales.

The tides have turned and now suppliers can afford to be selective about with whom they do business. Additionally, OEMs should reconsider how day-to-day processes are carried out and how vehicle architecture is designed so that logistics operations can be completed in a timelier manner.

To learn more about the effects of the electrification wave on the EV supply chain and how OEMs and suppliers can act now to resolve the bottlenecks that may lead to substantial disruptions of their operations, download the whitepaper, The Electrification Wave and its Impact on the Automotive Supply Chain.