Once the go-to solution for an enterprise wireless network, Wi-Fi 5 is nearing its demise. By 2025, Wi-Fi 5 will be near obsolete, as Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 offer superior performance in a world where enterprises introduce more and more connected devices to their work environments. To avoid getting caught off-guard, equipment vendors must learn where the greatest demands lie within the world of Information Technology (IT) and Operational Technology (OT) network solutions.

Enterprise Wireless Network Protocols

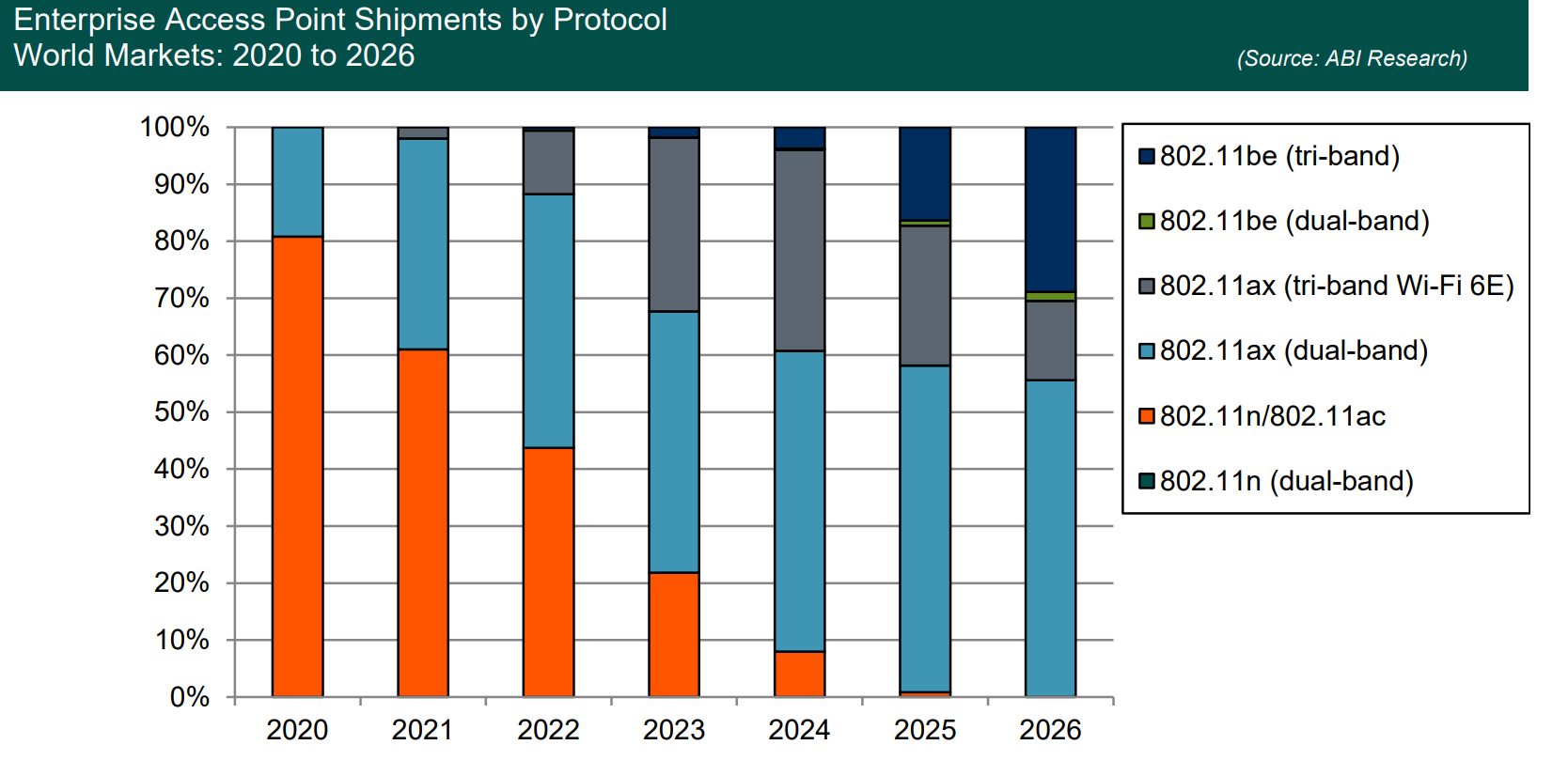

Of the 13.94 million enterprise Access Points (APs) shipped in 2022, 87% of them will come with either Wi-Fi 5 or Wi-Fi 6 protocols, which are dual-band. Wi-Fi 6E (tri-brand) will make up the rest of the shipments for the year. But what’s interesting is that companies seeking an enterprise wireless network solution will almost certainly not even consider Wi-Fi 5 by the time 2026 comes around, as tri-brand becomes more preferred.

Initially, Wi-Fi 6E will suffice as the de facto option for enterprises seeking a tri-brand wireless network. However, as the chart below depicts, Wi-Fi 7 will slowly take over the domain by 2026, when the next-gen protocol will account for two out of every three shipments of 6 GHz-enabled enterprise APs that year. Still, it should be noted that dual-core Wi-Fi 6 will remain the overall leader in enterprise AP shipments worldwide as the market aligns itself closer with tri-brand protocols.

Wi-Fi 6 versus Wi-Fi 6E

Wi-Fi 6 and Wi-Fi 6E are nearly on parity across the board, but the main difference between the two wireless network solutions is that Wi-Fi 6E leverages the 6 GHz spectrum. The 6 GHz spectrum is a big step in the right direction as it provides clearer connection, less congestion and interference, and can handle larger sums of data at low latencies. Currently, the availability of Wi-Fi 6E is shoddy due to limited device compatibility and hesitance from some regions.

The Nature of Enterprise Wireless Networks

Typically, IT wireless network equipment can be used off-the-shelf, is suitable for nearly every IT environment, is scalable, and the network is replaced every 3 to 5 years. For IT, enterprises are much more likely to adopt solutions with new Wi-Fi protocols because IT is so interwound with frontend business processes and peak performance is top-of-mind. IT networks also deal heavily with security and privacy.

Historically, Wi-Fi has been a more suitable solution for IT networks than OT networks because Wi-Fi was never designed with an industrial environment as the focus. Instead, Wi-Fi is more geared toward the residential and Small and Medium Enterprise (SME) segments. Because OT wireless networks require a more personalized approach, enterprises are hesitant to upgrade. Therefore, OT network lifecycles range between 15 and 30 years.

To address the unique needs of industrial workflows, such as network resilience in rough external environments, OT Wi-Fi equipment is developed with specific use cases in mind. Although a tailor-made solution is optimal, OT networks lack the scalability of an IT network. If OT Wi-Fi is ever going to rival IT Wi-Fi, equipment vendors must find breakthrough ways to make their solutions more flexible in industrial OT applications.

Due to the highly customized approach necessitated by an enterprise OT wireless network, associated costs are higher than IT deployments. Compared to the US$400 for a typical indoor IT wireless network, an indoor OT wireless network sits around the US$1,100 price point. For outdoor networks, IT deployments cost around US$590 on the low-end, US$970 for mid-range, and US$1,700 for the high-end. And outdoor OT networks cost US$2,200, on average.

Market Differences between IT and OT Network Solutions

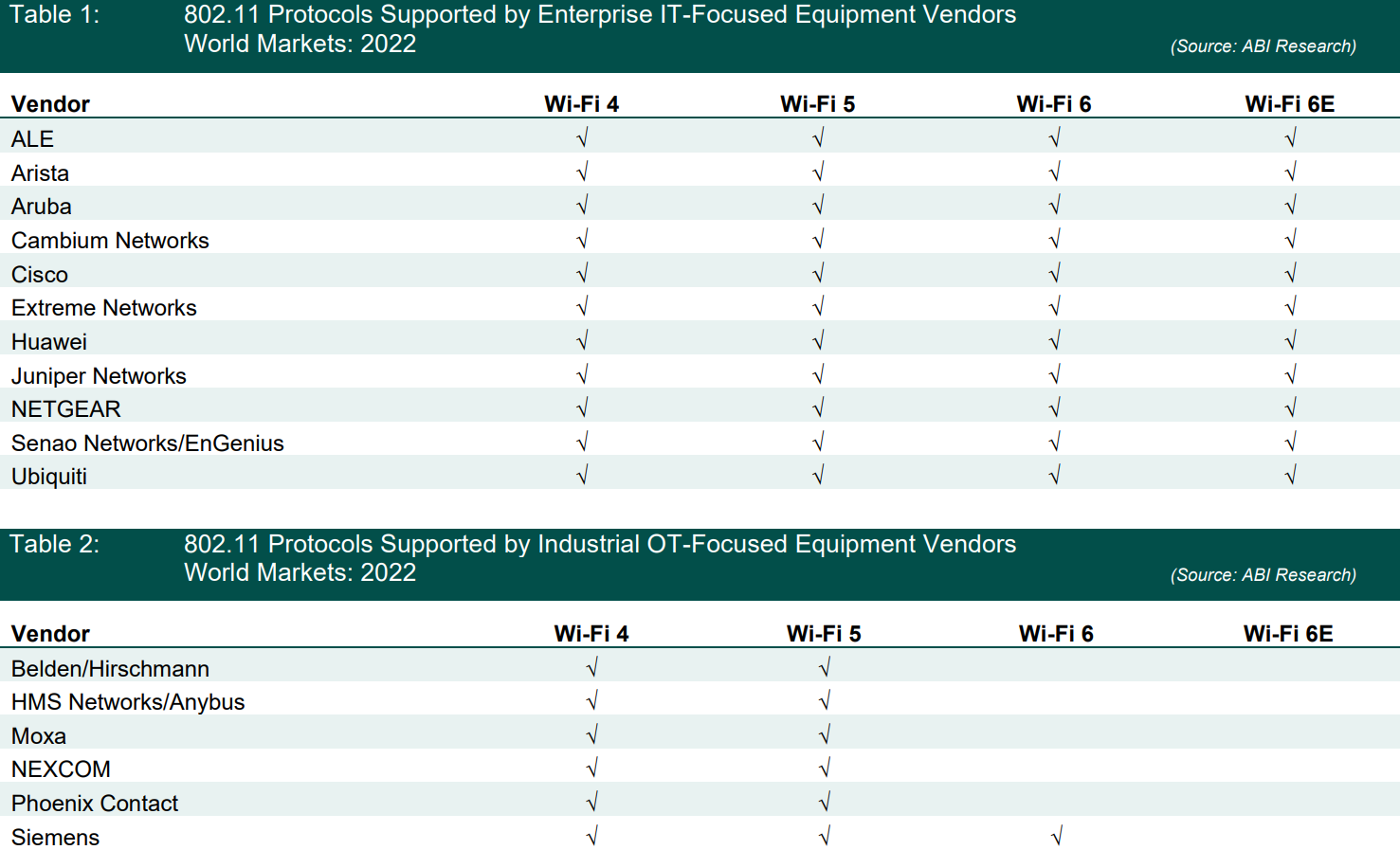

While the OT segment is happy with using legacy protocols like Wi-Fi 4 and Wi-Fi 5, the IT segment is more inclined to adopt newer protocols quickly. To exemplify this fact, consider the difference between the protocols used by IT equipment vendors and OT vendors, as found in Tables 1 and 2. As ABI Research notes, all enterprise IT vendors support Wi-Fi 6 and Wi-Fi 6E, but only one vendor (Siemens) supports Wi-Fi 6 in the OT space. And not a single OT equipment vendor supports Wi-Fi 6E.

Top Wireless Network Vendors Operating in the Enterprise Space

Some of the companies offering enterprise Wi-Fi 6E APs include:

- Alcatel-Lucent Enterprise: Based out of Paris, Alcatel-Lucent Enterprise operates in 65 countries globally on all continents, with Europe at the forefront. The company serves in the following industries: government, education, healthcare, hospitality, and transport. A wide range of APs is supported by Alcatel's product portfolio, including Wi-Fi 5, Wi-Fi 6, and in the near future, Wi-Fi 6E.

- Arista: Arista is an industry pioneer in data-driven, client-to-cloud networking for large data centers, campuses, and routing environments. Arista's Extensible Operating System (EOS), CloudVision, is a multi-domain network management plane built on cloud networking principles for telemetry, automation, and analytics. The company’s CognitiveCampus offers a comprehensive feature set designed to tackle the networking challenges faced in increasingly dispersed workspaces.

- Aruba: California-based Aruba focuses on the IT enterprise segment, providing solutions for campus, branch, data center, and remote workers. Aruba’s Edge Services Platform (ESP) is an AI-Powered, cloud-native platform built for automating and securing edge operations, and is used in the company’s APs. The company's APs are designed to withstand harsh environments like oil rigs and industrial manufacturing. Moreover, the vendor is also working with its parent company Hewlett Packard Enterprise (HPE) to converge Wi-Fi and cellular (Aruba Air Pass).

- Cisco: A clear market leader, Cisco specializes in development, manufacturing, and selling enterprise networking hardware and software. Plus, the company has an extensive amount of resources, with more than 80,000 employees worldwide. Cisco offers APs for virtually any segment, from small businesses to large enterprises. Adding to this, the firm provides networking solutions to both IT teams and OT teams, in some cases, specifically for OT. Some proprietary technologies the company has developed include CleanAir, which mitigates the impact of wireless interference with a spectrum-aware, self-healing, and self-optimizing wireless network, and ClientLink 4.0, which prevents legacy slower clients from impeding network performance by using beamforming technology. Proprietary technologies for OT include Fluidity, which supports connectivity reaching speeds of 500 Mbps between APs and the client when vehicles are traveling at speeds up to 225 mph/360 kmph. Recently, Cisco announced it will support private 5G, a cloud-based subscription service for enterprises.

- Extreme Networks: Extreme Networks is an enterprise networking company that develops both networking infrastructure equipment and software solutions that leverage AI/ML, analytics, and automation. The company has more than 50,000 customers globally, with a special focus on the education, healthcare, and government markets. Extreme Networks is the official Wi-Fi and Wi-Fi analytics provider of several global professional sports organizations, including Major League Baseball (MLB), the National Hockey League (NHL), and the National Football League (NFL). The company also supports Wi-Fi 6E APs and provides top-tier security after acquiring Avaya's Networking assets.

Wi-Fi 7 in the Enterprise Wireless Network

Wi-Fi 7, also called 802.11be, will be Institute of Electrical and Electronics Engineers (IEEE)-certified by early 2024 and takes the 6 GHz spectrum to an entirely new level. The year 2023 will see numerous Wi-Fi 7 product announcements.

Some of the most exciting features of Wi-Fi 7 include Multi-Link Operation (MLO) and preamble puncturing. MLO allows devices to use multiple bands on different frequencies to deliver faster speeds and reduce network congestion. For enterprise use cases that require high throughput and ultra-low latency, such as Automated Guided Vehicles (AGVs) and Extended Reality (XR) applications, Wi-Fi 7 will be at the top of the list of wireless network options because of its predictability and reliability.

As would be expected of a brand new technology, Wi-Fi 7 enterprise AP shipments are very low at the moment (50,000 shipments in 2022). Many companies want to get the most out of their existing enterprise wireless network, especially Wi-Fi 6E adopters, before migrating to Wi-Fi 7. However, as demand for industrial devices with Wi-Fi enablement increases rapidly in the coming years, such as smart glasses and mobile robots, the next-gen protocol will grab a firmer foothold on the enterprise AP market by 2025, and only grow larger as time goes on.

Next Steps to Implementation

Traditionally, IT and OT tech stacks have been separated, making collaboration extremely difficult. A Network Management System (NMS) is a solution that helps bridge the gap as it helps enterprises centralize the management and direction of IT and OT applications. Beyond that, equipment vendors in the enterprise wireless network domain clearly need to diversify their product portfolio as network needs are all over the map. While IT teams and niche OT sub-segments, will undoubtedly turn to Wi-Fi 6E and Wi-Fi 7 in a quick fashion, the broader OT market will be slower to adopt these protocols. The key to winning over the OT vertical is providing customized and flexible solutions that are designed with an industrial use case in mind.

These findings come from ABI Research’s Enterprise Wi-Fi and the Path to IT/OT & 5G/Wi-Fi Private Network Convergence. This research comes from the company’s Wi-Fi, Bluetooth & Wireless Connectivity Research Service.