A Small Unmanned Aerial System (sUAS), also known as a drone, was not long ago considered a rare commercial deployment. But today, the drone market encompasses a wide array of industries and use cases. Global sUAS drone ecosystems are expected to surpass the 3 million mark by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 25%.

Commercial drones are used in a wide range of commercial applications, such as workplace safety, product delivery, inspecting industrial sites, warehousing, and many more focus areas. Right now, the greatest revenue opportunity in the commercial drone segment comes from film and media—where drones can assist with filming from aerial vantage points impossible to access by helicopter.

The delivery segment is expected to explode in the next 5 years and account for more than half of all sUAS revenue. In this latest report, commercial drone market forecasts include unmanned aerial platforms with an approximate Maximum Take-Off Weight (MTOW) of less than 25 pounds (11.3 kilograms), technologies, services, and applications used for sUAS operation.

Notable Trends in the Commercial Drone Market

Although the COVID-19 pandemic curbed investment in drones a little bit, sales in the commercial sector are growing rapidly as most regions have lifted restrictions and companies feel more confident about the future. Besides COVID-19, the U.S-China power struggle is another factor affecting the commercial drone market because Western companies want to reduce their dependence on Chinese vendors. As a result, more sUAS hardware providers will pop up in other countries in the coming years, backed by their respective governments. Ironically, DJI, a Chinese-based company, is the go-to drone provider in the commercial sector. In 2021, DJI had a commercial sUAS market share of 66.6%.

Drone services are expected to become a major factor in commercial drone deployment, as companies struggle with adoption. There are myriad service vendors that provide solutions tailored to specific applications. In 2022, sUAS associated services and sUAS application services will account for 74.2% of commercial units. And by 2026, that number will increase to 84.1%.

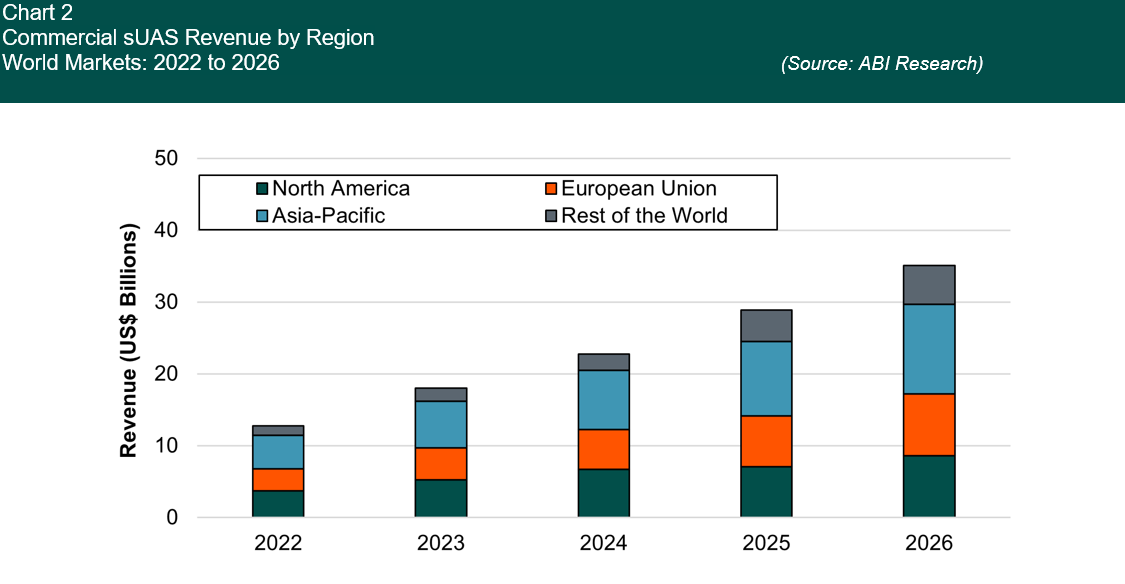

Commercial Drone Market by Product/Service

In 2026, the commercial drone market will experience 1.2 million sUAS shipments, which is about a third of all sUAS drone shipments that year. For perspective, that- is more than 3X as many shipments in 2022.

Total revenue in 2026, which extends to platforms, accessories, and services, is expected to reach nearly US$36 billion—about US$22 billion more than 2022 revenue. Even though the commercial sector represents roughly a third of total sUAS shipments, it accounts for 70%+ of total revenue throughout the forecast period among all market segments.

As Chart 1 depicts, by far, application services account for the greatest quantity of commercial sUAS revenue, with 2022 revenue reaching US$6.5 billion. By 2026, that number will surge to US$18.8 billion. Associated services trail considerably, at US$11.4 billion in 2026 revenue. Meanwhile, Small Unmanned Aerial Vehicle (sUAV) platforms and accessories will account for 15.8% of total 2026 revenue.

Commercial Drone Market by Industry Application

Delivery is easily the marquee highlight from the 2022 to 2026 industry forecasts. While delivery accounts for just 4.9% of 2022 commercial sUAS revenue (US$826 million), the segment will account for 12.6% of revenue in 2026 (US$5.4 billion). The CAGR will be 59.6% during that period.

Some other notable market trends include:

- Agriculture, film and media, and infrastructure/industrial inspection will continue to have strong demand for small commercial drones. These three industries will account for about a third of all sUAS revenue in 2026, across military, civil, and commercial segments.

- Geology and mining will hover around 6% to 6.5% of total revenue share for the next 5 years.

- Oil & gas companies will invest more in drones, as the share of revenue will increase from 8.3% in 2022 to 9.8% by 2026, which will be a market opportunity of US$4.2 billion.

- Commercial and residential insurance revenue in the sUAS space will grow from US$1.3 billion in 2022 to US$3.4 billion in 2026.

- Warehousing, which only accounts for 0.4% of the share of revenue in 2022, will make up 1.3% of the share of revenue by 2026.

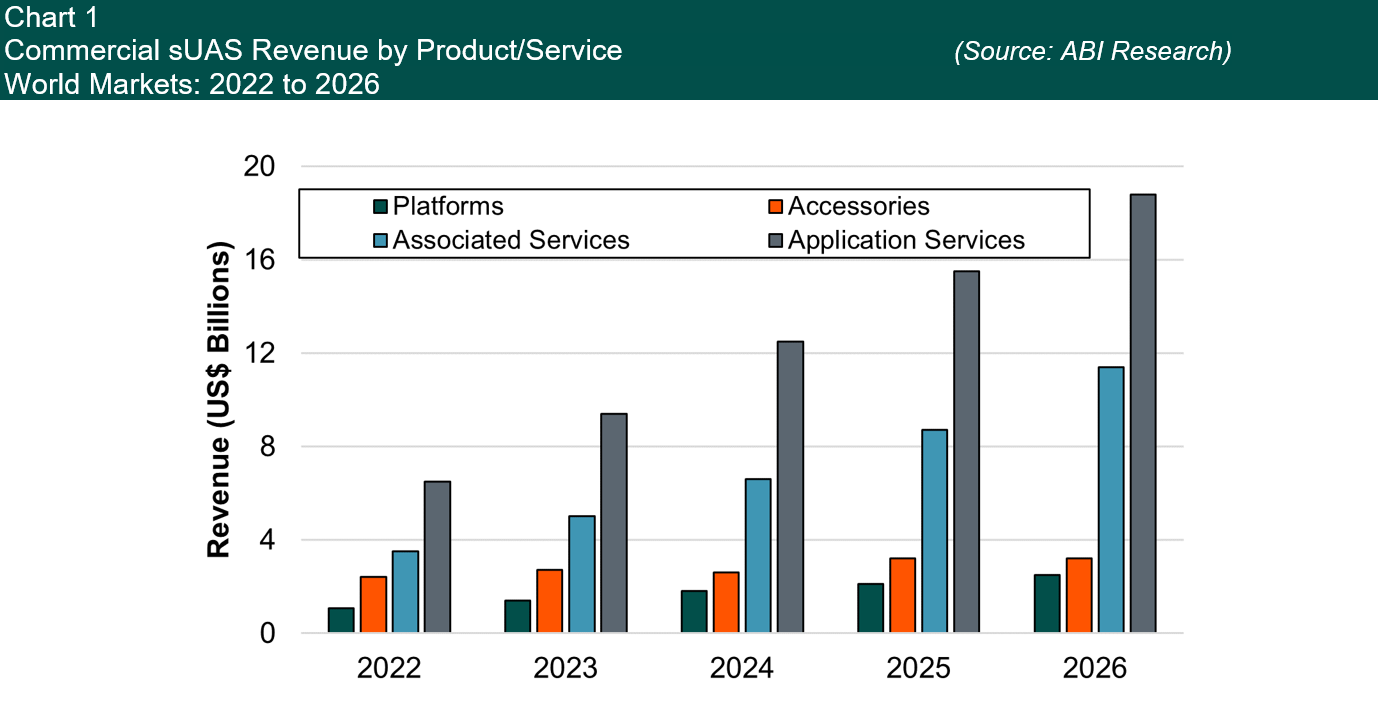

Commercial Drone Market by Region

The three regions dominating the commercial sUAS space are the United States, European Union (EU), and Asia-Pacific (APAC). Below is a more in-depth breakdown.

United States: US$3.7 billion in revenue will be had in the United States in 2022, which is 28% of global revenue. By 2026, that number will be US$8.6 billion and 24% of global revenue in the commercial drone market.

European Union (EU): The EU will account for 23% of total commercial sUAS revenue in 2022 and 24% of total revenue by 2026. In 2025, the EU and the United States will be at parity with US$7 billion in revenue.

Asia-Pacific (APAC): China and Japan are the big players in APAC, with the two nations making up nearly 100% of the US$4.7 billion in commercial sUAS revenue in the region in 2022. While China will increase its share of global revenue and even edge out the United States by 2025, Japan’s adoption rate will decline in the next 5 years. Compared to its 11% share of global revenue in 2022, Japan will account for just 6% of global revenue in the commercial drone market in 2025 and 2026. Reference the chart below for more sUAS revenue forecasts by region.

What Flight Types Are Used in the Commercial Drone Market?

Right now, multirotor is easily the most common flight type for commercial sUAS shipments, just like the military, civil, and prosumer markets. ABI Research expects this trend to continue as multirotor will represent 78.2% of the 1.2 million sUAS shipments in 2026.

Hybrid Vertical Takeoff and Landing (VTOL) will account for a not-insignificant 19.7% of all commercial sUAS flight types in 2026. Only about 2% of commercial sUAS shipments will have either single rotor or fixed wing flight types by 2026.

The Ensuring Outlook for Solution Providers in the Small Unmanned Aerial System (sUAS) Space

As the data show, the commercial drone market is growing quite fast and offers huge revenue opportunities for vendors in the sUAS space. Beyond the drone itself, companies need more resources—both hardware accessories and services from third parties—to make operability more effective and to onboard quickly. Beyond that, operators will also need to invest in connectivity, whether it’s Wi-Fi, Bluetooth, Near Field Communication (NFC), or something else—creating a new customer acquisition avenue for telecoms operators.

To dig deeper into the small drone market data and forecast the most encouraging sales possibilities, download ABI Research’s The Small Unmanned Aerial System Ecosystem market data report.