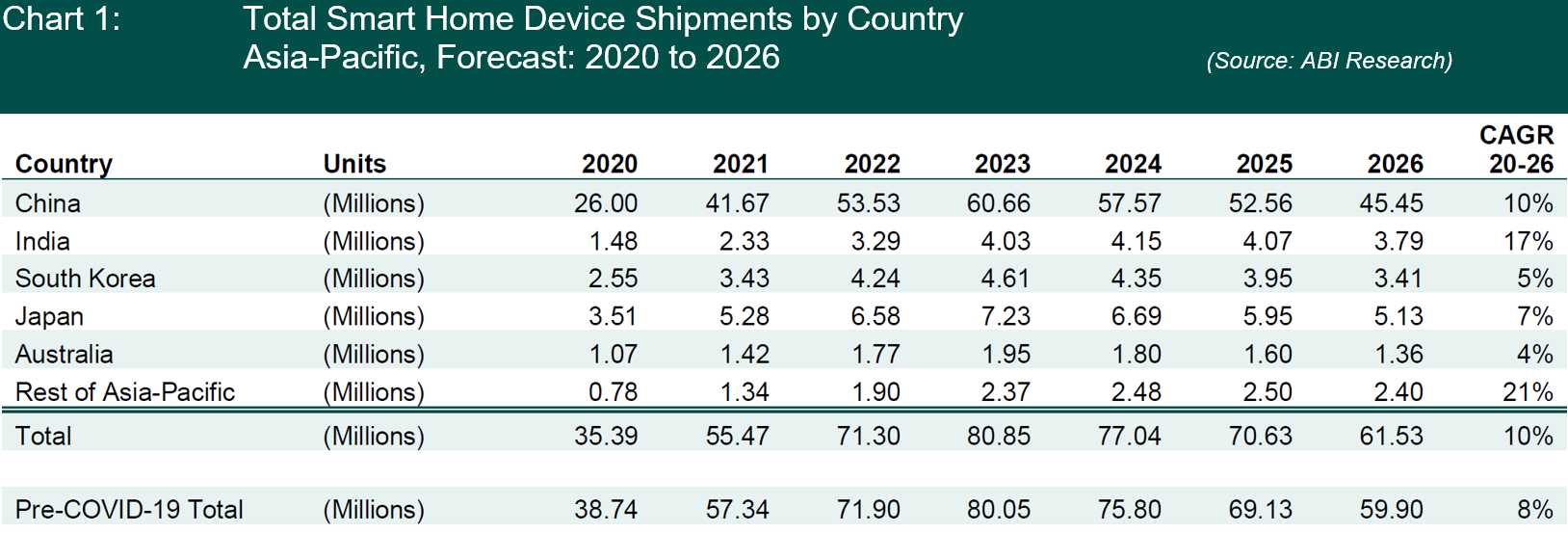

By 2027, the smart home hardware market will be a US$18 billion opportunity in Asia-Pacific, an industry that has historically been dominated by the North American market and its vendors. However, that trend is over and vendors will increasingly have to adapt their smart home strategies and products in response to the impact of developing Chinese and Asia-Pacific smart home markets.

Despite this anticipated surge, smart home players engaged in driving adoption across Asia-Pacific face a host of economic, political, technical, social, and national barriers, as well as competitive challenges. However, the opportunity offered in the world’s most populous region is significant. Some of the common smart home devices that will see tremendous growth in Asia include voice control front-end, smart lighting, smart locks, smart plugs, and garage door sensors will follow suit over the coming years.

China Sets the Stage for Asia-Pacific Dominance in the Smart Home Space

From fast follower to global influencer, the Asia-Pacific smart home market, and China, in particular, will increasingly help determine the shape and consumer appeal of global smart home offerings. The emerging trend, already forming, will be further exacerbated by the impact and emerging recovery from COVID-19 in the Chinese market. Overall, the Asia-Pacific smart home installed base will grow from 66 million in 2020 to 316 million (a 30% CAGR) between 2020 and 2026. In the same period, the smart home installed base in the United States will grow a mere 3.6%.

The influence of the Chinese smart home market will benefit from the commitment of its largest players emerging from the impacts of COVID-19 lockdown ahead of the U.S. and European competitors, and committing new resources and strategies to drive and cement smart home adoption and engagement. For example, the ability to manage systems in the home without physical touch, and the risk of contagion, has also gained greater value. In addition, the greater demand for home delivery of goods and services and the potential to further strengthen the ties between smart home offerings, such as voice control and delivery at smart-enabled access points, provide greater incentive for key players to take advantage.

Smart Home Technology #1 in Asia-Pacific: Voice Control Front-End

Driven by investments from Alibaba, Baidu, Xiaomi, and others, Asia-Pacific will see shipments of voice control front ends (mainly smart speakers and smart screens) reach over 79 million units in 2022, far ahead of the United States (50 million units). By 2027, that number will explode to 82 million shipments, compared to the dwindling shipments placed in the United States (34.5 million units). In fact, Western Europe (57.4 million units) will be the closest competitor to Asia in terms of voice control front-end shipments in coming years.

Voice control front-end devices, such as smart speakers and smart displays, account for the greatest amount of revenue among all smart home technologies - generating just shy of US$8 billion by 2027. For context, that's about a fourth of total smart home device revenue, which includes 15 different smart home categories.

Smart Home Technology #2 in Asia-Pacific: Smart Lighting

In 2020, North America shipped nearly twice as many units of smart lighting as Asia-Pacific. And Western Europe shipped 11 million more shipments than Asia too. But things have radically changed and as of 2022, Asia-Pacific will ship 61 million more units than North America - for a total of more than 108 million shipments. By 2027, Asia-Pacific will ship 208.5 million smart lighting units and account for more than 50% of ALL smart lighting shipments worldwide.

Smart Home Technology #3 in Asia-Pacific: Smart Locks

Smart locks are one of the most popular smart home technologies as safety and security are top-of-mind for consumers. Asia-Pacific is on track to be the world leader in this smart home category by 2024, when the region will see 14.6 million shipments and US$769 million in revenue. Impressively, that's more than double the 5.5 million units shipped just two years earlier, in 2022. US$2.5 billion in smart lock revenue is projected to be made in 2027 in Asia-Pacific alone.

Smart Home Technology #4 in Asia-Pacific: Indoor Smart Plugs

Asia-Pacific leads the world in indoor smart plug shipments as well, with more than 7 million shipments in 2022. This brings in US$120 million in revenue for the region. As early as 2024, smart plug shipments in Asia-Pacific (13.7 million units) will be over twice as much as North American shipments (5.6 million units).

Smart Home Technology #5 in Asia-Pacific: Garage Door Sensors

Garage door sensors are a smart home technology that has typically been a big winner in North American and Western European markets. But Asia-Pacific is growing in this category much faster than other regions, with a CAGR of 24% between 2022 and 2027. By the end of the forecast, more than 5 million units will be shipped in Asia-Pacific, which is more than North America and all of Europe combined. While garage door sensors are a US$14.9 million opportunity in 2022, that number will nearly triple to US$42 million by 2027.

Smart Home Technology #6 in Asia-Pacific: Smart Thermostats

In 2019, North America shipped more than 3X as many units of smart thermostats as Asia-Pacific, but like the other trends spelled out in this resource, that's all changing. In 2023, Asia-Pacific will overtake North America for smart thermostat shipments (12.5 million units) and revenue (US$599 million). By 2027, total shipments will surpass 21 million shipments, growing at a CAGR of 18% between 2022 and 2027.

Asia-Pacific the Key to Smart Home Dominance

The smart home industry has advanced at varying speeds in markets around the world and to varying degrees of success, most notably in Asia. Many aspects of the market remain and will continue to be extremely localized in demand and provision. What is key globally, however, is minimizing the cost and the complexity of smart home adoption. Developments geared toward the cost-consciousness demands of the Chinese and greater Asian smart home market will be an enormous revenue opportunity for existing smart home tech suppliers, and for local startups that want to make a big splash.

For the latest data on the smart home market in Asia-Pacific and other regions, download ABI Research's Smart Home Hardware market data report.

And to learn about the drivers, adoption rates, and potential for the smart home market in Asia-Pacific, download our The Emerging Influence of Asia-Pacific Smart Home research analysis report, which is part of the company's Smart Homes & Buildings Research Service.