For a 2025 edition of this topic, the reader is referred to the blog, Digitalization in Manufacturing: 6 Revelations from ABI Research’s Latest Survey.

The benefits of digital transformation in manufacturing should be pretty clear. Like other Industry 4.0 applications, digitally transformed manufacturers possess greater speed, agility, and scale for operations. Equipping plants and facilities with technologies like the Internet of Things (IoT) and other connected devices unlocks a goldmine of operational information and, ultimately, a competitive edge. Only with a fully digitalized approach can manufacturers defeat the army of challenges confronting them today.

Pressures Driving Digital Transformation in Manufacturing

Manufacturing companies aren’t investing in digital transformation in hopes of some vague goal like “generating more revenue.” Yes, that’s great and ultimately the final result, but there are very specific challenges that are motivating manufacturers to adopt data-driven solutions. This isn't much different from retailers adopting new pivoting in response to combating inflation and the 18% increase in production costs. Below, you’ll see some of the underlying concerns that are giving rise to Industry 4.0 and digital transformation in the manufacturing industry.

- Political: Among the political issues affecting manufacturers, trade disputes, such as U.S./Chinese tariffs and Brexit’s complicating and delaying of material supplies, have come to the forefront. Moreover, the war in Ukraine has caused safety concerns for staff and a shortage of critical raw materials. There are also raw materials and staff shortages in China as a result of the country's zero COVID-19 policy.

- Economic: Because of inflation, manufacturing companies either have to make peace with lower profit margins or charge the customer more for their products. The latter may hurt the brand reputation and customer perception. Higher energy costs also increase operational costs, such as heating and powering production lines and properties, as well as transportation. However, digital transformation improves productivity while reducing costs. You see, technologies like Autonomous Mobile Robots (AMRs) and Autonomous Guided Vehicles (AGVs) can put a dent in some of those manufacturing labor shortages that have been so prevalent over the last couple of years.

- Supply Chain: The raw material shortage makes it difficult for manufacturers to diversify supplier channels and maintain adequate inventory levels.

- Regulation: Governing bodies increasingly require firms to reduce the risk of injury in the workplace, limiting the number of staff inside a building (social distancing), and directing manufacturers to follow standardized procedures to ensure product consistency.

- Environmental, Social, and Governance (ESG): Most manufacturers are well aware of ESG pressures. For example, food & beverage manufacturers need digital technologies to demonstrate their commitment to ESG. Some ESG goals impacting the manufacturing industry include talent diversification, bettering local communities, and using sustainable materials and processes.

- Technology: With cyberattacks rising, enterprises must address security to protect company assets and customers' personal information. There’s also a great deal of pressure on manufacturers to push for digital processes in factories and to adopt Artificial Intelligence (AI) and Machine Learning (ML) to provide plant operators with greater autonomy and optimization tools.

"Improving yields and optimizing the overall process are key drivers across the verticals, as they can make tangible improvements to operations."

Manufacturers Have No Control over Some Issues

Based on spider diagram scores compiled by ABI Research, political issues come out on top in terms of pressure points for manufacturers. This is due to the fact that companies have no control over things like a geopolitical conflict or a Chinese factory being shut down. Regulation is considered the second most impactful pressure point for digital transformation in manufacturing. Failing to comply can lead to a factory shutdown and damage the brand’s reputation for failing ESG goals. For economic and supply chain pressures, the degree to which a company is affected depends on the range of influence it has on suppliers. The more influence a manufacturer has, the more likely raw materials can be reserved. Finally, technology pressures are not quite as dire, given the predictable nature of budgeting for new technologies.

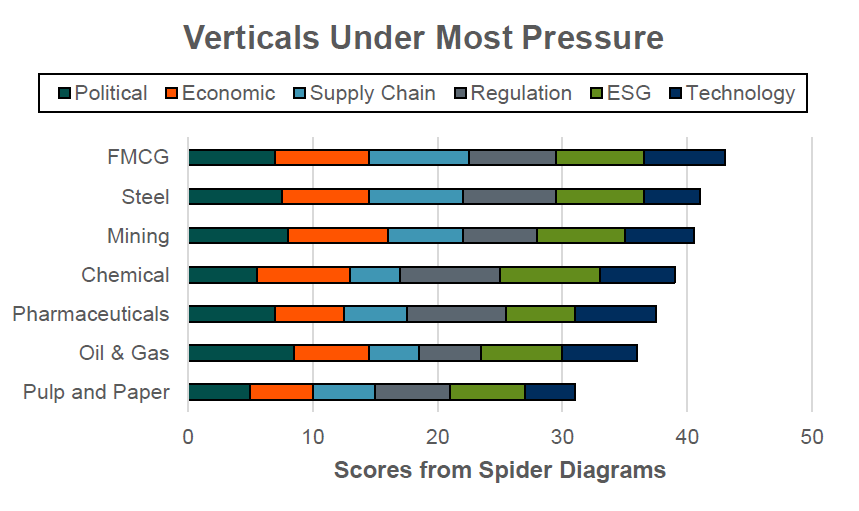

Naturally, not every manufacturing sector is going through digital transformation for the same exact reasons. The following highlights the main influences in each sector.

- Fast-Moving Consumer Goods (FMCG): Companies operating FMCG are facing the greatest adversity from external pressures. A tidal wave of challenges has developed for these firms, including Chinese shutdowns, rising costs, lack of ingredients, and the inability to simply raise prices on customers.

- Steel and Chemical: Steel and chemical producers, as well as miners, are heavily affected by ESG and regulation. Digitalizing their manufacturing processes will help these companies reduce their carbon footprints and adhere to safety standards.

- Pharmaceuticals: Pharmaceutical companies, partly due to the need for cold chain telematics, are impacted by regulation to a high degree. Supply chain visibility will help pharmaceuticals effectively track shipments and improve quality control.

- Oil & Gas: While politics and regulation are the most pressing concerns for oil & gas firms, they each have relatively greater operational control than other sectors because they can set their own prices.

- Pulp and Paper: Although pulp and paper manufacturers haven’t been spared from evolving pressure points, the sector is far better off than sectors like FMCG, steel, and mining. Labor shortages, supply chain visibility, and process optimization are the main drivers for digital transformation among pulp and paper manufacturers.

Diagram 1: Pressures Forcing Manufacturing Verticals to Invest in Digital Transformation

Digital Transformation Strategy for Manufacturers

A sound strategy for digital transformation in manufacturing involves five key markers of success: removal of paper, data connectivity, data analytics, devising digital twins, and lights out production.

- Removal of paper refers to operational data from the production line automatically being transmitted to cloud-based applications. Upgrading equipment is key to success in paper removal.

- Data connectivity means that data are more readily available across a variety of applications, not siloed in separate applications. Some of the applications that need full transparency include Enterprise Resource Planning (ERP), Manufacturing Execution System (MES), Product Lifecycle Management (PLM), and Supply Chain Management (SCM) platforms.

- Data analytics encompasses everything from simple reporting to predictive and/or prescriptive analytics to help make better decisions. For example, pulp and paper manufacturers use data-driven insights to monitor the health of filters that may be deteriorating due to dust buildup.

- Devising digital twins, enabled by the Industrial Internet of Things (IIoT), allows manufacturers to create virtual replicas of equipment, production lines, and even people. Also commonly used in urban planning, digital twin software enables users to track operations in real time and test/simulate proposed changes before actually carrying them out in the real world. To illustrate, a plant could adjust the number of production line workers in the digital twin model to see how it would affect yield.

- Lights-out production refers to fully digitalized facilities/factories functioning with minimal human workers. The mining industry, for instance, is well on its way to lights-out production with the use of autonomous trucks.

Digital Transformation in Manufacturing by the Numbers

ABI Research revenue forecasts for digital transformation in manufacturing are based on seven categories:

- Security services revenue

- Professional services revenue

- Network services revenue

- Device and application platform services revenue

- Data and analytic services revenue

- Connection revenue

- Industrial software revenue

Now, let’s take a look at the digitalization market opportunity for each manufacturing sector. The following shows the total spending on digital transformation in each sector in 2030:

- FMCG: US$23.8 billion

- Steel: US$5.5 billion

- Mining: US$9.3 billion

- Chemical: US$7 billion

- Pharmaceuticals: US$4.5 billion

- Oil & Gas: US$15.4 billion

- Pulp and Paper: US$3.6 billion

How Vendors Can Ease Manufacturer Skepticism of Digital Transformation

Although manufacturers are embracing digital transformation, they still need to see a clear demonstration of how technology solutions will solve their specific problems. Suppliers should identify exactly what pain points clients are dealing with and communicate with key stakeholders how their solution(s) address those challenges. For example, explain how productivity gains go hand-in-hand with sustainability goals. Remember, not only do you need to speak in technical terms with Operational Technology (OT) teams, but also in layman’s terms with corporate staff.

Suppliers can engage with germane authorities to keep up to date with the latest compliances. This will ensure that clients won’t worry about regulation as they digitally transform their facilities. Lastly, offering a Software-as-a-Service (SaaS) model is a great way to remove the barrier to entry for customers. Allowing users to access low-code/no-code tools on a flexible basis allows manufacturers to onboard with little risk.

Learn more by downloading ABI Research’s Digital Transformation in Process Manufacturing and Extractive Industries presentation.