Payment technologies are one of the most important things banks and financial services can pay attention to. These technologies are how customers make their transactions and bridge the consumer-brand bond. But it’s crucial to understand how consumer preferences evolve and how various market dynamics influence demand for physical and digital payment technologies. In this article, I’ll walk you through the following:

- How the global chip shortage has affected modern payment technologies and platforms

- The rapid growth in contactless payment methods

- Why contactless payment is a key trend for the banking industry

- Where the future of digital/mobile payment services is headed

Chip Shortage Impacts on Payment Technologies

Last year, banks and financial institutions had strong concerns about the chip shortage. These firms constantly discussed with their smart card partners how to navigate going forward. Key topics included deciding how their technological needs could be met, re-evaluating business opportunities, new payment methods, and optimizing existing processes (e.g., inventory management and payment card reissuance).

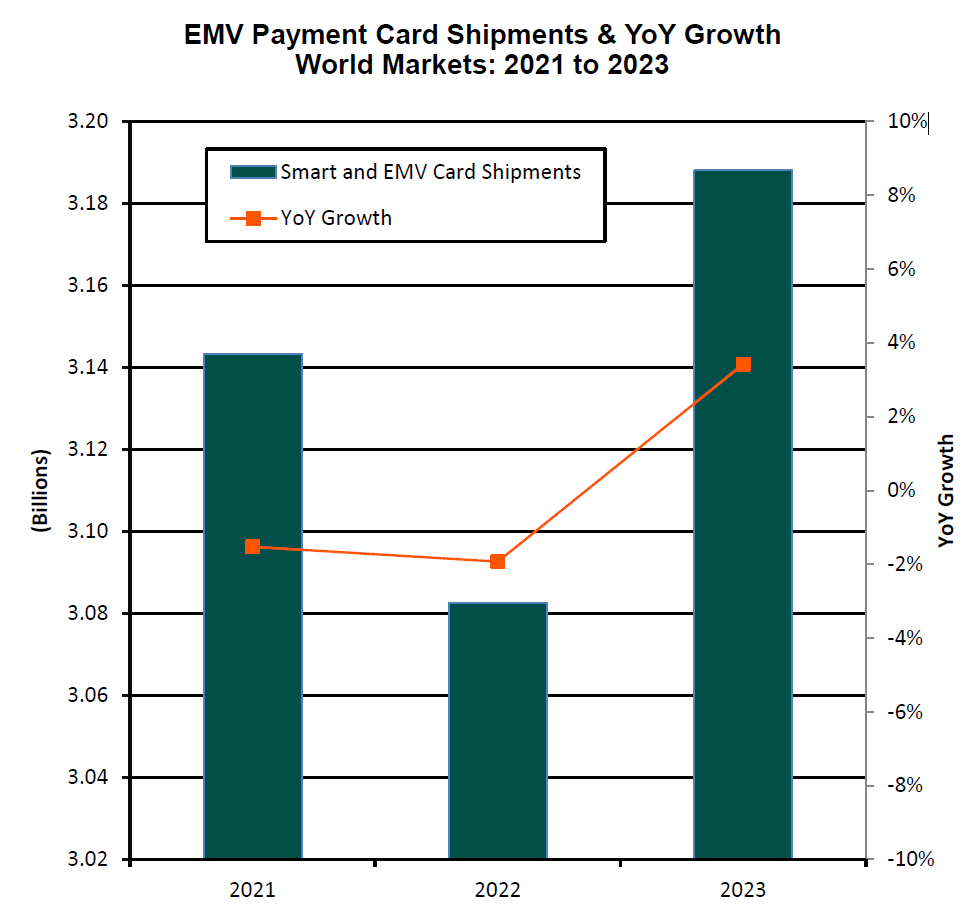

While these worries were justified, the issuance of payment cards was, in fact, better than expected. By leveraging existing stock levels of payment cards to reduce supply chain constraints, card issuers managed still to ship 3.08 billion payment cards in 2022.

Another major reason why payment technologies remained resilient in 2022 is because of the better-than-anticipated uptake of credit cards and debit cards in Latin America, as well as the sustained low-level growth in Europe. These regional trends offset the sizable market reductions in North America, which were primarily influenced by U.S. payment card reissuance cycles.

Within the payments industry, it’s a general consensus that the worst days of the chip shortage are over. Indeed, 2023 will see the return of a positive growth trend in the issuance of payment cards (3.4%) from the previous year.

With solid growth expected in countries like Brazil, Japan, and the United States, ABI Research forecasts 3.19 billion Europay, Mastercard, and Visa (EMV) payment cards to ship this year (see the chart below).

In the next section, we’ll go over the latest developments in contactless payment technologies.

Contactless Payments Are a Mainstay

Contactless payment technologies are here to stay for the future. During the COVID-19 pandemic, it’s reported that there was a 30% increase in the use of contactless payment platforms to pay for goods and services. This digital payment trend isn’t expected to go anywhere, and banking industry players have incorporated convenience, safety, and health as the hallmarks of contactless payment solutions.

According to our latest forecasts, the days of contact-only payment cards are headed for demise. Between latent experiences of COVID-19 and the acceleration of contactless migration strategies, payment cards with embedded contactless technology will continue to dominate. The year 2023 will see 83% of all payment cards issued to have contactless capabilities.

Contact Chips for Payments in Short Supply

During the chaos that was the global chip shortage, contact chips were harder to come by. This resulted in foundries paying more attention to the contactless interface for payment cards. These trends reduced the price gap between contactless payment technologies and contact-only because of a proportionally higher increase in the Average Selling Price (ASP) of contact chips than dual interface.

Due to the chip shortage and the growth in dual interface adoption, the overall ASP of payment cards has increased by 26% from 2020 to 2023. This means, thankfully for banks or other credit or debit card issuers, that any reduction in revenue during the 2020 to 2022 time range will not have been as impactful.

An Optimistic Future for Mobile Payments

Companies in the mobile payments space are set to be in a good position in the post-COVID-19 pandemic era. According to our forecasts, the number of mobile wallets in circulation worldwide will increase from 3.5 billion in 2022 to 5.6 billion by 2027.

A huge trend, and a pivotal catalyst for the adoption of mobile payment technologies, is the practicality of mobile solutions in developing regions. Many countries in the Middle East, Africa, and Latin America are increasingly turning to mobile banking platforms, notably mobile wallets, to make transactions.

This is because these regions lack an adequate number of brick-and-mortar banks, but have the readily available mobile infrastructure. As a result, citizens in these regions can enroll in a mobile banking program or mobile money services without the historically prohibitive friction.

Mobile wallet platforms will be more relevant as cashless societies become embraced. These digital solutions are how consumers access online transaction services in a world where physical payment for goods and services is considered inconvenient or unsanitary. Crucially, these mobile payment technologies, if they are to reach their full potential, need to come with enhanced functionalities that enable vendors to tap into a wide range of end markets (e.g., Identity (ID) and contactless ticketing).

It's important to note that, despite healthy growth in mobile payment adoption, these digital payment methods will not affect the future market for physical payment cards. In general, ABI Research expects mobile payment platforms to be a complementary technology to physical cards.

The main reason for this is that smartphone penetration—a necessity for mobile payments—is not uniform across the globe. Moreover, a physical payment card is still needed for Automated Teller Machine (ATM) usage and, sometimes, for checking into a hotel or a flight.

Key Takeaways

The demand for payment technologies is in a clear recovery mode after a COVID-19 slump. The adverse effects of the global chip shortage turned out to be less severe than expected, and smart card vendors have been able to minimize impacts.

Digital payment trends, such as contactless payment and mobile payment platforms, are two digital methods of transaction to focus on for future business plans. As prices for dual interface chips are closer to parity with contact chips, ABI Research sees now as an excellent time for banks that have not used contactless payment technologies to start doing so.

Furthermore, mobile payment platforms are a significant market opportunity in the banking/financial services industry. Developing regions are gravitating toward mobile payment services, and traditional banks are squaring off against online banks (e.g., Revolut, Monzo, and Curve) and payment companies (PayPal and Venmo). These digital-first payment methods will give rise to more demand for mobile wallets.

To learn more about the latest digital payment technology trends and their future—including shipment and revenue forecasts, smart card vendor shares, and the use of payment wearables (e.g., smartwatches)—download ABI Research’s Payment and Banking Card Technologies Analysis presentation.

This content is part of the company’s Digital Payment Technologies Research Service.