Whether it’s new recreational entertainment or a novel healthcare monitoring application, consumer technology is always evolving. Older tech is phased out and replaced with the latest and greatest offerings brought about by various companies’ exhaustive product developments. To help manufacturers, content providers, and other vendors pinpoint the current state of consumer markets, here’s a thorough rundown of 8 consumer technology trends in 2023.

Table of Contents

- Cable and Satellite TV Still Losing Popularity

- The Modest Comeback of the Smartphone

- Consumer Robotics Are Maturing

- Biometrics Expansion

- The Pivotal Role of Bluetooth in Consumer Devices

- Consumer AR/VR Still In Limbo

- AI in Mobile Devices

- Big Year for Foldable Devices

If you're running short on time, get the quick version of 2023's biggest consumer technology trends by watching the video below, which comes from the ABI Research YouTube account.

Cable and Satellite TV Still Losing Popularity

Cable TV subscriptions have been on the decline every year since 2017, and 2023 will be no different. ABI Research forecasts that cable TV subscriptions will decrease -0.03% Year-over-Year (YoY) compared to 2022, totaling 495.5 million subscriptions worldwide. Satellite TV will fare no better, with subscriptions declining -0.1% YoY, totaling 239.3 million for the year 2023.

The mature pay TV markets of North America and Western Europe have already been on a slow downward trend for years now, but unfavorable macroeconomic conditions only exacerbate this issue on a global scale. In the face of emerging inflationary pressures, rising interest rates, and fear of a pending recession, consumer behavior continues to lean toward “cord-cutting” to avoid long-term contracts. Helping ignite this consumer trend is the ever-increasing data throughputs available for home use, which makes alternative TV streaming services attainable for more people.

The Modest Comeback of the Smartphone

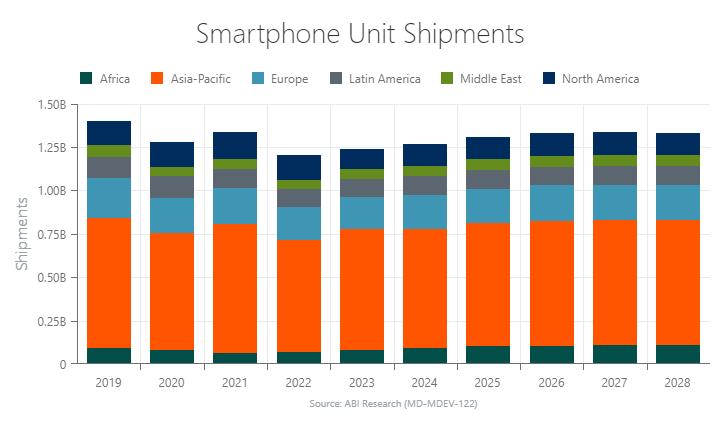

Everything from the COVID-19 pandemic aftershocks to an uncertain macroeconomic environment put the brakes on consumer smartphone shipments in 2022. But what was a -9.6% YoY sales decline last year will bounce back to 2.4% YoY growth in 2023—reaching an estimated 1.2 billion smartphone shipments.

High-end and 5G smartphone shipments, given that they were not significantly affected by ongoing supply chain disruptions, have been very resilient, while other types of consumer technologies have struggled. 5G device affordability, in tandem with consumer sentiment toward enhanced broadband speeds, new form factors (e.g., foldable phones), and greater processing power, will dictate future smartphone growth even beyond 2023.

All in all, there’s a lot to be optimistic about when surveying the smartphone market, and this enormous consumer space is beginning to resemble its former self, albeit still not at pre-pandemic levels.

Learn more about the consumer smartphone market by downloading ABI Research's PDF resource Global Smartphone Market Recap: Forecasts, Updates, And Vendor Performances.

Consumer Robotics Are Maturing

The consumer market for robotics continued to thrive during the past six months, although results from leading players suggest a market adapting to various economic and competitive pressures. This comes at a time when there are also some specific concerns about addressing inventory management and reduced consumer spending.

Consumer robotics shipments for 2023 will increase 13.6% from 2022, with revenue up 12% from 2022, as competition increases in the key home care robotics market. The total market for consumer robotics and smart appliances will see shipments at 215 million units, up 18% from 2022. Meanwhile, revenue will climb 9.6% to US$141.3 billion.

Biometrics Expansion

Another emerging trend in consumer technologies is the growing interest in biometrics for electronic devices. This latest development arose from consumer demand for quicker, easier, and more secure ways to unlock their devices, authenticate payments, and control their mobile apps.

Familiar smartphone capabilities, such as fingerprint authentication and facial recognition, are becoming more widespread biometric features in smartphones and tablets. At the same time, companies aim to differentiate their brands by increasingly developing new technologies like in-display fingerprint sensors and camera-based gesture recognition for consumer products. Conversely, vein recognition, iris scanning, and voice recognition are experiencing slower uptake due to greater technological complexity.

For consumer wearables, such as smartwatches and activity/health trackers, a growing number of devices will support gesture recognition. This feature has been active in smartphones for several years, enabling touchless device control or control over another piece of technology. A notable trend is companies exploring biometric payment authentication through Electrocardiogram (ECG) heartbeat tracking.

ABI Research projects that 12.9% more smartphones, tablets, and wearables (smartwatches and activity trackers) will ship with smart biometric technology in 2023 than in 2022. This translates to more than 3 billion units shipped.

Table 1: Consumer Device Shipments (Millions) in 2023 by Smart Biometrics (Source: ABI Research)

| Biometric Technology/Feature | Smartphones | Tablets | Wearables |

| Facial Recognition | 540.7 | 12.3 | - |

| Gesture Recognition | 174.1 | 4.3 | 36.8 |

| Voice Recognition | 533.4 | 22.5 | - |

| Voice AI | 902.3 | 65.5 | - |

| Ultrasound | 24.3 | - | - |

| Vein Recognition | 19.1 | 0.8 | - |

| In-Display Fingerprint Scanning | 498.9 | 10.3 | - |

| ECG Recognition | - | - | 52.9 |

Note that the above data do not depict the entire biometrics opportunity for consumer devices, just the most common technologies being embedded. For example, wearables (smartwatches and activity trackers) will experience a total of 236.7 million units shipped with biometric features in 2023.

The Pivotal Role of Bluetooth in Consumer Devices

Bluetooth-supported consumer device shipments continue to accelerate, reaching 4.7 billion annual shipments in 2022. Despite supply chain constraints, in 2023, this number is expected to reach a little over 5 billion device shipments, for a 8.8% growth in sales YoY. This upward projection in Bluetooth shipments comes as the technology continues to be deployed beyond smartphones.

Bluetooth is increasingly being used in smart homes, wearables, and other Internet of Things (IoT) applications, in addition to seeing continued growth in high-volume markets, such as wireless headsets, devices accessories, and other Consumer Electronics (CE) devices.

In the smart home, Bluetooth is expected to reach 685.5 million device shipments in 2023, a YoY growth of 24.5%. But the biggest non-cellular Bluetooth market is home entertainment and connected home devices, which include flat panel TVs, DVD/Blu-ray players, UHD Blu-ray players, gaming console controllers, speakers, and other applications. In total, home entertainment and connected home devices will account for 748 million Bluetooth shipments in 2023, or 14.7% of the total Bluetooth market.

Consumer AR/VR Still In Limbo

The consumer Augmented Reality (AR) smart glasses market is still in its early stages and requires further technological maturity, more affordable pricing, and richer content to gain consumer interest. In 2023, the AR smart glasses market will see notable growth due to new device launches from Facebook and, potentially, Apple and Google. Gaming remains the greatest revenue driver for VR. Notable announcements so far this year include Sony’s PlayStation PS VR2 at CES 2023, Reality Lab’s Meta Quest Virtual Reality (VR) gaming update showcase expected in June, and HTC’s new VIVE XR Elite headset.

ABI Research forecasts that total VR Head-Mounted Display (HMD) shipments will increase in 2023, reaching approximately 29 million units. Apart from changes in consumers’ lifestyles caused by the pandemic’s lockdowns, new and richer VR content will be another important growth driver. VR applications have expanded beyond gaming into areas like:

- Tourism

- Mobile retail & marketing (e.g., virtual try-on)

- Education

- Social VR (including Facebook’s Horizon, VR Chat, and Rec Room)

- Sports and fitness (e.g., FitXR)

- Productivity/creativity apps (e.g., Facebook’s Infinite Office and the DJ app, Tribe XR)

AI in Mobile Devices

Artificial Intelligence (AI) is rapidly advancing, transforming industries like healthcare, self-driving cars, manufacturing, and entertainment. In 2023, AI is set to be the game-changing technology of our time.

In the smartphone domain, AI has revolutionized user experiences with features like voice assistants and smart photography. Leading chipset vendors, including Qualcomm and MediaTek, have introduced flagship models like Snapdragon 8 Gen 2 and Dimensity 9200, focusing on AI capabilities, such as enhanced cameras, immersive multimedia, gaming, and security. Smartphone manufacturers have partnered with these vendors to showcase the latest AI innovations in their devices throughout 2023. Business professionals in the consumer technology world must embrace AI to leverage its potential, drive innovation, and gain a competitive edge.

This trend was part of ABI Research’s whitepaper on 2023 Technology Trends.

Big Year for Foldable Devices

Foldable devices are poised to become the next big thing in consumer technology, with 2023 being a pivotal year for pushing their mainstream adoption. Although still niche now, Original Equipment Manufacturers (OEMs) are heavily investing in modern designs and form factors, propelling the growth of this category.

While Samsung has led the way with its Fold and Flip series, other prominent brands like Huawei, vivo, Motorola, and OPPO have joined the foldable device bandwagon, expanding consumer choice. The appeal of foldable devices is steadily growing as consumers seek the convenience of a compact phone without sacrificing screen size.

ABI Research forecasts that shipments of foldable phones will reach 33.7 million units in 2023, at a robust Compound Annual Growth Rate (CAGR) of 77.9% between 2020 and 2025—hitting around 68 million units by 2025. Although these devices are currently limited to specific geographical regions, our research firm anticipates a price decrease over time, leading to increased demand and wider availability worldwide.

For more emerging consumer technology trends, download the following ABI Research reports:

Consumer Technologies [Market Data]

Mobile and Portable Broadband Device Markets [Market Data]

Consumer Technologies: 1H Market Update [Presentation]