Imagine for a moment that you’re a farmer working in a remote area of your country where there is little to no population. In this scenario, you would be far from any sprawling cities and, therefore, adequate Terrestrial Network (TN) infrastructure for device connectivity. The problem is that reliable connectivity is necessary when you need to monitor the condition of your crops, water supply, and tractors. This is where satellite Internet of Things (IoT) services are a game-changer, and these applications don’t just apply to the agriculture industry. Any work site located in a remote/rural area, such as the mining, oil & gas, and fleet management markets, could all benefit from space-based IoT communications. In this post, we list 13 companies that innovation leaders should assess as they look to implement satellite IoT solutions into their operations.

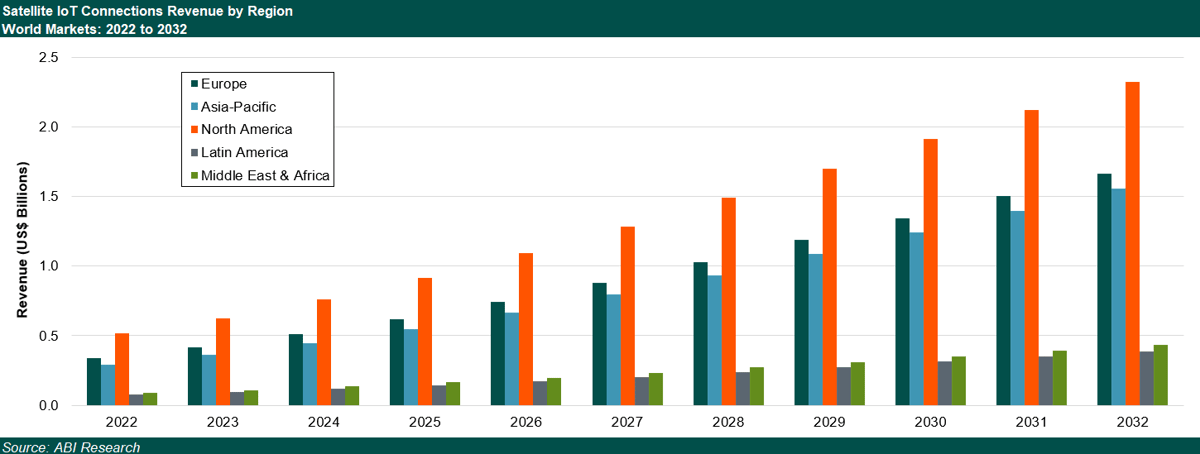

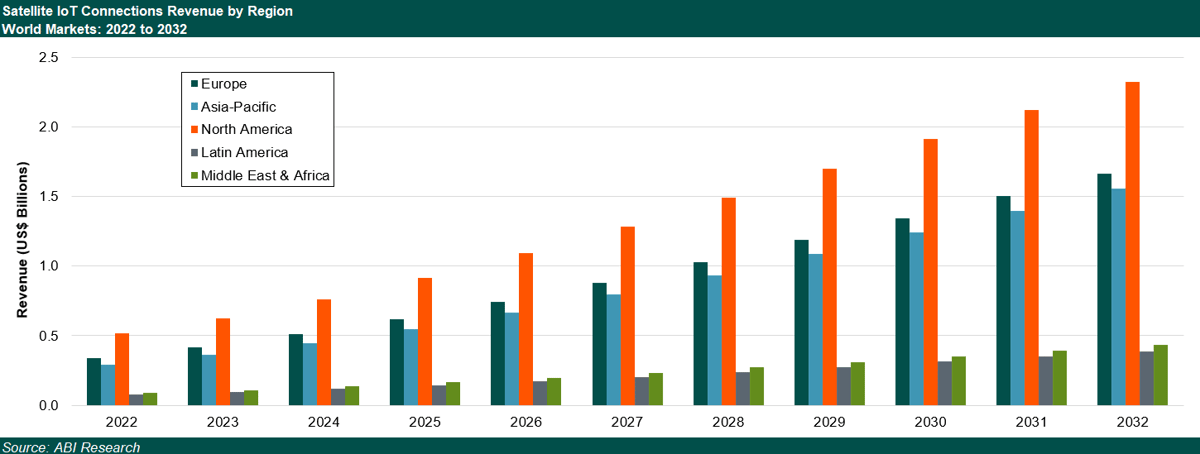

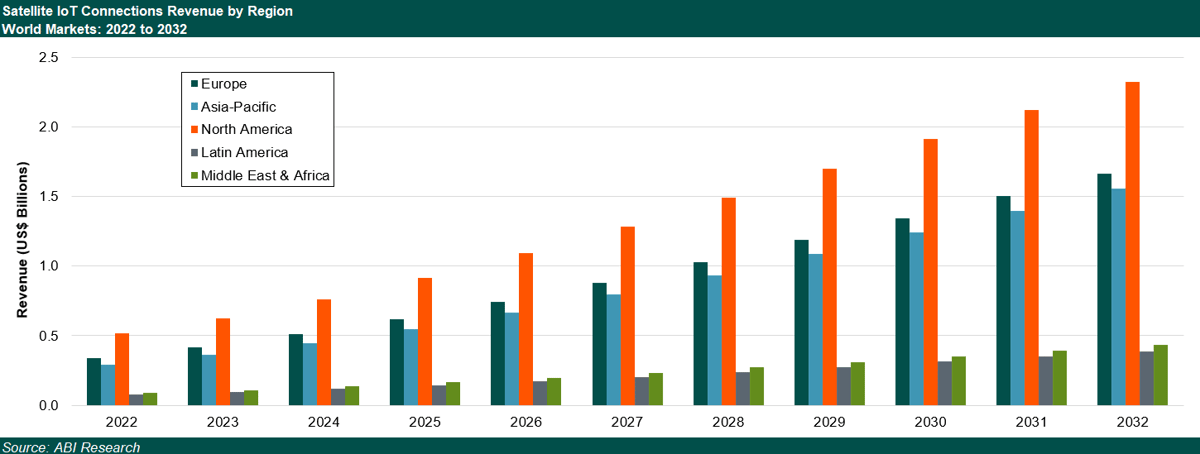

North America is set to dominate the satellite IoT market, driven by its cutting-edge technology, substantial investments in space technologies, and a favorable regulatory environment. North America's satellite IoT demand is driven by national security, military real-time data needs, and industries like agriculture, healthcare, and transportation. Investments in Low Earth Orbit (LEO) constellations like SpaceX's Starlink and Amazon's Project Kuiper will improve service availability and affordability, thereby reinforcing the region's market dominance.

China is set to dominate the Asia-Pacific satellite IoT market, driven by initiatives like Thousand Sails (Qianfan) and increasing private sector participation. Government investments, coupled with the booming Electric Vehicle (EV) market, will boost demand for satellite IoT services in

connected cars.

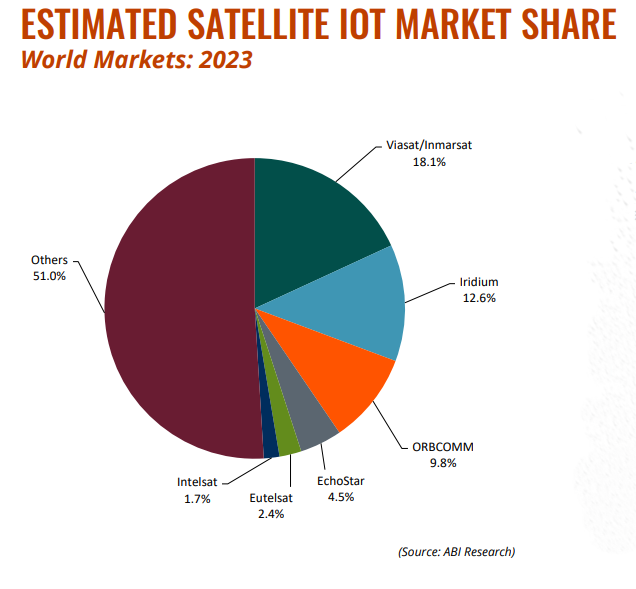

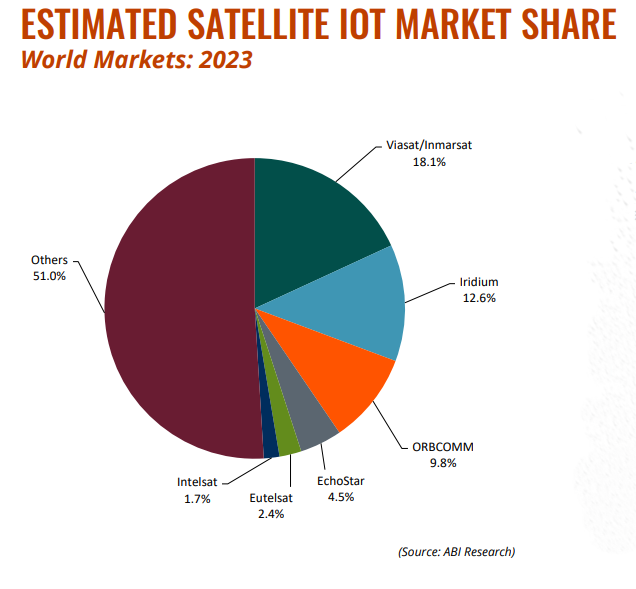

Viasat/Inmarsat, following the merger, has emerged as a major player in the satellite IoT market. Combining Viasat’s advanced broadband capabilities with Inmarsat’s extensive L-band network and global reach, the unified entity offers comprehensive satellite connectivity solutions across

industries and has strengthened its position as a key provider in the satellite IoT ecosystem.

Iridium, with an estimated north of 1.7 million subscribers, has a strong presence in the satellite IoT market. This extensive subscriber base highlights Iridium's leadership and its pivotal role in shaping the future of satellite IoT technologies.

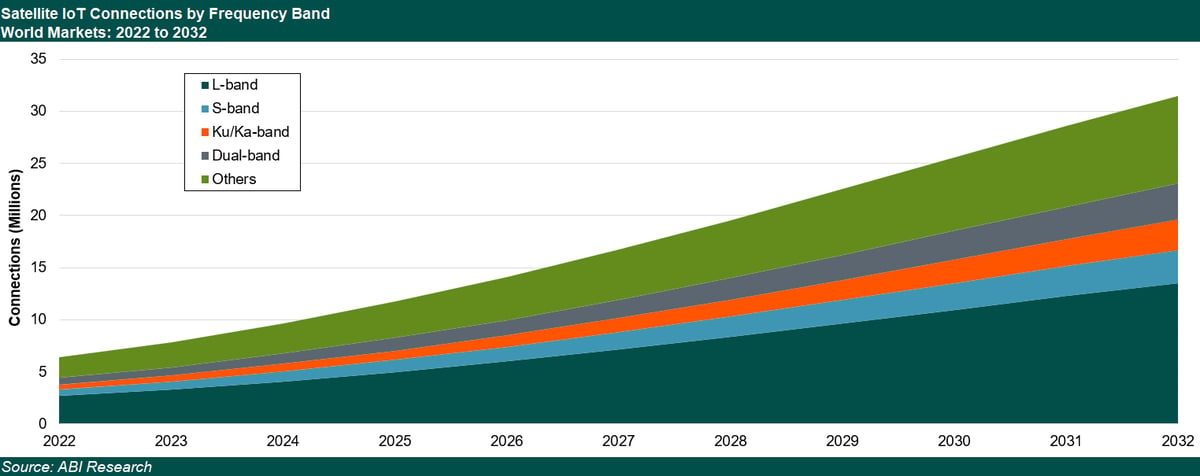

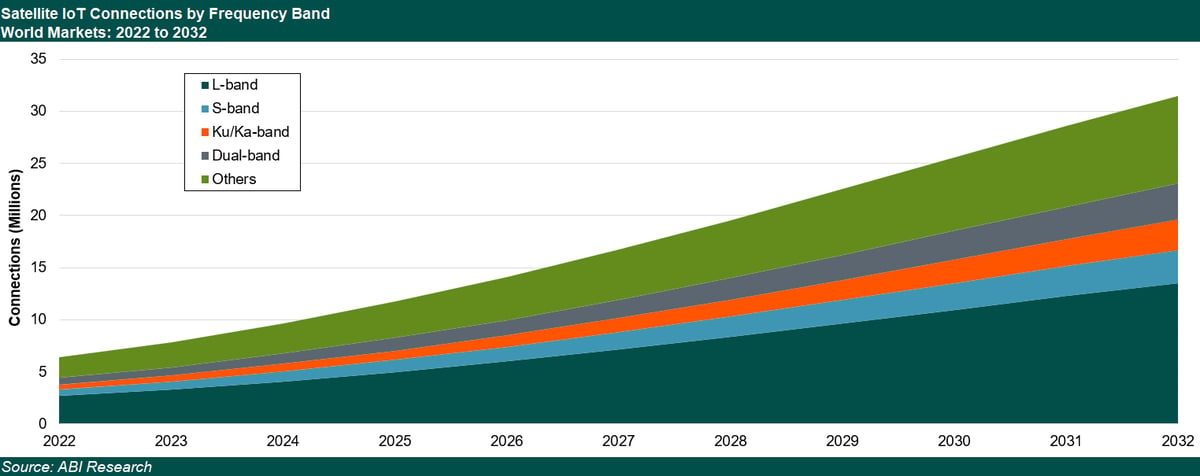

The total number of satellite-enabled Internet of Things (IoT) connections reached 9.7 million by the end of 2024 and are projected to reach approximately 31.5 million by 2032, highlighting rapid growth and increasing demand for global satellite IoT connectivity solutions. The L-Band (1 – 2 Gigahertz (GHz)) is expected to lead the satellite IoT market due to its weather resilience, global coverage, and compatibility with low-power devices.

Click the arrow to move this data slide deck

North America is set to dominate the satellite IoT market, driven by its cutting-edge technology, substantial investments in space technologies, and a favorable regulatory environment. North America's satellite IoT demand is driven by national security, military real-time data needs, and industries like agriculture, healthcare, and transportation. Investments in Low Earth Orbit (LEO) constellations like SpaceX's Starlink and Amazon's Project Kuiper will improve service availability and affordability, thereby reinforcing the region's market dominance.

China is set to dominate the Asia-Pacific satellite IoT market, driven by initiatives like Thousand Sails (Qianfan) and increasing private sector participation. Government investments, coupled with the booming Electric Vehicle (EV) market, will boost demand for satellite IoT services in

connected cars.

Viasat/Inmarsat, following the merger, has emerged as a major player in the satellite IoT market. Combining Viasat’s advanced broadband capabilities with Inmarsat’s extensive L-band network and global reach, the unified entity offers comprehensive satellite connectivity solutions across

industries and has strengthened its position as a key provider in the satellite IoT ecosystem.

Iridium, with an estimated north of 1.7 million subscribers, has a strong presence in the satellite IoT market. This extensive subscriber base highlights Iridium's leadership and its pivotal role in shaping the future of satellite IoT technologies.

The total number of satellite-enabled Internet of Things (IoT) connections reached 9.7 million by the end of 2024 and are projected to reach approximately 31.5 million by 2032, highlighting rapid growth and increasing demand for global satellite IoT connectivity solutions. The L-Band (1 – 2 Gigahertz (GHz)) is expected to lead the satellite IoT market due to its weather resilience, global coverage, and compatibility with low-power devices.

Click the arrow to move this data slide deck

North America is set to dominate the satellite IoT market, driven by its cutting-edge technology, substantial investments in space technologies, and a favorable regulatory environment. North America's satellite IoT demand is driven by national security, military real-time data needs, and industries like agriculture, healthcare, and transportation. Investments in Low Earth Orbit (LEO) constellations like SpaceX's Starlink and Amazon's Project Kuiper will improve service availability and affordability, thereby reinforcing the region's market dominance.

China is set to dominate the Asia-Pacific satellite IoT market, driven by initiatives like Thousand Sails (Qianfan) and increasing private sector participation. Government investments, coupled with the booming Electric Vehicle (EV) market, will boost demand for satellite IoT services in

connected cars.

Table of Contents

- 1. Inmarsat

- 2. Astrocast

- 3. Eutelsat

- 4. Lacuna Space

- 5. FOSSA Systems

- 6. Globalstar

- 7. ORBCOMM

- 8. Wyld Networks

- 9. HEAD Aerospace Group

- 10. Iridium

- 11. Myriota

- 12. eSAT Global

- 13. Hiber

1. Inmarsat

British satellite operator Inmarsat offers enterprises with a satellite IoT service called ELERA, which leverages Geosynchronous Earth Orbit (GEO) constellations. Operating on the L-band and Ka-band payloads, the company’s recently launched I-6 satellites are impressive. Our analysts report that these satellites top the charts in terms of both size and use of cutting-edge technology. These Satellite Communications (SatCom) services are key in facilitating IoT solutions from Hiber, ORBCOMM, Skylo, and other providers.

As an example, Inmarsat’s satellite IoT-supported solutions Fleet Connect and Fleet Data are being used by Saudi-based offshore firm Zamil to uncover important insights into vessels. The former will provide the necessary satellite connectivity to support monitoring activities onboard the vessels, while the latter provides the data analytics capabilities to better understand the performance of the vessels.

2. Astrocast

Swiss satellite operator Astrocast uses 18 Low Earth Orbit (LEO) nano-satellites to provide IoT connectivity services for businesses, with 80 satellites as a goal. LEO connectivity is done with Astrocast’s Astronode S modules, which are compatible with low-cost L-band patch antennas. Due to LEO satellites being closer to Earth—therefore requiring smaller data packets—Astrocast boasts 5- to 10-year battery lives for small-sized IoT devices.

In April 2023, the company announced that it had entered into an investment agreement with Thuraya, a subsidiary of the United Arab Emirates’ (UAE) leading satellite solutions provider Yahsat, with the latter investing US$17.5 million into Astrocast’s LEO satellite constellation.

Astrocast is a key facilitator of a satellite-based precision farming solution provided by Avirtech. As farms are in remote areas, terrestrial networks fall short of what farmers require in connectivity needs. The satellite IoT solution allows farmers to monitor data from their IoT devices, such as crop/soil conditions, in real time.

3. Eutelsat

Based in France, Eutelsat offers satellite IoT services via its IoT FIRST solution, which leverages its GEO satellite constellation. Eutelsat’s IoT solution provides customers with a simple and integrated solution that includes a compact, low-power, easy to install satellite terminal, Ku-band satellite capacity, and an IoT-dedicated hub, operated and managed by Eutelsat.

Some of the key verticals supported by Eutelsat’s IoT FIRST solution include the retail and banking, infrastructure and construction, energy and utilities, agriculture, and telecoms industries.

4. Lacuna Space

U.K.-based Lacuna Space enables data transfer with ground-based IoT devices via the LoRaWAN protocol. The company’s partnership with Wyld Networks is a key facilitator of the satellite IoT solution, leveraging Wyld Networks’ sensor solutions and cloud-based Fusion platform. The goal for Lacuna Space is to eventually have 240 satellites in orbit to form its LEO constellation. In tandem with Semtech Corporation and IoT Ventures, Lacuna Space was a key collaborator in developing a Drought Early Warning System for geographically remote islands in the Pacific.

5. FOSSA Systems

Spanish company FOSSA Systems is one of the newer players to the satellite market, having been officially established in 2020. The company’s satellite IoT solution relies on connectivity from 13 pico-satellites, but 80 satellites by 2024 is its target. Future satellites are expected to be larger than the current ones in orbit to offer higher performance.

FOSSA Systems’ satellite IoT services are backward compatible with Long Range Wide Area (LoRa) protocols and go hand-in-hand with the terrestrial connectivity solutions your firm may already be using. Finally, the company’s close collaboration with several satellite ecosystem partners allows it to provide customers with an End-to-End (E2E) IoT solution supporting device and data visualization features.

6. Globalstar

American satellite operator Globalstar is the secret sauce behind Apple’s satellite-based direct-to-phone emergency messaging services, which saved lives during the Maui wildfires. Reportedly, Apple loaned Globalstar US$252 million to launch a fleet of LEO satellites to support the emergency services app. Supposedly, 85% of the new satellites’ capacity will be dedicated to Apple alone. This partnership also places Globalstar in the Non-Terrestrial Network (NTN) mobile market.

Globalstar’s IoT and SPOT products are capable of two-way duplex and one-way transmission, transmitting over 1.8 billion messages annually, tracking and monitoring assets, and saving lives in more than 100 countries worldwide.

Related Content:

5 Ways Satellite IoT Is Changing

Launching Into the Future of Satellite Technology with SpaceX’s Reusable Rockets

What SatCom Operators Should Know as the Satellite IoT Age Ushers In

7. ORBCOMM

Customers of ORBCOMM can choose to get satellite IoT services either through the LEO-oriented ORBCOMM OG2 or GEO-oriented IsatData Pro (IDP). The former uses ORBCOMM’s own 12-satellite constellation, while the latter leans on Inmarsat’s GEO network to provide IoT connectivity.

Maritime is one of the key use cases of ORBCOMM’s satellite IoT solutions, with Global Ocean Security Technologies partnering with the company to track, monitor, and manage its sea-bound vessels. If any kind of incident (fire, theft, power loss, etc.) occurs, vessel owners will be alerted in real time so that a course of correction can be made as quickly as possible.

ORBCOMM has also struck up an arrangement with global materials manufacturer Terex to provide an End-to-End (E2E) telematics solution that tracks and monitors the performance of Terex’s crushers. This way, Terex’s customers can view critical telemetry data of their machinery, translating that into increased productivity and reduced downtime with rich performance analytics.

8.Wyld Networks

Swedish satellite IoT solutions provider Wyld Networks uses DTS LoRaWAN connectivity from Lacuna Space, Eutelsat, and other LEO operators the company has partnered with. In early 2023, a couple of big announcements were made by Wyld Networks. First, the company plans to cement 5G Narrowband IoT (NB-IoT) into its service, which will reportedly double its Total Addressable Market (TAM). Second, Wyld Networks announced a US$1.2 million purchase order for its satellite IoT modules from a telco/SatCom services provider based in the Middle East.

Notable case studies for Wyld Networks include providing energy supplier Chevron, as well as a Middle Eastern water utility provider, with a satellite-based Condition-Based Monitoring (CBM) solution. With the satellite IoT solution, these companies have full visibility over their infrastructure, thereby detecting leaks, improving operational efficiencies, and performing predictive/preventative maintenance.

9. HEAD Aerospace Group

HEAD Aerospace Group’s demonstration mission in 2017, the HEAD satellite, marked the beginning of the Chinese operator’s satellite IoT ambitions. This diverged from the path on satellite-based Earth Observation (EO) imagery services that HEAD originally focused on. The company currently has 14 of its 48 planned nano-satellites launched in space, which form the LEO/Sun-Synchronized Orbit (SSO) constellation dubbed Skywalker. Like Wyld Networks, HEAD satellite IoT terminals support LoRaWAN standards, thereby providing a low-cost and low-power means of IoT connectivity.

10. Iridium

U.S.-based Iridium provides satellite IoT connectivity services over 66 satellites operating in the L-band. A key differentiation of Iridium is that its use of medium-sized satellites enables the company to support a greater variety of applications. With these medium-sized satellites, Iridium provides enterprise customers with increased data processing capabilities (Iridium Messaging Transport (IMT) and Iridium Certus services), inter-satellite links for improved network reliability/resilience, and other attractive product features.

Japanese firm Sumitomo Construction Machinery Co. Ltd. (SCM) has leveraged Iridium’s services to provide satellite connectivity for its RemoteCARE service platform. The satellite IoT solution ensures that owners can consistently monitor the performance of their heavy equipment via telemetry and geographical data. This satellite-based connectivity offering is particularly useful for when equipment is located in hard-to-reach remote/rural work sites.

11. Myriota

Australian SatCom company Myriota provides satellite IoT services over its 20 deployed nano-satellites, with a target of 50 in the future. Myriota, through a partnership with solar-powered pump manufacturer Grundfos, helps livestock farmers remotely monitor pumps and tanks in rural regions that often lack reliable terrestrial network connectivity. For example, farmers will be alerted via a mobile app when the water supply is low. These space IoT communications reduce the costs of manually inspecting agriculture water systems and providing maintenance services.

Myriota’s low-cost, power-efficient satellite IoT services have also been leveraged to develop the Agbot (autonomous farming robot) and improve the South Australian Department for Environment and Water (DEW) groundwater bore monitoring and management.

12. eSAT Global

Leveraging GEO satellites (L-band) from Thuraya, American company eSAT Global can achieve Direct-to-Satellite (DTS) connectivity at sub-2-second latencies with minimal interference. In its efforts to collaborate with other IoT service providers, eSAT Global joined the IoT Machine-to-Machine (M2M) Council in January 2023. This makes the company a major player in developing satellite solutions that can address critical requirements.

13. Hiber

Dutch firm Hiber decided to begin centering its business model around satellite IoT services in 2020, and pivot away from providing SatCom connectivity. Hiber was acquired by Swiss IoT provider Astrocast in 2022 and uses Inmarsat’s ELERA network to enable satellite connectivity. Hiber is renowned for its water supply and pipeline Condition-Based Monitoring (CBM) solutions, as exemplified in its partnership with Shell. The solution cuts manpower costs, while also improving worker safety at the oil site.

Satellite IoT Market Findings

Today, the satellite IoT market is relatively small, but many companies are gearing up to capitalize on this fast-growing space. The historically cost-prohibitive factors of constructing and launching satellite constellations has dissipated due to recent satellite technology advancements. This puts the direct-to-satellite market in a healthy state, allowing more companies/startups to innovate on the IoT side of things. As can be concluded from this article, strategic partnerships have been a common trend as satellite connectivity operators and IoT players lean on each other’s strengths. Moreover, many satellite operators are partnering with other operators to leverage different orbits, technologies, or spectrum. For many, these partnerships are the path to full, E2E satellite IoT solutions/platforms.

As the market barrier to entry has lowered, ABI Research forecasts satellite IoT connection revenue to increase from US$1.6 billion in 2023 to US$6.3 billion in 2030—for a Compound Annual Growth Rate (CAGR) of 16.6%. Our company expects fleet operators and organizations with robust condition-based monitoring requirements to leverage satellite IoT services the most.

To stay on top of all the latest SatCom trends, be sure to subscribe to our Space Technologies & Innovation coverage.