The year 2024 is set to be a big one for sustainability. Governments worldwide have introduced various policies in recent years that will drive further enterprise investment in green technologies in 2024. Sustainability has ingrained itself into corporate strategies as companies look to appease eco-conscious consumers and adhere to new green regulations. What will this year bring in terms of net-zero emissions efforts? How are enterprises reacting to increased demand to reduce carbon footprints? How can this be achieved? In this post, we’ll share five unique sustainability trends pulled from ABI Research’s annual trends whitepaper.

Table of Contents

- Regulators Accelerating Adoption of Traceability and Transparency Technologies

- LFP Batteries Will Gain Market Share in Europe

- Sustainability Software Advancements and Increased Spending

- Further Implementation of AI In Telco Networks for Energy Efficiency

- Green Hydrogen Production Ramping Up

1.) Regulators Accelerating Adoption of Traceability and Transparency Technologies

Between population growth and higher quality of life, consumers buy products and absorb resources more than ever. The planet has limited resources, necessitating more sustainable supply chains. To achieve this goal, Digital Product Passports (DPPs) are increasingly being adopted this year to modernize tracking, labeling, and communication of product information.

Traceability regulations in the European Union (EU) and eco-conscious manufacturers (Electric Vehicles (EVs), construction materials, consumer goods, food, and pharmaceuticals) are key drivers of DPP adoption. The European Commission recently identified textiles, furniture, iron and steel, aluminum, tires, paints, lubricants and chemicals, electronics, and energy-related products as the top priority for DPP adoption. Businesses in these industries will be the first to adopt DPPs, with a 2026 target date for the mandate to begin.

DPPs help companies track sustainability performance across the entire value chain. The data generated by DPPs will promote greater transparency about an organization’s recyclability, circularity, and carbon footprint. In 2024, more companies are expected to prepare for DPP implementation to gain fuller transparency in their supply chains.

2.) LFP Batteries Will Gain Market Share in Europe

Our next sustainability trend for 2024 is the increasing popularity of Lithium Iron Phosphate (LFP) batteries for EV manufacturing. Cost is still the biggest inhibitor to EV adoption by consumers, according to recent survey results from S&P Global. To get around this, ABI Research expects more European carmakers to use the more cost-effective and ethical LFP batteries. A lower cost of manufacturing will translate to an overall lower retail price for EVs, making them accessible to more consumers.

Compared to the more popular lithium Nickel Manganese Cobalt (NMC) batteries, LFP battery minerals are less expensive to extract and don’t carry the ethical concerns surrounding cobalt and nickel extraction processes. Chinese suppliers, such as CATL and BYD, dominate the LFP battery market and will be key partners for European Original Equipment Manufacturers (OEMs). Notable car brands, including Mercedes, Stellantis, and BMW, have partnered with Chinese battery suppliers to introduce LFP cells for their upcoming entry-level EVs in 2024 and beyond.

At the same time, these European carmakers will compete with Chinese OEMs (BYD Dolphin, Volvo EX30, and XPENG G6), which are already one step ahead with LFP battery adoption and plan to expand their geographic market range. These brands’ significant cost advantage allows them to provide excellent value for money, something consumers are drawn to.

3.) Sustainability Software Advancements and Increased Spending

Sustainability software solutions are increasingly seen as an essential technology, with pressure coming from governments, consumers, and investors to track the environmental impact of operations. Environmental, Social, and Governance (ESG) software has come to the forefront of the market as we head into 2024. Sustainability software providers aim to make their solutions even more robust, introducing additional services like data Quality Assurance (QA) and real-time monitoring.

To expand their customer bases in the European and North American markets, ESG software suppliers will fuse their offerings with Artificial Intelligence (AI), data analytics, automation, and predictive analysis. Businesses that use these ESG reporting solutions will be better equipped to improve operational efficiency, increase equipment efficiency, minimize environmental impacts, and prioritize worker well-being.

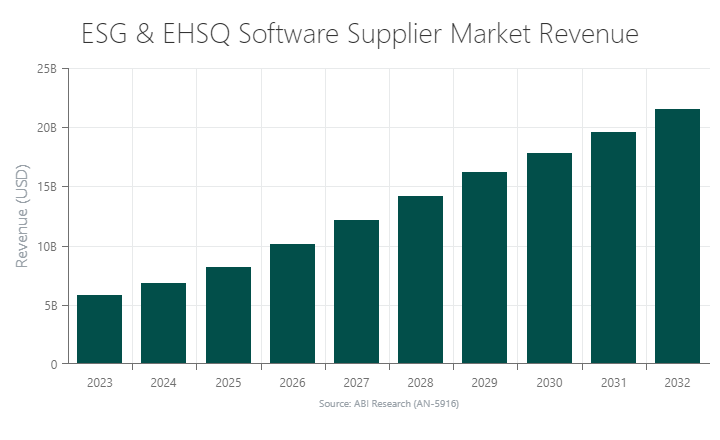

ABI Research forecasts that revenue for ESG and Environmental, Health, and Safety Quality (EHSQ) software will grow 17% Year-over-Year (YoY) in 2024. This translates to a US$6.8 billion market opportunity, with companies in North America and Europe, the Middle East, and Africa (EMEA) accounting for 78% of worldwide spending on ESG and EHSQ software.

4.) Further Implementation of AI In Telco Networks for Energy Efficiency

The recent partnership between Ericcson and Telenor signals the dawn of AI-driven energy management in the telecommunications industry. The solutions from the companies aim to improve Radio Access Network (RAN) performance using AI-driven insight.

In recent years, AI has shown proven value in network optimization and predictive maintenance, enhancing operational efficiency, reliability, and profitability. For sustainability purposes, AI-supported software applications can accurately predict network demand, optimize network routing, and reduce energy consumption during off-peak hours. As telcos embark on their net-zero emissions efforts, ABI Research expects the trend of adopting AI for network management to increase in 2024.

5.) Green Hydrogen Production Ramping Up

Green hydrogen (powered by renewable energy) is seen as a sustainable substitute for fossil fuels within heavy industrial sectors such as oil & gas, steel, transport, and cement. Governments worldwide have ramped up their clean hydrogen ambitions.

For example, the EU wants 42% of hydrogen used by industry to be renewable hydrogen by 2030. In the United States, the Department of Energy (DOE) has allocated US$1 billion to the Midwest Alliance for Clean Hydrogen (MachH2) to kick-start a clean energy ecosystem in the region. And in India, a new policy mandates that 30% of fossil fuels originating at oil refineries must be replaced with green hydrogen by 2035.

The year 2023 was already a great one for green hydrogen production, and 2024 will continue that trend as governments seek Carbon Dioxide (CO2) reductions. Shipments for electrolysers, key to green hydrogen production, have been doubling every year since 2020, with 2024 expected to reach similar results.

Final Thoughts

Achieving net-zero emissions requires a global effort from organizations, governments, and consumers. Sustainable practices can stem from various operational areas, from on-site renewable energy adoption to circular product design. While solid momentum is building for sustainability, the momentum must continue to reach carbon emissions reduction targets. ABI Research is committed to assisting enterprises and technology vendors embarking on the sustainability journey with research services in EVs, sustainability software markets, circularity technologies & programs, and more. To see more key trends, download the whitepaper 82 Technology Trends That Will—And Will Not—Shape 2024.