From 2019 to 2023, global Electric Vehicle (EV) sales grew by 506%. From regional policies to consumer sentiment, several factors have brought the EV market to where it is today. While EV sales have improved significantly in recent years, ABI Research has witnessed a market growth slowdown. In developed Western countries, EV prices are still mostly premium, making Internal Combustion Engine (ICE) cars a more affordable option for average consumers. There is a limited number of early adopters willing to pay the premium price for an EV. Now, automakers must find a way to tap into the mainstream consumer base to broaden the market.

Governments with zero-emissions targets, notably in Europe, have driven EV demand through financial incentives. However, as Germany and the United Kingdom scale back EV subsidies, the European EV market is expected to slow down. Meanwhile, the U.S. EV market is too centered around Tesla as the carmaker and California as a customer base.

China has been the most significant EV market, with the country continuing to experience sales growth higher than the rest of the world. BYD’s local presence has undoubtedly been a huge contributing factor, providing Chinese consumers access to affordable entry-level EVs.

Overall, the EV market outlook is positive and on a clear upward trajectory with tremendous potential. However, recent market data forecasts from ABI Research illustrate short-term market growth stagnation in major regions.

Key Takeaways

- While the EV market will still experience sales growth in 2024 and beyond, it won’t be at the same rate as recent years.

- China remains the top regional market for EV carmakers

- The economically critical countries of Germany and the United Kingdom have curtailed EV incentives, causing a dip in sales for Europe as a whole.

- EV adoption rates in the United States lag behind Europe and Asia, as there is a lack of real competition to Tesla.

- Public charging infrastructure is expected to be built rapidly throughout the decade to support the upcoming electrification transition.

Global EV Sales Outlook in 2024

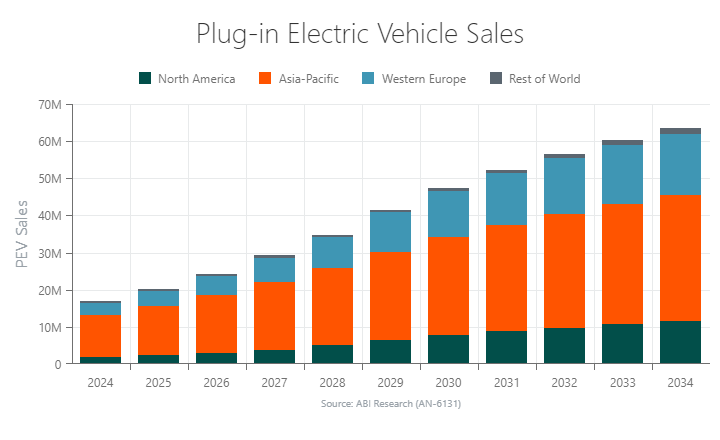

ABI Research forecasts that 16.98 million EVs will be sold worldwide in 2024, a 25% Year-over-Year (YoY) growth. However, this sales growth is a sharp decline compared to the 31% sales growth in 2023 and 60% in 2022. The EV market slowdown can largely be attributed to a lack of government incentives for consumers to purchase an EV and the high Manufacturer’s Suggested Retail Prices (MSRPs) of EVs in Europe and North America.

YoY EV sales growth will sustain a rate of around 15% to 20% throughout the rest of the decade, never reaching pre-2024 levels. As governments ramp up their zero-emissions targets and Original Equipment Manufacturers (OEMs) develop lower-priced models, annual EV sales volume is expected to climb to 48.6 million by 2030.

China Continues Its EV Market Dominance

Asia-Pacific is easily the largest EV market in the world, with China’s EV industrial focus being the most influential factor. China is home to the new EV market leader, BYD, an automobile manufacturer holding 35% of the country's EV market share. The Shenzhen, China-based company possesses huge supply chain advantages over competitors, allowing it to offer consumer-friendly price points.

While EV adoption has somewhat hit the brakes in China, ABI Research asserts that the country is still in a very healthy state and will sustain its dominance throughout the decade. Chinese EV sales are estimated to grow by 23% in 2024, outpacing global sales growth. Much of this growth comes from the recent price war led by Tesla and BYD, dragging in other Chinese OEMs. These OEMs have cut their EV prices to win over the price-sensitive Chinese customer base. Moreover, new EV brands such as Geely’s ZEEKR, Huawei’s Aito, and Li Auto ignite further consumer excitement for EVs in China.

Our market analysis also indicates that 2 out of 3 EV purchases worldwide will be made in the Asia-Pacific region this year. As other regional markets mature, Asia-Pacific’s EV market share will shrink slightly to 55% by 2030.

Related Content

North American OEMs Launch Their Own Charging Network to Fight Against a Tesla Monopoly

How Is Europe Faring?

EV adoption has largely been solid across Europe, particularly in affluent Western European countries. In 2024, our team expects EV sales to grow by 10% YoY, totaling 3.2 million total shipments. While this sales growth is consistent with the last few years’ growth rates, it’s a far cry from the explosive 65% and 143% YoY growth for EV sales in 2021 and 2020, respectively. The main reason for this sales stagnation is the rollback of government policies to incentivize consumers to purchase EVs.

A key trend to be aware of is the relationship between government subsidies and EV adoption rates. Germany and the United Kingdom have recently withdrawn subsidies for citizens who purchase an EV. Germany eliminated a €6,750 subsidy for BEV owners at the end of 2023, succeeding the United Kingdom’s elimination of £1,500 EV grants in 2022. Government incentives have proven to be an essential factor in EV market proliferation. Considering Germany and the United Kingdom account for almost half of total EV sales in Europe, these subsidy rollbacks will cause the European EV market to slow down a bit in 2024. In contrast, countries with strong government incentives—France, the Netherlands, Belgium, etc.—are experiencing significant and sustained EV sales volumes.

ABI Research believes that introducing entry-level EVs will help push wider EV adoption on the continent, despite a lack of subsidies in some countries. The good news is that ABI Research forecasts 10.4 million annual EVs to be sold in Western Europe by 2030, more than 3X the number of EVs sold in 2023.

EV Sales in North America Held Back by Premium Prices

North American EV sales grew by 50% in 2023, reaching 1.59 million shipments. However, that trend will be short-lived, significantly dipping to 20% in 2024. This equates to a total of 1.9 million EV sales for the year. Considering the high population and heavy presence of automakers in the region, EV sales volume in North America is lackluster compared to Western Europe and China.

Outside of California—where a third of U.S. Battery Electric Vehicle (BEV) registrations are held—EV adoption hasn’t taken off meaningfully. Moreover, most OEMs have struggled in the U.S. market, with Tesla holding an impressive 55% EV market share. A lack of competition hinders EV innovation and keeps prices relatively high.

Carmakers such as Ford and General Motors (GM) have recently reduced their 2024 EV sales targets as consumer demand is not strong enough. A recent Autolist survey suggests the lack of EV demand in the United States comes from high sticker prices, range anxiety, and a lack of charging infrastructure. Moreover, the United States lacks the widespread EV incentives that many European Union (EU) members offer. Until OEMs can offer reliable EV models at entry-level or mainstream price points and build out widespread charging stations, the electrification transition will be hindered in the country.

Constructing gigafactories, such as Gotion’s planned US$2 billion battery plant in Illinois, will be key to facilitating the mass production of EVs across North America. Many hurdles will be addressed in the next couple of years, stimulating broader demand for EVs in the second half of the decade. ABI Research expects North American EV sales to be 7.7 million annually by 2030, a nearly five-fold increase compared to 2023’s figures.

Public EV Charging Infrastructure Must Be Built

Range anxiety is a top reason for consumer skepticism of EVs. Coupled with a lack of widespread charging infrastructure, there is justified skepticism about EVs. After all, consumers shouldn’t have to worry about finding a charging station when their EV battery is drained. Indeed, it should ideally be just as easy to find an EV charging station as it is to find a gas station.

There is still a concerning discrepancy between the number of EVs on the road and the number of public charging points. More specifically, the geographic coverage of chargers must expand to accommodate a wide range of driving use cases (e.g., highway, suburbs, metropolitan, etc.).

In 2024, there will be 27.2 EVs per every public Direct Current (DC) charging point, which are essential for fast and ultra-fast charging. For Alternating Current (AC) charge points, the ratio is 13.5 EVs per charging point (see more in the Public EV Charging Points by Type chart).

EV Market Summary

The pace at which the EV market is progressing has come to a slowdown in all the major regions. While EV sales are expected to still be on the rise again in 2025, it won’t be nearly as high an adoption rate as during previous years. In Western Europe, EV sales growth should ideally be looked at on a country-by-country basis due to differing government policies. For example, while Germany’s BEV sales are expected to dip by 11% in 2024, France's BEV sales will increase by 25%. Unlike Germany, France has kept its consumer incentives for purchasing EVs.

This trend is not dissimilar to the EV situation in the United States. California sells the most EVs in the country by a long shot, hitting a record number of sales in 2023. While California already has a huge population, the state also has the highest EV sales penetration (25%). Like France, Belgium, the Netherlands, and other European nations, California’s government provides rebates for consumers who purchase or lease a zero-emission vehicle. In this regard, a state-by-state analysis makes more sense for gauging the U.S. EV market.

Finally, China has perhaps set the gold standard for the EV industry. Although the country has mostly rolled back its national government subsidies, some tax exemptions and financial incentives remain at the municipal level. Even more, many Chinese EV industry players like BYD have achieved near-parity price points with ICE vehicles. For the average consumer, lower sticker prices make EVs a more realistic option for their next car purchase. In the coming years, ABI Research expects carmakers in Europe and North America to also lower their EV price points, which will create an inflection point for EV adoption and accommodate bans on fossil fuel vehicles. Until the automotive industry can offer affordable EVs and provide ubiquitous charging infrastructure, hybrid vehicles may be a necessary stepping stone to a fully electric car future.

For a full evaluation of the current and future EV market, download ABI Research’s The EV Market Slowdown report.