The automotive industry operates like a jungle: you adapt, or you die. If you fail to evolve and enhance vehicle features, you risk losing your customers to the competition. When reflecting upon vehicle evolution, the transition to Electric Vehicle (EV) powertrains and charging infrastructure probably first comes to mind. After all, government mandates and eco-conscious consumers alike are stimulating unprecedented demand for zero-emission vehicles. While the electrification transition is essential for Original Equipment Manufacturers (OEMs) to remain competitive, so too will be the evolution of in-vehicle infotainment.

Cars are becoming more software-defined and connected with every passing year, creating truly digital cockpit experiences beyond the typical radio or standard Global Positioning System (GPS) navigation. Indeed, ABI Research has observed several recent developments in multimedia streaming, in-vehicle gaming, next-generation car assistants, integrated app stores, and other features shaping the future of the automotive experience. Many strategic partnerships have been struck between carmakers and software partners to bring automotive infotainment to new heights.

This new trajectory for in-vehicle infotainment solutions will entice consumers by offering novel applications. Simultaneously, the entertainment and productivity apps enabled by forward-looking infotainment will unleash revenue streams previously unattainable for OEMs, content providers, advertisers, and infotainment technology vendors.

Why Is In-Vehicle Infotainment Gaining Popularity?

The primary reason in-vehicle infotainment services will gain greater prominence is that drivers have more leisure time than ever. For one thing, cars are becoming increasingly automated, which can be boring for the driver if there’s no content to engage with. While fully automated vehicles are still some years away from the mass market, OEMs must prepare for this future.

Imagine being in a self-driving car that’s traversing dozens or even hundreds of miles along the highway. You could go on your phone or read a book to kill time, but infotainment services such as Virtual Reality (VR) gaming would provide a more immersive experience. When cars reach SAE Level 4 and Level 5 automation, it’s likely that carmakers will re-purpose windshields as displays for entertainment and productivity apps. Augmented Reality (AR) Heads Up Displays (HUDs) are already offered by select OEMs and Tier Ones to provide driving information within the driver’s Field of View (FOV). In the future, these AR tools will extend to entertainment and productivity-based services for drivers and passengers trying to pass the time.

Another catalyst for in-vehicle infotainment is the electrification wave. As more consumers purchase Electric Vehicles (EVs), there is an opportunity for carmakers and their software partners to address the time-consuming process of charging cars. If you’re in a bind and must use public EV charging infrastructure, in-vehicle entertainment and content can make the waiting process more bearable, or even enjoyable. During the 30 to 35 minutes it may take to charge the EV, you could hop on a Zoom call with co-workers or virtually race your friends through a cornfield by playing Racing Wars via the AirConsole gaming platform. For EV drivers and prospective customers, consuming productivity and entertainment-based infotainment services while charging their car makes for a compelling offer.

Finally, infotainment capabilities become more essential for the 86% of EV drivers who worry about range anxiety. EV charging points are not nearly as prevalent as gas stations, making it important for drivers to closely monitor nearby charging station proximity and driving range. An embedded infotainment center can provide this vital information, which is safer and more convenient than having to use a smartphone or other personal device to track down the information.

Forward-Looking Features of an In-Vehicle Infotainment System

A future-proof vehicle infotainment system should integrate the latest and greatest automotive solutions to provide an immersive and convenient experience that supports entertainment and productivity-focused applications. The hallmark features of an in-vehicle infotainment solution are listed below.

Multi-Media Streaming

Improved connectivity and increased digital real estate of today’s vehicles paves the way for carmakers to complement audio streaming with video streaming. OEMs such as Tesla, Ford, Jeep, BMW, VinFast, and Porsche have struck partnerships with streaming services partners to unlock Video On Demand (VoD) capabilities for premium models. These infotainment features enable drivers and passengers to watch Netflix, Disney+, Amazon Prime, and other streaming services via in-car displays and backseat screens. By 2030, ABI Research forecasts that consumers will spend more than 500 million hours with in-car VoD apps annually.

Gaming

Tesla’s Arcade platform and its integration with Steam have ignited tremendous interest in in-vehicle gaming. Other carmakers like BMW, Mercedes-Benz, BYD, Hyundai, and Polestar have followed suit by striking their own partnerships with video game companies. The cloud-based NVIDIA GeForce NOW platform, for example, enables users to emulate a Personal Computer (PC) gaming experience in a vehicle. Meanwhile, AirConsole lets users turn their smartphones into controllers to play video games with their friends from select BMW models.

The in-vehicle gaming opportunity accounts for single-player titles and local or online multiplayer titles. My team and I expect gaming to account for nearly 700 million hours of in-vehicle content consumption annually by the end of the decade.

AI-Powered Voice Assistants

Voice assistants have been a staple of the automotive experience for years now, but the advent of AI-powered in-car voice assistants breathes new life into this infotainment feature. Advancements in Artificial Intelligence (AI) and Machine Learning (ML) technology enable support for Natural Language Processing (NLP) and more sophisticated voice queries.

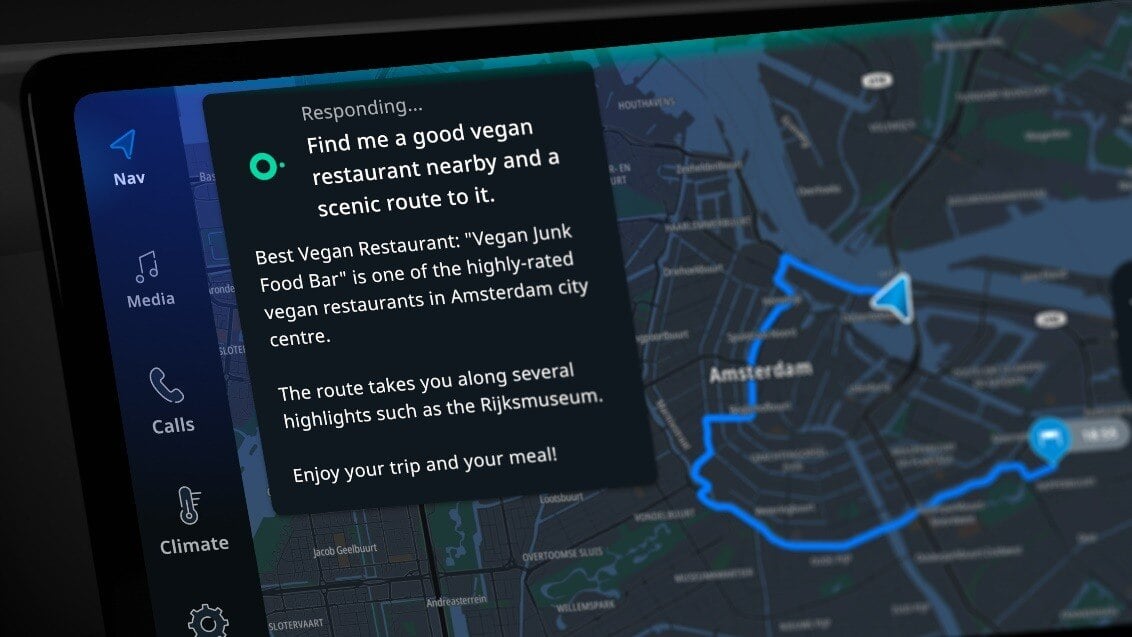

For example, an AI voice assistant can list nearby hotels for the driver when entering a new city—comparing prices, locations, and amenities. Or, as pointed out in ABI Research’s Tech Digest Q1 2024 whitepaper, a new AI-powered assistant developed by TomTom and Microsoft can tell you where EV chargers are located along your route (learn more in the ABI Insight, “A Bold New Frontier for In-Car Voice Assistants, Driven by Generative AI”).

Figure 1: TomTom’s New In-Car Generative AI Voice Assistant

When combined with image recognition capabilities, these AI-powered assistants serve as virtual copilots. Image recognition features can detect driver alertness, comfort level, gaze, posture, and other characteristics. From there, the vehicle can adjust seat positioning, lower the temperature, and suggest pulling over to rest.

What makes a next-generation car assistant stand out is its ability to be proactive, rather than reactive. These intelligent voice assistants don’t necessarily require the driver to ask a prompt. Indeed, they can make suggestions about hotels, restaurants, rest stops, etc., based on the user profile compiled after many hours of using the infotainment system.

App Store

An in-vehicle app store is a central aspect of the modern infotainment system. Consumers increasingly expect a similar convenience level as they experience with their smartphone apps, which has led to tethered app stores like Apple CarPlay and Android Auto. Recently, carmakers have shown greater interest in embedded app stores such as HARMAN’s Ignite Store and the Twine4Car store developed by ACCESS. These app stores provide more control over the in-vehicle experience and driver data. Embedded app stores enable OEMs to customize and expand vehicle features, such as climate control, seat temperature, or Advanced Driver-Assistance Systems (ADAS) and autonomous driving; these add-on features unlock new revenue streams for automotive industry players.

It’s also important to mention that these solutions allow OEMs to make the app store “their own.” OEMs can customize the User Interface (UI) and layout. As a result, consumers see the in-vehicle app store as an extension of the car brand, as opposed to a product of a third-party software company.

Over-the-Air Updates

As vehicles shift from hardware-based to software-based architectures, the role of Over-the-Air (OTA) updates becomes paramount. OTA updates enable OEMs to integrate new applications and features into the vehicle over its life span. The revenue opportunities associated with convenient OTA vehicle updates are significant as they keep even an older vehicle relevant and up to date with the latest and greatest infotainment services.

Productivity Applications

Carmakers such as Polestar, Renault, and Ford have partnered with Google to integrate work collaboration apps. Through Android software, these brands can integrate apps like Zoom, Microsoft Teams, and Webex into their vehicles. Newer car models, notably the 2024 Mercedes-Benz E-Class, go beyond this by equipping cars with in-cabin cameras for video conferencing support.

Moreover, advancements in AI voice assistants and voice recognition unlock the opportunity for drivers to schedule their workday, prep for a presentation, edit documents, and more. In other words, in-vehicle infotainment systems should enable drivers to stay productive during their commutes.

Read More: How Android Automotive OS Is Changing Connected Vehicle Services

Read More: How Android Automotive OS Is Changing Connected Vehicle Services

Revenue Opportunities from In-Vehicle Infotainment

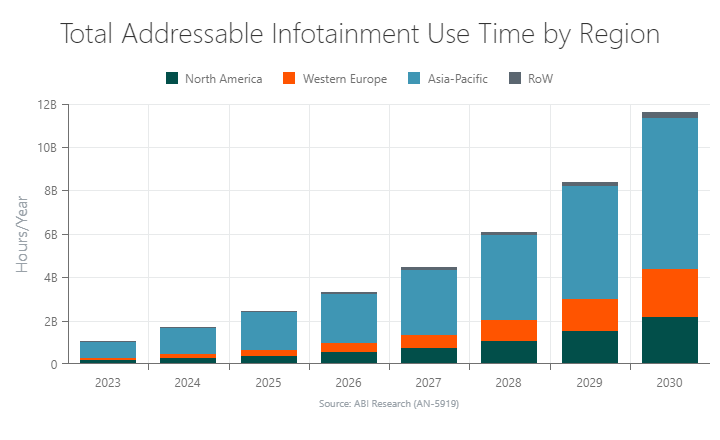

Demand for in-car infotainment systems is rapidly increasing as drivers and passengers seek the same experiences they have in their homes. In 2024, drivers and passengers are expected to spend a little shy of 2 billion hours with in-vehicle infotainment. That number will skyrocket to almost 12 billion hours annually by 2030, signaling the onset of a new, software-defined era for the automotive industry.

For OEMs, content providers, and infotainment technology vendors, this trend generates new revenue streams. Cars will increasingly come equipped with in-vehicle commerce, advertising, and app store purchasing capabilities. Furthermore, the driver data compiled over time will help personalize experiences and make retail suggestions based on past preferences.

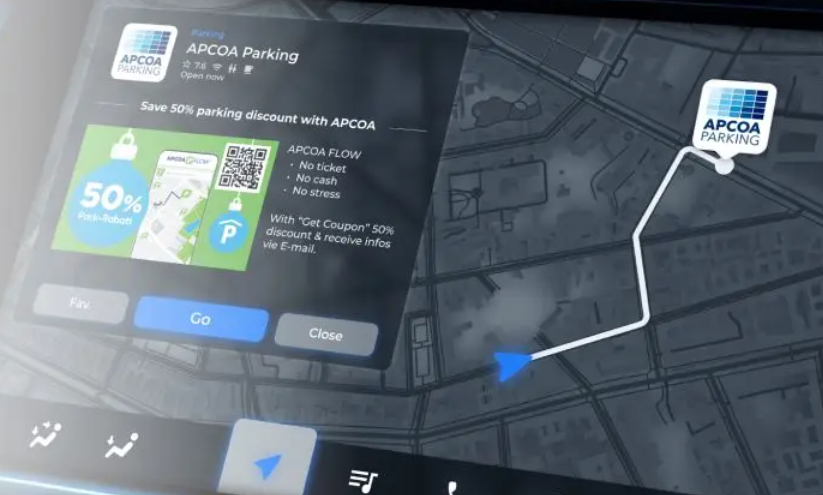

Of course, it’s vital that any in-vehicle advertising attempts are not overly intrusive because that will most certainly turn consumers away. To address this challenge, OEMs, content providers, and places of business must ensure that advertising is subtle or even feels like an enhancing feature to an in-vehicle experience. A good example of discrete in-car marketing campaigns comes from 4screen’s branded pins on navigation screens. Drivers see company logos on the map, which are accompanied by information like discounts, menus, app download suggestions, and more.

Figure 2: 4screen In-Car Advertising for APCOA Parking

What makes 4screen successful is the fact that its marketing/advertising campaigns fit seamlessly into the natural driving experience. Drivers are already going to look at the navigation system, so seeing branded pins on the map does not feel intrusive. The solution also enables brands to pop up on in-car search results for broader visibility.

Conclusion

In summary, connected infotainment systems are an essential pillar of a future-proof automotive strategy. These entertainment/productivity hubs are key to monetizing vehicles across their entire lifecycles and creating new, long-term revenue streams.

To learn more about the future of in-vehicle infotainment systems and the opportunities they present, download ABI Research’s Infotainment-Driven Differentiators for Software Defined Vehicles: Video-On-Demand, Gaming, and Productivity report. This research is part of the company’s Smart Mobility & Automotive coverage.