The eIDAS 2.0 regulation set a target for the upcoming European Union (EU) Digital Identity (EUDI) wallet to be available to 80% of EU citizens by 2030. While ABI Research doesn’t anticipate the European Commission’s target being met, there's significant momentum building for the borderless wallet. Since mid-2023, there have been a number of large-scale pilot projects across the continent testing the digital wallet in select EU countries. The wallet’s upcoming launch is a pivotal part of the EU’s digitalization ambitions, providing a digital version of physical ID documents. The primary goal of EUDI is to provide a consistent Electronic Identity (eID) wallet that unifies all personal documentation and simplifies life for EU citizens.

The EUDI wallet will empower citizens and service providers to potentially access digital versions of physical identity credentials, such as national IDs, driver’s licenses, healthcare IDs, travel documents, and education credentials via a smartphone or tablet. The new wallet is set to revolutionize how people interact with public and private services, providing unprecedented convenience for users who need to authenticate their identity online or offline. For example, Europeans can visit other EU member states without the hassle of obtaining new forms of identification. Governments and enterprises (e.g., banks, healthcare providers, etc.) that issue mobile identities also benefit from reduced overhead costs and happier customers.

This article is a comprehensive analysis of the latest trends regarding EUDI wallets, including current challenges and a future outlook for the technology. It aims to provide insights into the wallet’s potential impact on European society, the latest EUDI developments, and how digital identity/wallet vendors should approach the transition to digital ID wallets.

Top Use Cases for the EU Digital ID Wallet

Since mid-2023, several EU countries have been testing the deployment of EUDI wallets before the rollout in 2025. The European Commission (EC) reports the following 11 use cases as the key focus areas for EUDI wallet pilot studies:

- Accessing Government Services: Securely interact with digital public services, including applying for passports or national IDs, filing taxes, or accessing social security details.

- Opening a Bank Account: The new wallet verifies identities for online bank account setup, removing the need to repeatedly submit personal details.

- SIM Registration: Provide identity proof for Subscriber Identity Module (SIM) card registration and activation, reducing fraud-associated costs for Mobile Network Operators (MNOs).

- Mobile Driver’s License: Store and present a mobile driver’s license for both online and in-person checks, such as roadside inspections.

- Signing Contracts: Use a mobile identity wallet to generate secure digital signatures for online contract signing, removing the need for physical documents and signatures.

- Claiming Prescriptions: Share prescription details with pharmacies to facilitate the dispensation of medications.

- Traveling: Display travel document information (e.g., passport, visa) for streamlined airport security and customs processing.

- Organizational Digital IDs: Verify your identity as a legitimate representative of an organization.

- Payments: Confirm identity for initiating online payments.

- Education Certification: Provide proof of educational qualifications, such as diplomas and certificates, to simplify job applications or further education.

- Accessing Social Security Benefits: Use the wallet to digitally access social security benefits, entitlements, and other information securely. Moreover, the wallet can store documents like the European Health Insurance Card for ease of movement.

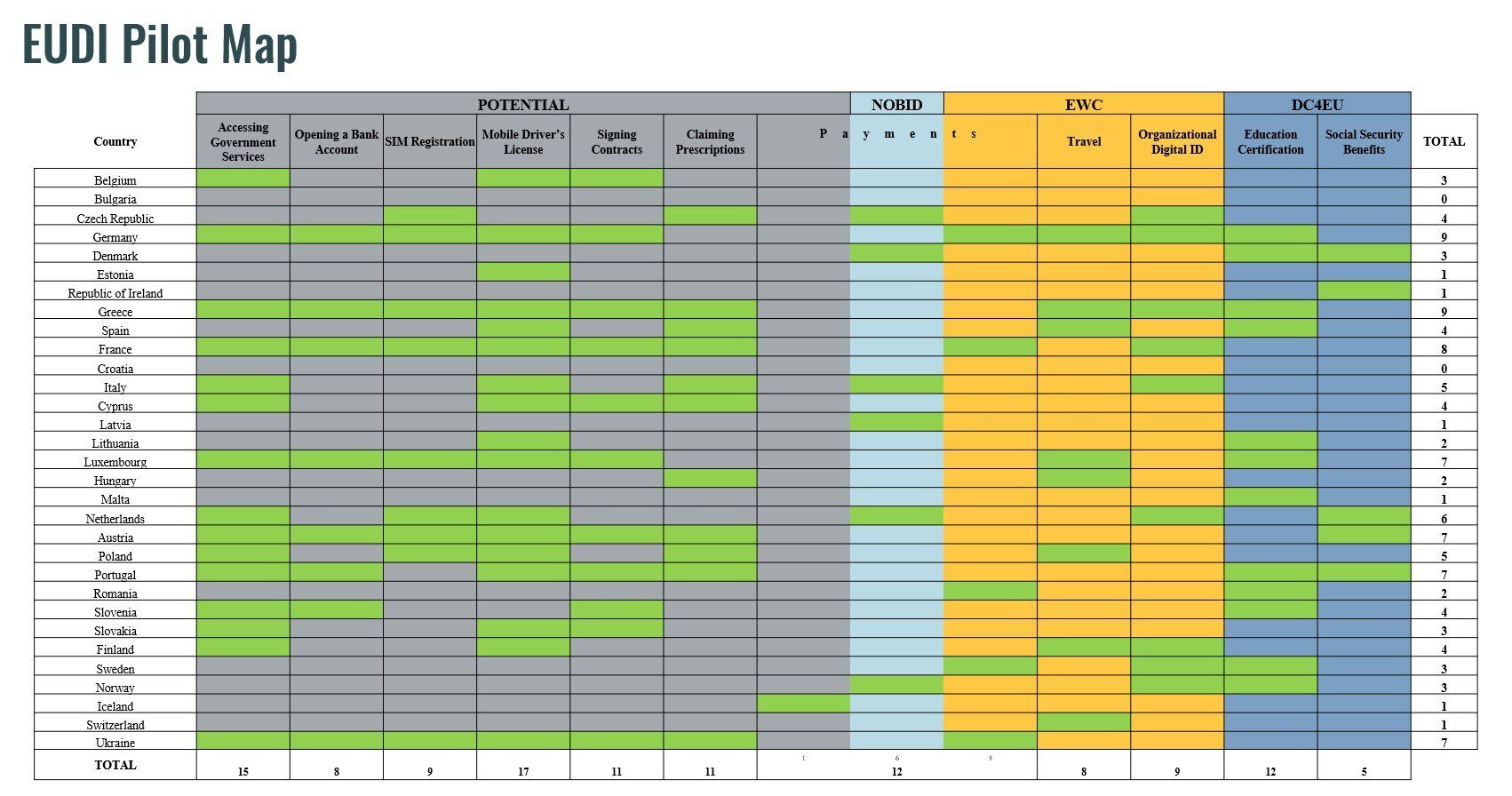

Of all the use cases listed, ABI Research expects mobile driver’s licenses and access to government services to be the biggest growth drivers for EUDI wallet uptake. So far, 17 countries have launched an EUDI pilot for mobile driver’s licenses and 15 have done so for accessing government services.

Figure 1: EUDI Wallet Pilot Projects by Country

(Source: ABI Research)

EU Digital ID Wallet Adoption Trends

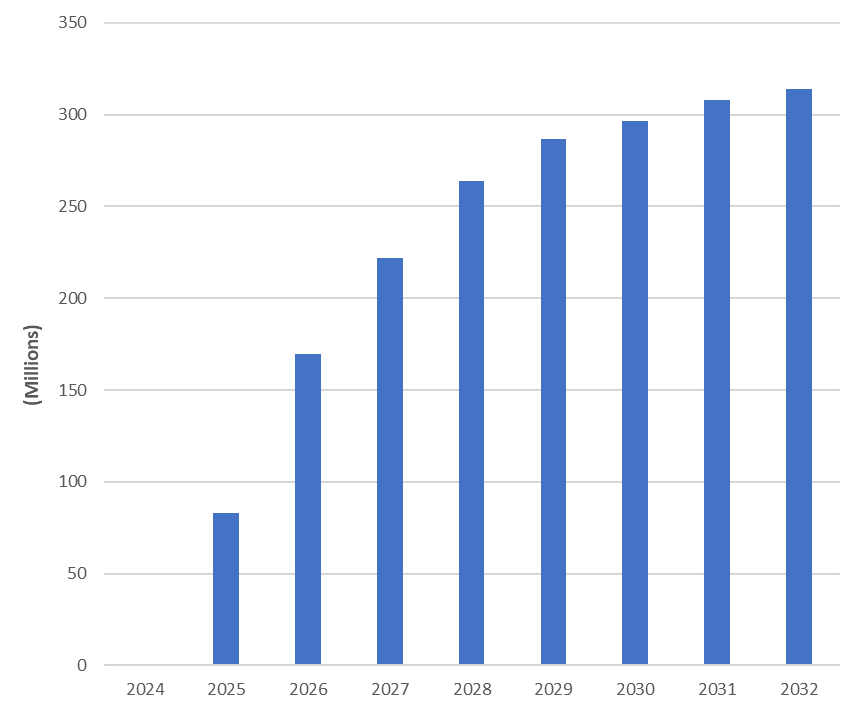

European citizens can start using an EUDI wallet in 2025, with France and the Nordic region driving most of the early uptake. My team and I forecast 83 million digital ID wallets to be in circulation by the end of 2025, with that number more than doubling to 169 million in 2026. As EU members learn how other members are addressing technical and commercial considerations, it will encourage broader adoption.

Chart 1: Total Valid EUDI Wallet Instances, Europe: 2024 to 2032

(Source: ABI Research)

As discussed in a recent ABI Insight, the European Commission is unlikely to achieve its goal of an 80% availability rate for the EUDI wallet by 2030. Rather, ABI Research expects the goal to be met 2 years later in 2032.

One primary issue going against the European Commission is the lack of standardization of mobile identity wallets. The first EUDI Architecture and Reference Framework (ARF) was published back in February 2023, but the document still hasn’t been finalized. This indicates that EU regulatory bodies are still unsure how to address wallet functionality, implementation, and security.

Another challenge for the EU digital ID wallet is the varying digitalization maturity levels among EU members. Eastern European countries like Bulgaria, Croatia, and Romania are less technologically advanced than France, Estonia, and the Scandinavian countries. The latter nations are expected to be the earliest adopters of EUDI, as they already have existing advanced ID systems to handle the transition to digital identity wallets. In contrast, ABI Research expects European countries with a less developed national ID strategy to take far longer to offer digital wallets. For instance, Bulgaria only recently introduced its first digital ID systems. For countries like Bulgaria, it may not be economically viable for the government to invest in EUDI, when the underlying technology infrastructure cannot support it. However, over time, these countries will mature and gradually transition to digital ID wallets. In the meantime, there may be opportunities for mobile wallet providers to target use cases that support ID provisioning at the national level only. Moreover, smart card vendors in Europe can continue innovating (e.g., enhanced biometric authentication) as select EU members continue to focus on physical ID cards. In fact, the EU digital identity wallet is designed to complement the physical ID card—not completely replace it. Therefore, there will be continued room for innovation in the physical ID space.

There are also “middling” countries that we expect to be a little more reserved about adopting EUDI solutions. Countries like Germany, Portugal, Poland, and Austria will begin issuing digital ID wallets to their citizens after the earliest deployments in Europe materialize during the 2025 breakout year.

How Digital ID Wallet Providers Can Find Favor with EU Member States

Once the piloting phase has ended and technical specifications are finalized, ABI Research forecasts a very competitive market for EUDI-supported solutions. While most wallets will be provided by leading digital ID technology vendors, some governments may choose to develop the wallet themselves, resulting in further competition.

For the European governments that choose a technology partner for wallet development, digital ID vendors hitting on the following points will be in the best market position:

- Active Engagement in EUDI Pilot Schemes: Digital ID companies that have participated in EUDI pilot projects across the European continent will possess the experience governments seek in a wallet solution provider. These firms can adequately address ongoing technical challenges and are also accustomed to complying with the eIDAS 2.0 framework.

- Existing Partnerships with EU Member States: Having close ties with EU member states through existing smart card or digital ID solutions demonstrates competence to prospective government customers. Furthermore, a trusted partner used in the past makes it more likely the vendor will be selected again in the future.

- Personal Identification Data Provisioning Capabilities: Providing both the wallet and Personal Identification Data (PID) simplifies the EUDI implementation process. A single turnkey solution is preferable to establishing multiple partnerships.

- Broad Range of Wallet Use Cases: While mobile driver’s licenses will be the primary growth driver for EUDI adoption, digital ID vendors should aim to support as many use cases as possible. Governments will have to promise citizens that the wallet can be used for a wide array of public and private services to encourage swift uptake.

- A Balance between User Experience and Security: While EU digital identity wallets must account for security (e.g., cryptography, biometrics, etc.), User Experience (UX) must not be sacrificed. Vendors must ensure a seamless experience, especially for the onboarding process. If EU citizens find the process of onboarding personal data to the mobile wallet too convoluted, adoption will be hindered.

Thales and IDEMIA are the more obvious wallet providers that EU governments will think of when it comes time to choose an EUDI implementation partner. These French companies get a head start, as they are juggernauts in the digital ID industry with proven track records. Furthermore, Thales and IDEMIA are well-known for highly secure digital ID solutions (biometrics, liveness detection, etc.)—something that is a top priority when dealing with sensitive personal data. For example, Thales’ acquisition of Imperva enables the company to expand its cybersecurity capabilities for enterprises and governments.

However, smaller trust service providers like Archipels, Gataca, Namiral, and Signicat aim to challenge Thales and IDEMIA head-on in the region with tamper-proof platforms that authenticate citizen identities digitally. All of these aforementioned companies are active participants of EUDI consortiums like POTENTIAL, NOBID, DC4EU, and EWC. These consortiums are essential to test EUDI's “potential” to be used for eGovernment services, opening a bank account, SIM card registration, mobile driver’s licenses, eSignatures, ePrescriptions, travel credentials, and payment transactions.

The next year or so will be crucial for governments, European regulatory bodies, and digital ID technology vendors as they iron out the final kinks in EUDI. Nothing is set in stone, making it imperative that the ecosystem remains agile and ready to conform to any emerging requirements that arise before the new wallet's launch in 2025.

Further Reading: