Laser satellite communication (also called lasercom) is a subset of free-space optical communication, presenting significant advantages over Radio Frequency (RF) signals. Laser satellite users can expect increased data rates (bandwidth), enabling them to send and receive far more information than traditional radio waves. With major satellite players like Starlink and Amazon Project Kuiper investing in the technology, there is broader attention being paid to Optical Inter-Satellite Links (OISLs).

ABI Research forecasts laser-based satellite networks to generate US$15.2 billion in revenue annually by 2027.

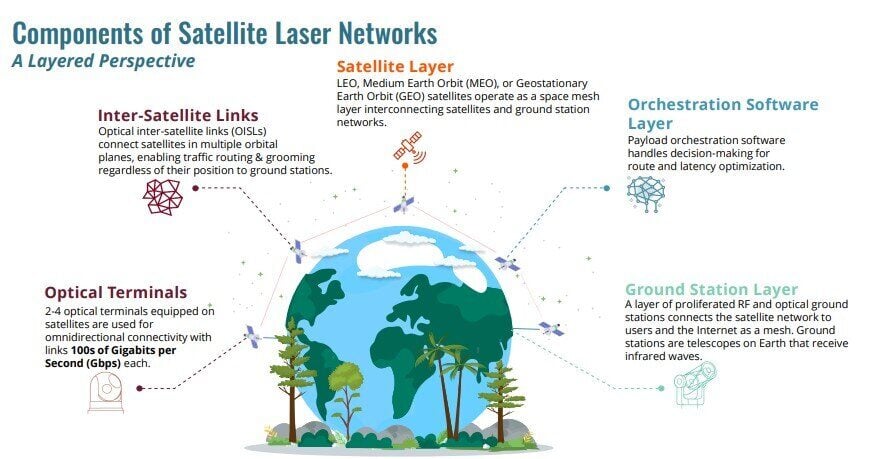

Laser Satellite Communication Components

A laser satellite network consists of five key components: optical terminals, inter-satellite links, the satellite layer, the orchestration software layer, and the ground station.

- Optical Terminal: Satellites are equipped with 2 to 4 optical terminals, each providing hundreds of Gigabits per Second (Gbps) of omnidirectional connectivity.

- Inter-Satellite Links: Optical inter-satellite links connect satellites across orbits. This ensures traffic routing and grooming are possible regardless of the satellite’s position relative to ground stations.

- Satellite Layer: Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Earth Orbit (GEO) satellites function as a space mesh layer, ensuring satellite-to-ground station network linking.

- Orchestration Layer: Optimizing route and latency necessitates payload orchestration software capable of decision-making.

- Ground Station: A layer of proliferated RF and optical ground stations forms a mesh network, connecting satellites to users and the Internet. These ground stations, equipped with telescopes, receive infrared waves from space.

Laser Satellite Benefits

High Data Rates

Lasercom systems have increased data rates, allowing more information to be sent and received in a single transmission.

Network Resiliency

Laser-based satellite networks ensure communications in areas where connectivity is compromised. For example, a cargo ship may lose connectivity if subsea cables are damaged. Laser communications are not held to the same constraints, making them essential for network resiliency and flexibility.

Robust Security

Satellites using laser beams have low latency, low probability of detection/interception, and are jamming-resistant. This makes the technology a viable candidate in high-sensitive use cases within government/defense, enterprise, and critical communications infrastructure.

Multi-Orbit Connectivity

If connectivity suffers, a satellite signal must sometimes be transferred to another orbital link. For example, a signal may need to be transferred from a GEO to an MEO or LEO satellite system. An optical/laser crosslink could improve latency and extend coverage to regions of Earth lacking Internet connectivity. For this to happen, it is key that interoperability between satellite networks is accounted for; RF links must be able to transfer traffic to another satellite using optical crosslinks.

Network Backhaul

Backhaul is one of the top use cases of satellite constellations. Traffic can be backhauled over an optical inter-satellite link, which then connects to the core telco network. In the event that a terrestrial fiber network or microwave site is hindered, optical satellite backhaul can ensure sustained connectivity.

Commercial & Enterprise Broadband

Network traffic transportation is another leading use case for laser satellite communications. With data transmission at the speed of light, organizations gain superior network coverage and connectivity. The largest optical satellite network currently in operation is SpaceX’s Starlink. Primary services from the Elon Musk-led company include best-effort broadband, Direct-to-Cellular (D2C), and some cellular backhaul applications.

Related Insight: Is Laser Communications the Key to the Future of Satellite and NTN Networks?

Laser Satellite Communications Companies

Three main company types serve the laser satellite communications market: service providers, equipment vendors, and solution providers. Some companies serve multiple market segments, such as Aalyria, which offers both equipment and orchestration/management solutions; or SpaceX, which offers satellite services and equipment. However, most companies serve a single segment within the laser satellite market.

Service providers are the satellite operators facilitating optical satellite connectivity from Communication Service Providers (CSPs). The networks managed by service providers are the liaison between satellite infrastructure, devices, and the Internet backbone. Examples of service providers include SpaceX, Amazon Project Kuiper, Telesat, and Kepler.

Equipment vendors manufacture Optical Communication Terminals (OCTs). The beam width of OCTs is narrower than RF systems, offering a smaller “illuminated footprint.” They are also highly secure, making them essential for organizations to prevent jamming and electromagnetic interference. Equipment vendors also sell Optical Ground Terminals (OGTs) and Optical Ground Stations (OGSs) to connect terrestrial infrastructure with space assets. Examples of equipment vendors include Aalyria, Honeywell, Astrogate, and iXblue. SpaceX is a newer member of the equipment vendor segment, announcing its plans to be an OCT vendor at SATELLITE 2024.

Solution providers deliver advanced orchestration and management software platforms specifically designed for satellite lasercom mesh networks. These platforms facilitate the automation of complex network operations, such as scheduling and tasking across various layers, from satellites to ground stations and user interfaces. Streamlining these processes ensures seamless connectivity and efficient management of the entire network infrastructure. Aalyria and LaserLight are the primary solution providers in this space.

Figure 1: List of Companies Offering Laser Communication Solutions

(Source: ABI Research)

Capitalizing on the Lasercom Opportunity

ABI Research anticipates that satellite deployments with laser payloads in orbit will increase from a little over 4,000 in 2024 to 12,600 by 2027. As demand for laser-based satellite communications explodes, vendors should take the following actions to maximize their market opportunity:

- Cater to the Government and Commercial Sectors: The government and defense sector is home to some of the largest deployments of laser satellite communications. Third-party terminals are the preferred purchasing option for these networks, making terminal vendors a key partner. The commercial sector may also present opportunities, as High-Altitude Platform Stations (HAPSs) and other new connectivity platforms that use optical links can stimulate demand.

- Prioritize Scalability and Interoperability for Terminals: The satellite industry is expected to see a sizable increase in users around the world. This rapid growth means organizations will seek terminals that function with existing technologies. Terminal vendors can accommodate this requirement by designing terminals for different generations and technology stacks. This interoperability will ensure long-term value for the terminal and existing technological investments.

- Embrace Partnerships with Other Ecosystem Players: Collaboration between terminal vendors, network operators, and solution providers will help broaden the applicability of laser satellite communications. OISL is a convoluted and rapidly scaling technology, making it necessary to develop integrated solutions that attract governments and commercial organizations. In many cases, this can only be streamlined through strategic partnerships.

- Enable OISLs with Regenerative Payloads: The enablement of OISLs is heavily dependent on regenerative payloads. They handle onboard data processing between laser links. This capability allows data to be routed and retransmitted across multiple hops within the mesh network, reducing dependence on ground stations. Therefore, satellite operators should incorporate regenerative payloads from the perspectives of layers 1, 2, and 3 when designing new systems for this market.

Learn more about the outlook of laser satellite communications by downloading ABI Research’s presentation, The Future of Satellite Networking: Laser Communications in Space. This market research is part of our Satellite Communications Innovation & Technologies Research Service.