As the manufacturing landscape continues to evolve, companies are increasingly looking toward technology to bolster their operations and overcome emerging challenges. To better understand the attitudes, adoption rates, and pain points manufacturers have regarding technology, ABI Research conducted The State of Technology in the Manufacturing Industry survey.

We asked 461 manufacturing stakeholders from the United States, Germany, and Malaysia various questions about their perceptions toward emergent technologies like Generative Artificial Intelligence (Gen AI), private cellular networks, and cloud computing. The results reveal critical insights to help decision makers navigate this complex environment and align manufacturing technology suppliers’ products with customer sentiment.

We now share several data-backed trends demonstrating how manufacturers view digital transformation in 2024.

Embracing Technology: A Necessity, Not an Option, for Manufacturers

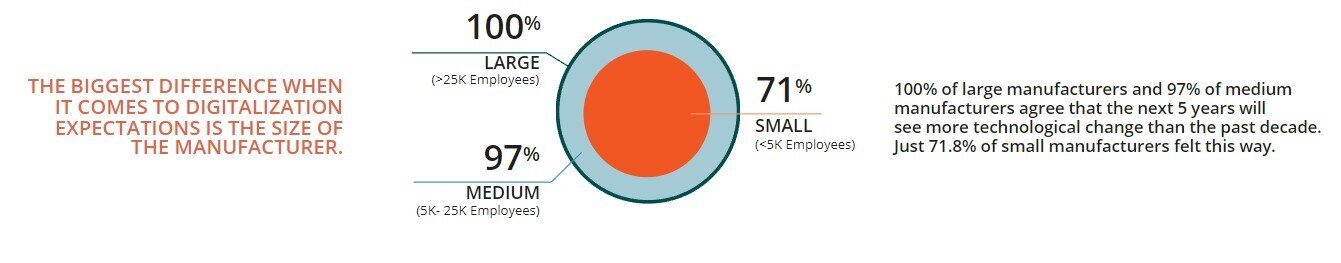

A staggering 87% of manufacturers anticipate leveraging more technology in their operations moving forward. This trend is particularly pronounced among large manufacturers, with 100% affirming this need. In contrast, 97% of medium-sized firms (5,000 to 25,000 employees) share this sentiment, while only 71% of small businesses (under 5,000 employees) do the same.

This gap highlights the crucial role that technology adoption plays in maintaining competitive advantages across varying company sizes.

People-Related Challenges Hampering Digital Transformation

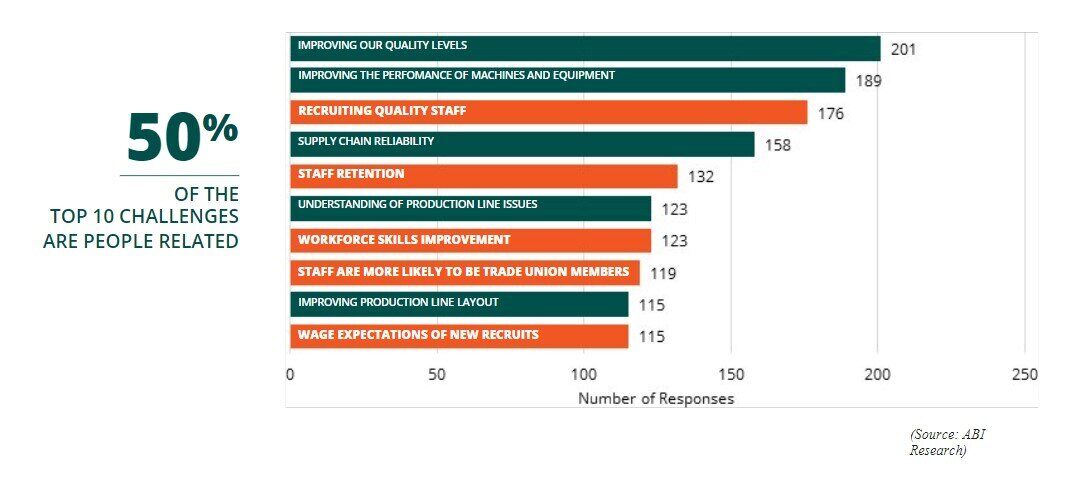

Despite the optimistic outlook on technology, manufacturers face significant people-related challenges that hinder their digital transformation ambitions. According to our survey, five out of the top ten obstacles identified involve workforce issues, such as recruitment, staff retention, and skills improvement.

Addressing these challenges will be vital for manufacturers looking to fully realize the benefits of technological advancements.

The Role of Gen AI in Problem Solving

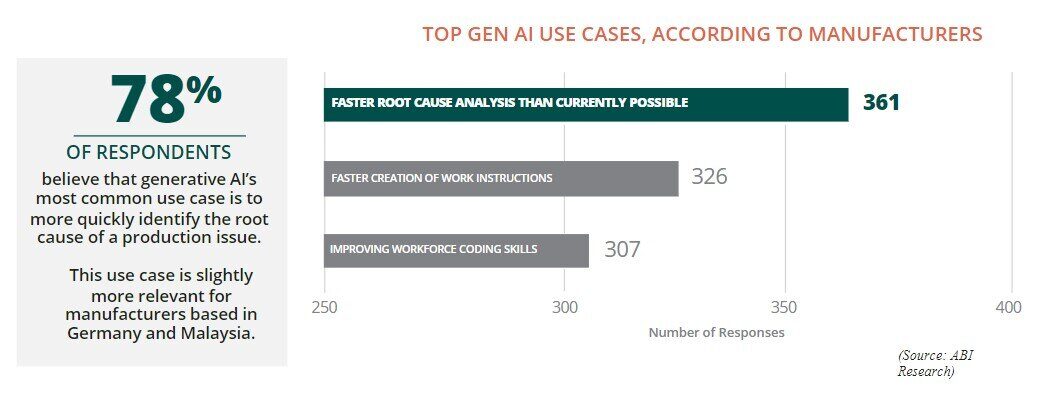

Identifying the root cause of production issues emerges as the top use case for Gen AI, with 78% of manufacturers supporting this view. Notably, 52% of U.S.-based manufacturers believe that Gen AI can expedite software bug fixes, compared to just 37% of their German counterparts.

This disparity highlights a growing confidence in AI technologies among U.S. manufacturers, setting the stage for broader acceptance of AI solutions in the sector.

Exploring the Industrial Metaverse

Nearly eight in ten manufacturers see potential in the industrial metaverse for new product designs, with firms in Germany and Malaysia identifying this as their top use case. In contrast, U.S. manufacturers prioritize staff training and upskilling in the metaverse.

This variation underscores how geographical differences influence manufacturers’ perceptions of new technologies.

Sustainability: An Emerging Challenge

Interestingly, sustainability remains a lower priority for many manufacturers, with only 17% considering Environmental, Social, and Governance (ESG) factors as a top-five challenge. This isn’t to say industrial decarbonization isn’t a goal of manufacturers, but rather there are higher priorities that supersede it.

German manufacturers are more than twice as likely to view ESG as a critical issue than Malaysia-based manufacturers. While 23% of German respondents acknowledge ESG as an urgent priority, just 11% of Malaysian manufacturers do. The survey results also find that 16% of U.S.-based manufacturers consider ESG a leading challenge in 2024.

As the industry evolves, this could shift, making it essential for companies to stay ahead of the curve.

The Importance of Security in Private Cellular Investments

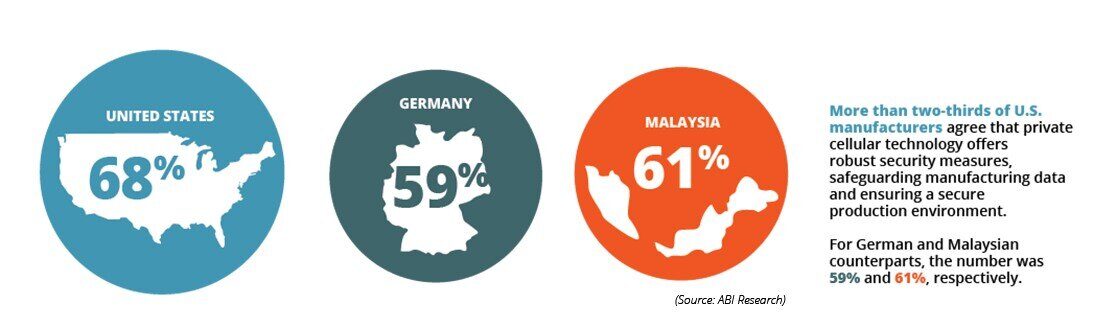

When it comes to private cellular investments, 68% of U.S. manufacturers cite enhanced security as a key benefit. In comparison, 59% of German and 61% of Malaysian manufacturers share this perspective on 4G/5G. These data illustrate a growing recognition of the need for robust security measures to safeguard sensitive data and maintain secure production environments.

Prioritizing Quality Management Systems

For manufacturers looking to improve quality levels, Quality Management System (QMS) software stands out as the primary investment area. This is particularly true for U.S. and Malaysian firms. Meanwhile, German manufacturers prioritize digital threads as their key quality-improving technology. This trend indicates a shift toward integrated systems ensuring quality throughout manufacturing.

Take Action with Our Survey Insights

These survey results highlight significant trends and challenges shaping the future of manufacturing. In today’s technology-driven landscape, manufacturers’ success will depend on choosing the right supplier and their ability to harness the full power of digital transformation. These survey findings help support technology vendors in their efforts to tailor solutions to manufacturers’ main priorities.

To dive deeper into our findings and discover how they can impact your organization, check out more survey results today! Be sure to share anything interesting with your colleagues.