5G New Radio (NR) Reduced Capability (RedCap) will revolutionize cellular connectivity by simplifying and lowering the cost of 5G for Internet of Things (IoT) devices. The technology was finalized in The Third Generation Partnership Project’s (3GPP) Release 17 (R17). It is designed to facilitate a smooth 5G migration path for power-constrained devices currently using Long Term Evolution (LTE) Cat-4 and LTE Cat-6.

According to Jonathan Budd, industry analyst at ABI Research, RedCap offers a crucial bridge for IoT hardware manufacturers looking to transition to 5G without the complexities and costs of full-scale 5G network deployments.

In this blog, we’ll break down the key features, advantages, challenges, and future developments of 5G RedCap.

80 million RedCap IoT module shipments between 2024-2029.

$690 million market size for IoT RedCap modules by 2029.

62% of revenue will come from Enhanced RedCap (eRedCap) modules.

What Is 5G RedCap and Why Does It Matter?

5G RedCap is a series of network and device optimizations that reduce the cost and complexity of connecting cellular devices to 5G networks. By scaling back some of the advanced 5G features, RedCap offers a streamlined solution for mid-range IoT devices.

Budd explains that while Low-Power Wide Area Network (LPWA) technologies such as LTE Cat-M or Narrowband IoT (NB-IoT) are great for low-data rate applications, and Enhanced Mobile Broadband (eMBB) provides high-speed connectivity for advanced use cases, RedCap strikes a balance. It offers simplified 5G features for IoT devices that require moderate data rates.

RedCap also uses energy-saving features to reduce power consumption. For example, China Unicom helped State Grid Shandong achieve a 32% energy reduction with 5G RedCap terminals.

Key Features and Advantages of 5G RedCap

Several features of 5G RedCap R17 make it attractive to IoT Original Equipment Manufacturers (OEMs):

- Reduced Bandwidth: 20 Megahertz (MHz) in sub-7 Gigahertz (GHz) frequencies, or 100 MHz in Millimeter Wave (mmWave) bands.

- Simplified Device Architecture: By simplifying device architecture, NR-RedCap makes 5G connectivity a reality for more IoT applications. Single transmit and receive antennas, along with reduced Multiple Input, Multiple Output (MIMO) layers, helping to lower device costs.

- Comparable Data Rates to LTE Cat-4 and Cat-6: 5G RedCap delivers similar speeds, but retains key 5G benefits like network slicing and advanced positioning.

- Single Antenna Configuration: Reduces device size and Bill of Materials (BOM) costs, making it more affordable.

- Reduced MIMO Layers: Lowers power consumption and extends battery life.

- Half-Duplex Frequency Division Duplex (FDD) Support: Reduces power requirements by not needing simultaneous transmit and receive functions.

These features provide cost-saving opportunities for device manufacturers, helping them develop smaller, lower-power IoT devices. Table 1 provides a quick breakdown of RedCap’s key advantages:

Table 1: Select Features of 3GPP 5G RedCap R17 and Their Advantages

|

Select Features from 3GPP 5G RedCap R17 |

Advantages |

|

Single transmit antenna, and a single receive antenna (with 2 receive antennas being optional). |

Taking precedent from LTE Cat-1bis, this reduces the physical size of device, which, in turn, reduces the Bill of Materials (BOM) for device OEMs. Ericsson estimates that compared to the simplest regular 5G devices, RedCap will reduce the BOM cost by ~65% in FR1 bands and ~50% in FR2 bands. |

|

Reducing the maximum number of Downlink (DL) MIMO layers to 1 for RedCap devices with 1 receiver branch, or 2 for RedCap devices with 2 receiver branches. |

Alleviates the requirement for 2 antennas, saving on hardware costs as described above. Reducing downlink MIMO layers also requires less power usage, which extends device battery life. |

|

Optional support for half-duplex FDD, instead of full-duplex FDD. |

Half-duplex FDD ensures utilization of the entire channel, as there is no simultaneous monitoring of DL and Uplink (UL) messages. Using a single path for sending and receiving data reduces power requirements compared to simultaneous transmission. |

|

Extended Discontinuous Reception (eDRX) |

It enables a higher level of precision when defining the conditions by which an IoT device is in sleep mode, and when it is reachable in receive mode. Greater customization over these intervals means device OEMs can optimize device sleep patterns to minimize power consumption and prolong battery life. |

(Source: ABI Research)

5G RedCap Use Cases

5G RedCap is already being used in many areas—from mobile devices to smart factories and video cameras. Below are the most common and growing RedCap use cases.

Mobile Broadband (MBB)

Many early RedCap devices help bring 5G to mobile broadband (MBB). These include USB dongles and portable Wi-Fi hotspots made by companies like MultiTech, TCL, and MeiG Smart. Some Chromebooks now come with built-in RedCap 5G, making them great for schools and offices. While these are not IoT devices, they help grow 5G networks, which helps lower costs for future IoT use.

Fixed Wireless Access (FWA)

RedCap is used in routers that bring internet to homes and businesses. About one-quarter of RedCap devices today are used for FWA applications. For example, routers from Digi International and MeiG Smart leverage RedCap to deliver internet in places where cable or fiber is not available.

Fixed Wireless Terminals (FWT)

FWTs are rugged devices made for factories and offices. They connect machines and systems to the internet. Digi’s IX20 and MosoLabs’ 5G adapters help with tasks like digital signs, payment kiosks, and remote equipment, all using secure RedCap connections.

Video Surveillance

RedCap is a good fit for security cameras and video systems. It uses less power than regular 5G but still streams video well. Cameras from Askey and Four-Faith use RedCap to watch over places like warehouses, smart grids, and transportation hubs.

IoT Video Upgrades

Some IoT devices only collect sensor data. With RedCap, they can now add video too. For example, a device that tracks driver behavior could also add a camera for more details. This helps improve safety and monitoring.

Smart Grids (eRedCap)

eRedCap is an upgrade made for smart energy systems. It helps new smart meters send data in real time. This lets power companies fix problems faster and use energy more efficiently. It works better than older networks that are too slow for these jobs.

Adoption Challenges for 5G RedCap

Despite its promise, 5G RedCap faces adoption challenges, primarily related to cost. Budd points out that RedCap modules are currently more expensive than LTE, which is slowing adoption. IoT device OEMs are expected to delay large-scale migration until RedCap module prices fall closer to LTE price points. Our team doesn’t expect this to happen until around 2027.

Another challenge is the availability of 5G Standalone (SA) networks. For 5G RedCap to function effectively, widespread deployment of 5G SA is essential, and not all markets are fully equipped yet. However, as 5G SA networks expand globally, RedCap's business case will become more apparent to enterprises.

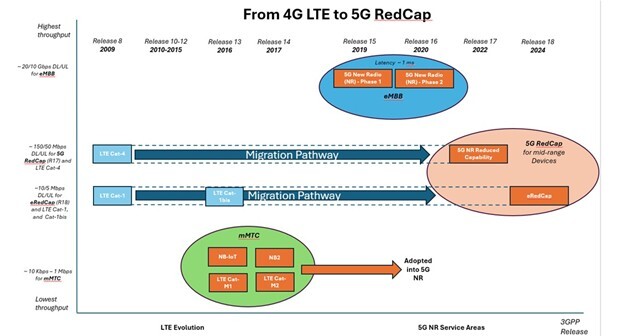

Figure 1: 3GPP Standardization Summary Timeline from LTE to RedCap

(Source: ABI Research)

Waiting for eRedCap

The evolution of 5G RedCap doesn’t stop with R17. Indeed, 3GPP Release 18 (R18) will introduce Enhanced RedCap (eRedCap), which will further reduce device costs and complexity. Scheduled for commercial rollout in 2026, eRedCap is expected to enable smoother transitions for devices currently using LTE Cat-1. This will make it an attractive option for IoT OEMs looking for cost-effective upgrades to 5G.

ABI Research projects that 56 million eRedCap shipments will account for 71% of all RedCap module shipments through 2029, compared to 23 million units (29%) for R17 RedCap.

Related: 4 Key Factors Determining the Viability of 5G RedCap in IoT

Leading Players in 5G RedCap Chipsets

Several chipset manufacturers have already integrated 5G RedCap into their commercial offerings. Qualcomm and MediaTek are leading the charge, with their Snapdragon and T300 System-on-Chip (SoC) architectures, respectively. Other vendors such as ASR Microelectronics, UNISOC, and Sequans are also active in RedCap chipset development.

Table 2: RedCap Chipsets

|

Chipset Vendor |

Chipset Name |

Primary Technology |

Fallback |

Status |

Launch Date |

|

Qualcomm |

Snapdragon X35 |

5G RedCap (R17) |

LTE Cat-4 |

Commercial |

February 2023 |

|

MediaTek |

T300 SoC (M60 Modem) |

5G RedCap (R17) |

LTE Cat-4 |

Commercial |

November 2023 |

|

ASR Microelectronics |

ASR1903 |

5G RedCap (R17) |

LTE Cat-4 |

Commercial |

February 2024 |

|

UNISOC |

V517 |

5G RedCap (R17) |

Not Specified |

Commercial |

February 2024 |

|

Sequans |

Taurus LT |

5G RedCap (R17) |

LTE Cat-4 |

In Development |

TBC |

|

Sequans |

5G NR eRedCap |

eRedCap (R18) |

LTE Cat-1 |

In Development |

TBC (Expected mid-2026) |

(Source: ABI Research; Note: *As of 1Q 2024)

The Future of Cellular IoT with 5G RedCap

IoT device capabilities are only as good as the connectivity technology they use. Given its future-proof features, a 5G connection is a widely sought-after option for IoT manufacturers and end users. However, 5G integration with connected devices has historically been hindered by high costs and deployment delays.

5G RedCap is the answer the industry has been waiting for. It goes hand-in-hand with cost-effective 5G connectivity for the IoT. While still-too-high prices will initially turn customers away, the upcoming release of eRedCap in 3GPP Release 18 will drive greater migration to 5G networks.

As Budd emphasizes, 5G RedCap will bridge the gap between LPWA technologies and full-scale 5G eMBB capabilities. This is a value proposition that is difficult to pass up.

Below are some recent ABI Research reports on the topic.

- 5G RedCap for IoT

- 5G RedCap Standards and Chipsets for IoT

- RedCap for the IoT: Milestones and Obstacles

Frequently Asked Questions

What is the 5G RedCap protocol?

5G RedCap is a New Radio (NR) connectivity technology designed specifically for low-power devices. This is beneficial for Internet of Things (IoT) applications that do not require advanced 5G features nor significant power draw.

When should you select 5G RedCap?

You should choose 5G RedCap if you only require moderate data rates and aim for simplified device architecture. That way, energy costs can be reduced while meeting the cellular connectivity requirements for IoT applications.

What is the difference between 5G and RedCap?

5G is a broader connectivity technology that brings significant benefits over 4G, while 5G RedCap scales back several high-end 5G features to accommodate low-power devices. 5G RedCap has lower data rates, reduced bandwidth, and limited 5G-Advanced features. This allows enterprises to achieve gains in cost, power consumption, complexity, and connectivity requirements.

What are some 5G RedCap use cases?

5G RedCap use cases include Fixed Wireless Access (FWA), Fixed Wireless Terminals (FWT), video surveillance, IoT video upgrades, and smart grids, among others.

What is eRedCap?

5G eRedCap is the next evolution of RedCap, providing even more cost savings and simplicity. The Third Generation Partnership Project (3GPP) plans for a 2026/2027 launch. eRedCap will enable a more seamless transition from LTE Cat-1 enabled devices.

What companies support 5G RedCap?

Some of the top chipset suppliers supporting 5G RedCap include Qualcomm (Snapdragon X35), MediaTek (T300 SoC), AR Microelestronics (ASR1903), UNISOC (V517), and Sequans (Tauras LT & 5G NR eRedCap).