Green hydrogen is emerging as an essential commodity for decarbonizing hard-to-abate industries. Unlike grey hydrogen, which is produced using natural gas and is carbon intensive, green hydrogen is generated using renewable energy sources. Therefore, it offers a sustainable alternative for industrial applications that are not candidates for electrification.

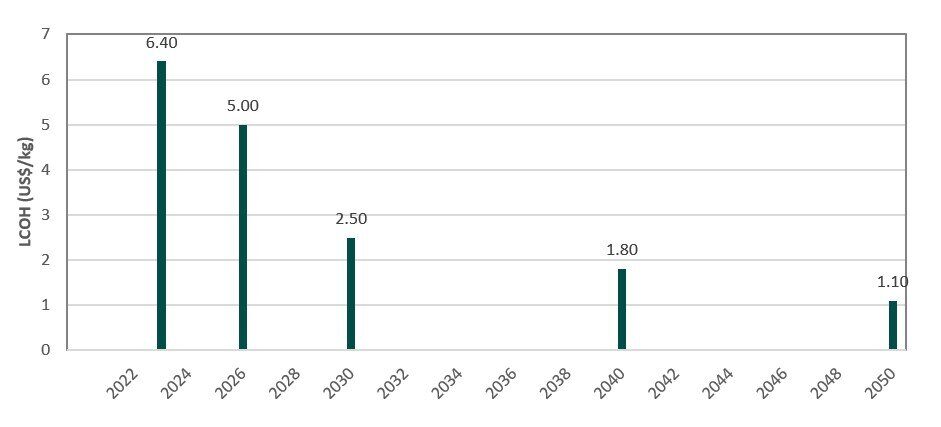

Despite evident sustainability benefits, widespread adoption of green hydrogen hinges on its economic viability. The high cost of production, referred to as the Levelized Cost of Hydrogen (LCOH), has hindered investment in, and demand for, green hydrogen. To compete with traditional hydrogen production, the LCOH must reach approximately US$2 per Kilogram (kg). For it to become truly ubiquitous, this cost must drop further to around US$1/kg.

Chart 1: Global LCOH of Green Hydrogen, 2022 to 2050

(Source: ABI Research)

Thankfully, there is reason to be optimistic.

Advancements in electrolyzers (which split water into hydrogen and oxygen using electricity), improving efficiencies and economies of scale, more affordable and available clean energy sources, improvements in renewable energy infrastructure, and government incentives will reduce costs rapidly over the next 25 years.

ABI Research has mapped out a timeline for when various industries will make the jump to green hydrogen based on evolving production costs.

Timeline for Green Hydrogen Investment across Industries

Early Adopters by 2030: Petrochemicals, Ammonia, and Methanol Manufacturing

The first adopters of green hydrogen are the companies that already rely heavily on hydrogen for their operations. Significant inroads will be established in the petrochemicals, ammonia, and methanol sectors by 2030.

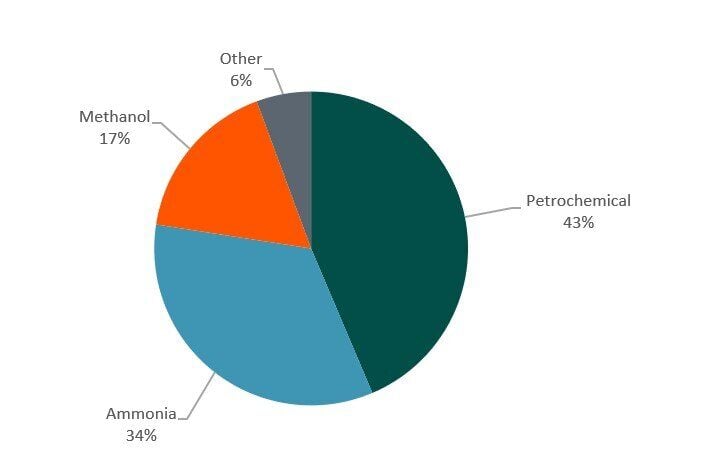

Chart 1: Hydrogen Demand by Industry: 2022

(Source: ABI Research)

Global hydrogen demand reached 95 million tons in 2022, with the following sector breakdown:

- Petrochemicals (43%) for oil cracking and reducing the sulfur content of resultant fuels

- Ammonia (34%) for agricultural fertilizers

- Methanol (17%) for feedstock

- Steel manufacturing (6%) for improving furnace productivity

Green hydrogen functions exactly like its grey counterpart. Therefore, these sectors can switch to clean hydrogen without extensive changes to their existing infrastructure. The only roadblocks to adoption are cost and availability. Fortunately, the LCOH is projected to drop to US$2.50/kg by 2030. This price point makes green hydrogen a viable option for heavy industries looking to reduce their carbon footprint. While just 0.2% of total hydrogen production was green in 2022, this number will increase to 27% by the end of the decade.

Companies in these sectors should be looking to secure early off-take agreements with green hydrogen producers now. This will enable them to stay ahead of growing demand and regulatory pressures. In doing so, they can lock in favorable pricing and ensure a steady supply as the clean Hydrogen (H2) market, and that for renewable energy, continue to expand.

For example, the Middle East (excluding North Africa) is home to some of the largest oil producers in the world. Saudi Arabia, as a global petrochemical producer and a "swing" producer of OPEC will be especially interested in green hydrogen as it aims to ease the cost of phasing out fossil fuels. Saudi Arabia’s investments in green hydrogen production will contribute significantly to scaling the wider market, with the Kingdom expected to produce the majority of the Middle East’s forecast 2.4 million tons of green hydrogen by 2027. Therefore, plants constructed now will be the first to benefit from electrolyzer cost reductions and improvements in efficiency and scale. If Saudi projects—most importantly NEOM—avoid further delays, the Kingdom could be a major driver of the early clean hydrogen ecosystem.

Widespread Adoption by 2040: Steel, Shipping, and Aviation

Industries with historically high emissions, such as steel, shipping, and aviation, but with little or no historic demand for H2, will have adopted green hydrogen at scale by 2040. Emissions in these sectors are particularly hard to abate, as they are poor candidates for electrification due to technical limitations. Greenifying hydrogen offers a path to sustainability for each sector, but high prices and the low availability of sustainable H2 have suppressed meaningful adoption. Yet, as production costs fall, emissions-free hydrogen will become an appealing option—if not a necessity—for organizations in these industries.

For steel sectors, hydrogen can replace coal in blast furnaces, used to reduce iron oxide into workable iron, at manufacturing plants. Various steel producers, like Swedish producer SSAB, are already pioneering the use of green hydrogen in their processes. This is not a trend that is isolated to Europe; SSAB plans to operate the first green hydrogen plant in the United States.

Despite such developments, full-scale adoption in these remaining heavy industries requires the LCOH to drop below US$1.80/kg—a milestone expected by 2040. Regardless, steel producers should adapt their plants for hydrogen adoption by 2030 to be ready when low LCOHs are achieved.

The shipping and aviation industries are also exploring the use of green hydrogen to create sustainable fuels (e.g., green ammonia and e-kerosene). Today, there are considerable barriers to effective adoption: fuels are still under development, shipping companies must retrofit vessels or purchase new ones to accommodate the change, and airlines must establish reliable supply chains for clean aviation fuels. That said, with green hydrogen’s increasing commercial viability and surmounting regulatory and political pressure, widespread adoption across these transportation sectors is expected by 2040.

Ubiquitous Use by 2050

Nearly 100% of the 600 million tons of total hydrogen produced in 2050 is expected to be green. The LCOH is projected to fall to US$1/kg, making green hydrogen an economically feasible option for most applicable industries. At this stage, it will already be fully integrated into industries like steel, shipping, and aviation. However, this low cost of production will also open doors to innovative technologies and new use cases.

One of the most promising developments lies in the aviation sector, where hydrogen fuel cells could revolutionize air travel. Companies like ZeroAvia are already laying the seeds for future aircraft innovation. The firm has been testing zero-emission, hydrogen-powered plane engines and has struck deals with the likes of Airbus and American Airlines. While these technologies are unlikely to replace conventional air travel, which will have adopted e- and bio-fuels en masse at this juncture, fuel cell-powered light aircraft could play an increasing role in the sector.

Additionally, cheap and abundant green hydrogen could potentially provide the conditions for hydrogen-powered vehicles. Hydrogen-powered trucks, buses, and ferries could all be benefactors and compete with electric alternatives. Currently, Electric Vehicles (EVs) have far outstripped fuel cell vehicles in terms of affordability and performance. Lower prices and further Fuel Cell Electric Vehicle (FCEV) innovation could change this, offering greater market diversity across transport applications.

Preparing for the Green Hydrogen Revolution

Adoption of green hydrogen by heavy industries will be fundamental to meeting sustainability commitments and net zero targets on company, national, and regional levels. These sectors must start building and implementing hydrogen strategies now to ensure sustainable operations in the future. Hesitation could lead to unfavorable contract terms with clean hydrogen suppliers, difficulties in securing supply in an increasingly competitive commodity market, trouble with regulators, and an inability to capitalize on the many opportunities of a rapidly changing market.

Early adopters in petrochemicals, ammonia, methanol, and, to a limited extent, steel manufacturing are already positioning themselves for success. Companies within these sectors are entering off-take agreements and investing in on-site electrolyzers. In a decade, ABI Research expects industries like shipping and aviation to follow suit, as regulatory pressures and an improved awareness of the economic advantages of green hydrogen drive significant adoption in these sectors. By 2050, when the LCOH of green hydrogen reaches the critical US$1/kg milestone in most regions, emissions-free hydrogen will be fundamental to, and widely integrated by, nearly all hard-to-abate industries.

For more developments in the clean hydrogen market, reference the following ABI Insights from ABI Research’s Smart Energy for Enterprises & Industries Research Service:

- Ørsted’s Abandoned Project, Equinor’s Pivot, and Hannover’s Failure: Is Green Hydrogen Faltering, or Are Suppliers Mistiming the Market?

- Delta Power’s Bet on Hydrogen Backup Generators Is the Right Call for Data Centers

- Germany and Morocco’s Hydrogen Alliance: A New Chapter for European Green Hydrogen?