The contactless ticketing market saw a significant recovery in 2023, growing 16% Year-over-Year (YoY) as it rebounded from the challenges of prior years. Microcontroller-based ticketing stood out with a 30.4% increase, driven by transit authorities replenishing inventories. While 2024 is expected to bring moderated growth due to overstocked supplies, the market is on track to return to pre-pandemic levels by 2025, with shipments forecast at 441 million units. These developments reflect the market's resilience and its readiness to adapt to emerging technologies and evolving consumer demands.

Regional Trends: Contactless Ticketing Growth Across Markets

North America

n North America, contactless ticketing shipments declined slightly in 2023, dropping from 17.7 million units in 2022 to 17.3 million. Plateauing ridership and the increasing adoption of open-loop payment systems contributed to this dip. However, recovery is expected in 2024, with shipments projected to reach 18.6 million units. Initiatives like the American Express Enterprise Transit Solution and Amex TransLink, which have expanded to multiple cities, continue to drive adoption.

Latin America

Latin America experienced strong growth in 2023, with contactless ticketing shipments increasing by 14%. Rising fuel prices and the affordability of public transit boosted demand in this price-sensitive region. In 2024, shipments are forecast to grow to 35.1 million units. Efforts toward financial inclusion and Mobility-as-a-Service (MaaS) adoption will further accelerate growth in the coming years, enhancing public transit accessibility across the region.

Europe

Europe recorded an impressive 53% YoY growth in 2023, driven by the success of the Calypso protocol and preparations for the 2024 Paris Olympics. Shipments climbed from 15.6 million units in 2022 to 48.1 million in 2023. While growth in 2024 will moderate due to inventory overstocking, the Calypso protocol will continue to drive demand, with shipments projected at 59.5 million units.

Asia-Pacific

Asia-Pacific achieved 11% growth in 2023 as markets recovered from the 2022 chip shortage. However, 2024 is expected to see slightly slower growth at 9%, with demand constrained by inflated inventories. Key initiatives like India’s National Common Mobility Card and New Zealand’s National Ticketing Solution will continue to modernize transit systems. By 2025, shipments are forecast to grow by 32%, reflecting the region’s long-term potential.

Middle East & Africa

The Middle East & Africa is rapidly transitioning to digitized ticketing ecosystems. In the Middle East, YoY shipment growth doubled in 2023, from 7.8 million to 15.6 million units, driven by large-scale projects to modernize transit networks. Africa, while smaller in scale, is seeing steady growth, with shipments increasing from 2.7 million in 2023 to a forecast 3 million in 2024. Mobile money solutions and open-loop payment systems are transforming ticketing in these regions, enhancing accessibility and convenience for commuters.

Technological Advancements: Mobile Ticketing and UWB

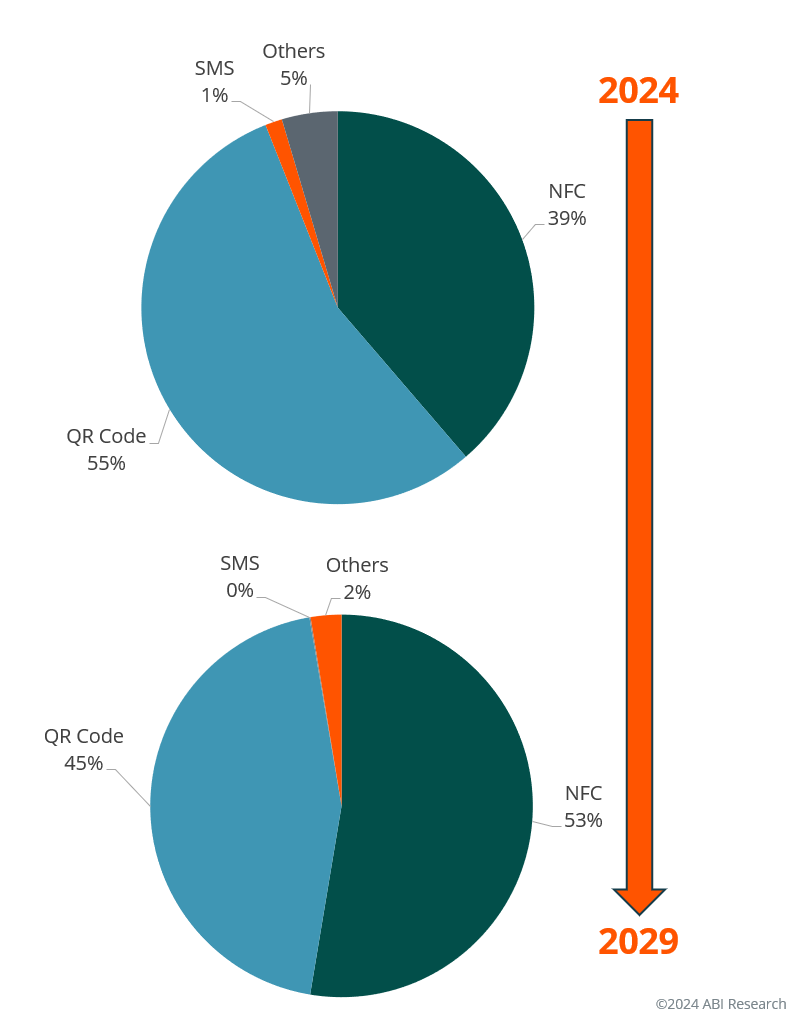

Mobile Ticketing Mobile ticketing continues to evolve, with Quick Response (QR) codes maintaining a dominant 58% market share in 2023. However, Near Field Communication (NFC) adoption is increasing rapidly due to its superior security and compatibility with open-loop systems. By 2029, NFC is expected to surpass QR codes, reaching a 53% market share. The growing penetration of smartphone-based ticketing offers travelers greater convenience and transit operators valuable insights into passenger trends.

Chart 1: Mobile Ticketing Sales Share by Technology

Ultra-Wideband (UWB) UWB presents a transformative opportunity for contactless ticketing, offering seamless, tap-free transit experiences. Unlike NFC or QR codes, UWB eliminates the need for manual interactions, making it particularly appealing for passengers with mobility challenges. However, its adoption faces hurdles, including high implementation costs and limited industry support. While UWB holds promise for high-traffic transit scenarios, significant investment in infrastructure and standardization is needed for widespread adoption.

More insights can be found in ABI Research’s Contactless Ticketing Update Market Data Overview: 3Q 2024 presentation.