When Sputnik 1 successfully launched into space on October 4, 1957, it marked a Herculean moment in human history. After millennia of staring at the stars, we finally knew it was possible to launch continent-spanning communications and then mini-computer platforms into space to explore and provide vital intelligence about the Earth. The event also critically served as a launching pad for revolutionizing telecommunications and Earth Observation.

Human activity in space has come a long way since its 1957 debut. Today, more than 10,400 active satellites are orbiting the Earth. By the end of 2024, 297 annual space launches are expected, with Starlink accounting for nearly half of all these launches. Indeed, Elon Musk’s SpaceX is clearly at the forefront of space innovation, particularly regarding reusable rockets.

ABI Research’s latest study provides valuable insight into SpaceX’s influential role in making satellite launches more accessible, as well as a few key technical and regional trends shaping the future of satellite solutions.

SpaceX Opens New Doors to Space Innovation

SpaceX is transforming the space industry with innovative rocket technology and unlocking significant cost reductions for space operations. In 2024, the company led global orbital launches with 138 missions. This accounts for nearly half of all launches, powered mainly by the Falcon 9 family of rockets, which handled 134 missions. Starship rockets were used in 4 missions.

Additionally, the new U.S. administration is expected to show more favor toward mega constellations (1,000+ satellites), which may potentially lead to full approval of Starlink Gen 2 (30,456 satellites) versus partial approval now.

A significant development in the space industry is SpaceX’s nearly 400-foot-tall Starship, a fully reusable super-heavy launch vehicle. Reusable rockets are spacecraft designed to be recovered, refurbished, and relaunched, reducing the need to build new rockets for each mission. This technical marvel significantly lowers the cost of space travel, making access to space more affordable for commercial ventures, scientific research, and global connectivity projects.

The idea of reusable heavy-lift rockets inches one step closer as 5 Starship launches occurred in 2024. Reusability has already been a game-changer for SpaceX, drastically cutting launch costs for its smaller Falcon 9 rockets. The cost of sending payloads to Low Earth Orbit (LEO) with Falcon 9 is now as low as US$3,059 per kilogram. Internal estimates suggest that costs could drop below US$700 per kilogram with increased booster reuses. This marks a 99.61% cost reduction compared to the cost of launching payloads to space in 1961. With Starship, costs could fall even further—potentially US$300 per kilogram after 10 reuses and under US$30 per kilogram with 100 reuses.

These advancements are revolutionizing access to space. Lower costs make commercial ventures, such as satellite networks, more feasible. SpaceX remains the only company with a commercially proven reusable rocket system. The company uses over half of its launch capacity to support Starlink, its global Internet satellite network.

Through its technological breakthroughs and cost-efficient models, SpaceX is reshaping the future of space exploration and communications. Reusable rocket technology is making satellite launches and the deployment of space assets more economically feasible for governments and commercial ventures.

Key Findings from the Report

Among the many insights revealed in our study, four were especially striking: U.S. space dominance, the rise of Chinese mega-constellations, the growing importance of vertically integrated space companies and supply chains, and the emergence of use cases beyond communications.

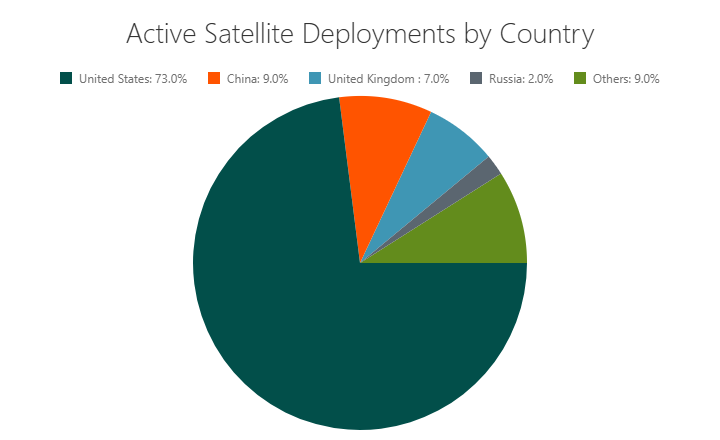

First, the United States is far and away the world leader in active satellite infrastructure. According to current International Telecommunication Union (ITU) filings, operators based out of the country plan to operate over 500,000 satellites cumulatively. Currently, U.S. space networks (like SpaceX) account for 73% of all satellites in space. China is a distant second, accounting for 9% of network infrastructure in space. According to the ITU, the geopolitical foe of the U.S. plans to launch more than 45,000 satellites. This enormous gap is a reflection of the United States’ status as a space tech innovation hub and the ascendance of California-based SpaceX.

China, however, is accelerating its efforts. The commercial space industry has been written into this year’s Government Work Report for the first time, and several provinces are pushing the growth of the sector by introducing development policies and establishing industrial parks/bases. On the commercial network front, Shanghai Spacecom Satellite Technology (SSST), owner of the Thousand Sails mega-constellation (14,000 satellites planned), has already launched 54 satellites into Low Earth Orbit (LEO), where Starlink and Amazon Kuiper also operate.

A second notable trend from the report is the market success of space companies that achieve a vertically integrated supply chain. SpaceX manufactures its own satellites and terminals, ensuring that constant hardware is supplied for the Starlink network. London-based OneWeb, in conjunction with Airbus, also manufactures its own LEO satellites. Through this manufacturing advantage, these companies are able to deploy more satellites at a competitive cost than any other company on Earth.

Finally, ABI Research forecasts robust growth for satellite use cases beyond communications. While satellites with communications payloads will continue to dominate the market and grow at the fastest pace, other payloads such as remote sensing, Earth Observation (EO), satellite imagery, signals intelligence, and technology & training are expected to play a larger role going forward. These satellite payloads are forecast to grow at an average Compound Annual Growth Rate (CAGR) of 15% between 2023 and 2032. Demand for these emerging use cases stems from the increased need for improved Earth and space situational awareness, as well as the convergence of satellites with Artificial Intelligence (AI) machine vision.

Reusable Launch Vehicles Are Only the Beginning

The more than 10,000 active satellites in orbit provide essential network coverage in nearly every corner of the globe. Whether it’s a ship in the middle of the ocean or a mining site in a remote region, satellite communications ensure connectivity of devices, equipment, and systems, despite geographic barriers. The end result is the enablement of countless applications, ranging from Non-Terrestrial Network (NTN) mobile emergency services in natural disasters to exchanging data with thousands of Internet of Things (IoT) equipment connectivity in mobile and heavy industries.

As demand for space technologies continues to rise, satellite manufacturers/operators must continue to push the innovation envelope. SpaceX’s reusable rocket technology is a standout example, paving the way for more organizations to access space real estate. However, Chinese operators are ramping up their respective space projects as satellite ingenuity is now a staple of geopolitical advantage.

While communications applications, such as Direct-to-Cellular (D2C), NTN, IoT, broadband, and backhaul, will continue to help drive innovation in connectivity, it is expected that demand for a total space solution incorporating both communications and remote sensing capabilities will be on the rise over the next decade, fueled by synergies with AI and Machine Learning (ML). To dive into these segments and the latest dynamics in satellite constellation development, download ABI Research’s Space Tech Constellations and Launch Market Data Overview: Q4 2024.