By Phil Sealy | 2Q 2020 | IN-5821

Registered users can unlock up to five pieces of premium content each month.

How Big Will the COVID-19 Impact Be? |

NEWS |

Along with COVID-19 itself, questions and uncertainty continue related to its potential impacts on key smart card and secure Integrated Circuit (IC) markets, including payments, SIM, and government ID.

Undoubtedly, COVID-19 will have an impact on all smart card markets, although each one will be impacted very differently, with some end markets such as SIM cards heavily pinned and reliant on other end markets such as smartphones, whereas other markets such as payments and government ID are not reliant upon other devices.

This ABI Insight will focus on the payment cards market and provide some initial forecast expectations inclusive of the COVID-19 impact, driven by recent interactions with industry and ecosystem players to help provide some light on what to expect within the market in 2020.

Impact on Payment Card Issuance and Contactless Demand |

IMPACT |

|

- The payment cards market is not directly reliant upon other end markets or device types. For this reason, the expectation is that this market will be less affected than others, such as SIM.

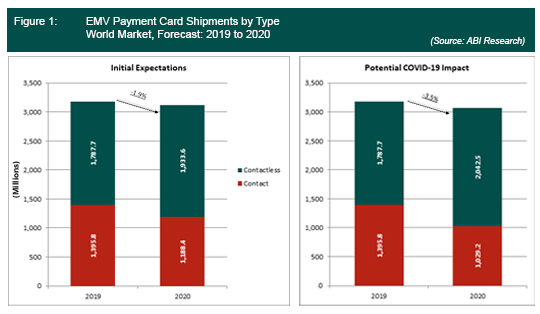

- Even prior to the COVID-19 outbreak, the payment cards market was expected to retract in 2020 by approximately -1.9%. This market retraction was driven by high 2019 issuance levels in the United States, which were not expected to be repeated in 2020.

- Considering the COVID-19 impact the decrease will likely be slightly greater, mainly driven by a decreasing demand for credit cards and other premium account types, which will have a direct impact on issuance levels as consumers look to reduce spending and borrowing.

- The first half of 2020 is expected to be stronger than the second half. Issuing banks and financial institutions prepared by increasing stock levels in the first half of the year, which will likely counterbalance a slower second half. At this time, it is not yet known how great an impact this stocking issue may have, but today’s assumption is that higher levels of supply in the first half of 2020 will counterbalance a weaker second half of the year.

- Finally, COVID-19 is expected to have a profound effect on the payments market. Contactless is considered the more hygenic way of making proximity payments and this is being reinforced by ecosystem players that are shifting marketing messages for contactless being used to increase convience, safety, and health.

- For this reason, contactless adoption is expected to increase. Although the overarching trend toward contactless was well in place prior to COVID-19, the pandemic will likely further increase the speed of contactless adoption, particularly within countries and economies where cash remains king, with usage not only being encouraged by payment ecosystem players and suppliers, but also by governments and health organizations including the World Health Organization (WHO).

The Way in Which Consumers Pay Is Rapidly Evolving |

RECOMMENDATIONS |

The way people pay for things is rapidly evolving and changing. Firstly, COVID-19 has driven a significant shift in consumer spending habits, driven by economic uncertainly and a drive toward the purchase of mainly essential items. Additionally, there has been a surge in ecommerce whereby consumers are becoming even more heavily reliant on online retail channels in order to avoid crowded places to limit social interactions.

However, with a significant strain being placed on ecommerce, physical brick and mortar retail still has a significant role to play and is essential in many instances. In most countries, retailers considered to be of an essential nature (e.g., supermarkets) remain open and have put measures in place to help combat the spread of COVID-19 to shoppers and customers via the enforcement of 2-meter distancing and putting protective screens in place at checkouts. These measures extend to the Point of Sale (POS), where digital payments and, where possible, contactless transactions are being encouraged over cash.

Major payment networks, including Visa and Mastercard, are looking to aid in the pandemic by increasing contactless card spending limits. Many national and local authorities and governments as well as merchants are also encouraging digital payments over cash, using the digital transaction method to limit contact with items and objects that are communal in nature and used by multiple people—in this instance, POS terminals.

However, with many retailers and merchants remaining shut and a significant shift to online transactions, the risk on the payment cards market from a transaction volumes perspective, rather than an issuance perspective, is much greater. Increased encouragement to favor digital and contactless payments over cash will somewhat counterbalance the reduction in card transaction volumes, but the fact remains that with many retailers and merchants closed, physical transaction volumes are going to significantly decline.

Despite any shortfall in transaction volumes, the message is clear and contactless payments has a critical role to play in the fight against COVID-19, from hygiene, health, and safety perspectives.

COVID-19 is bringing not only contactless to the forefront of the proximity digital payment experience, but also other next-generation payment card form factors. As consumers increasingly use and become more reliant on contactless, the question of how best to secure and limit fraud on increasing contactless transaction volumes and values will come into play.

Biometric payment cards are well-positioned as a solution that offers a contactless experience without limits. The use of multi-factor contactless transaction authentication will become a key theme post COVID-19, extending security previously reserved for high computer powered devices such as smartphones and mirroring the experience and security features onto the passive payment card form factor.

For further information related to the potential impacts of COVID-19 on the payment cards market, alongside analysis of other prominent smart card and secure IC markets including SIM Cards, government ID credentials, NFC controllers and Secure elements and eSIM, please view ABI Research’s recent Assessing the Impacts of COVID-19 on the Smart Card and Secure ICs Market (PT-2375) Application Analysis Report.