By Andrew Cavalier | 1Q 2021 | IN-6107

Registered users can unlock up to five pieces of premium content each month.

Starlink Constellations Steadily Materializing |

NEWS |

SpaceX is the world leader when it comes to launching Low Earth Orbit (LEO) satellites into space, providing internet coverage for hundreds of thousands of customers. According to recent news reports, the Starlink network has its sights on eventually deploying 42,000 satellites into orbit by 2027. It should be noted that 12,000 have been permitted by the U.S. Federal Communications Commission. Impressively, only 1% of Starlink’s satellites have failed so far. Starlink now has over 2,000,000 customers as of September 2023 and is expected to continue growing in the coming years because of how reliable and accessible the network is. In fact, Starlink has played a critical role in helping keep Ukrainians online in the face of Russia’s invasion. The network is also well on its way to supporting satellite-to-mobile connectivity in unmodified mobile phones on KDDI and T-Mobile cellular plans. For enterprises considering a LEO network, it’s worth taking a closer look at LEO satellite providers such as Starlink. Although, there are a number of other LEO constellations that are also jostling for position.

The Pros and Cons of Starlink |

IMPACT |

The following Starlink pros position SpaceX as a market leader when it comes to providing LEO satellite internet coverage.

Pro #1 of Starlink: One of the First “Mega-Constellations”

There are more than 4,200 operational LEO satellites currently in orbit. According to FCC filings, the final constellation size is planned to eventually reach 42,000 satellites[JS1] , with 12,000 having received the green light so far. With a constellation this size, Starlink can essentially cover any point on Earth, as LEO satellites do not stay in one fixed location but rather move over ahead which means a large constellation of LEO satellites is needed. While more satellites are needed, it also means that a single failed satellite launch or deployment of a batch of Starlink satellites has a much smaller impact on the network and operations than a single, more expensive GEO satellite.

Pro #2 of Starlink: Operates in Low Earth Orbit (LEO)

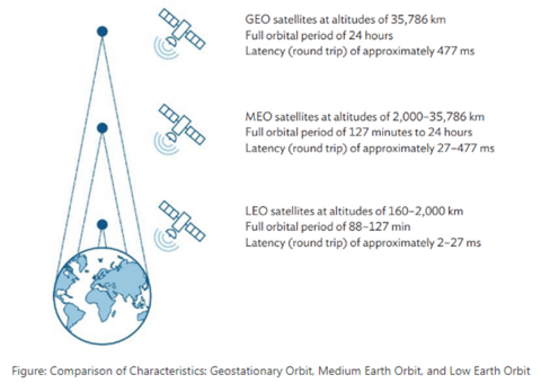

This LEO approach means that there is less distance for those Starlink signals to travel – and thus, less latency. The round-trip data time between the user and the satellite – also known as latency – is much lower than with satellites in geostationary orbit. This enables Starlink to deliver services like online gaming that are usually not possible on other satellite broadband systems.

|

Pro #3 of Starlink: Faster Than Other Satellite Internet Providers

Pro #3 of Starlink: Faster Than Other Satellite Internet Providers

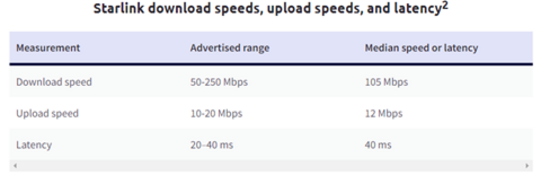

Other than Starlink, other providers use geosynchronous satellites or medium Earth orbit satellites to transmit data over the Internet. It can transmit data faster than any other network that exists. This means Starlink provides the potential for lower latency information transmission over long distances. In a recent report by Ookla, Starlink achieved download speeds between 70 Mbps to over 100 Mbps, still akin to the early days of the network. This finally brings Starlink's latency down to its advertised range of 20 to 40 ms, leagues better than other satellite providers with a median latency between 627 to 725 ms. Starlink latency is in a galaxy of its own when compared to Viasat and HughesNet:

- Starlink median latency: 40 ms

- Viasat median latency: 627 ms

- HughesNet median latency: 725 ms

- Starlink median latency: 40 ms

- Viasat median latency: 627 ms

- HughesNet median latency: 725 ms

|

Pro #4 of Starlink: Internet Access to Rural Areas/Places with No Access

Starlink wants to sell internet access, particularly to people in rural areas and other parts of the world who don't already have access to high-speed broadband. It hopes to bring high-speed satellite internet to many of the 3.7 billion people on this planet who currently have little or no internet connection at all. Compared to Viasat and HughesNet, which rely on a few large geostationary satellites to create an internet network, Starlink relies on a web of thousands of smaller satellites that surround the Earth. Starlink’s goal is to build a mega constellation of 42,000 satellites to power its internet service across the world. This positions it as an excellent candidate for satellite backhaul in tough-to-reach regions for consumers and enterprises (e.g., agriculture, mining, oil & gas, etc.) alike. In this regard, some Telcos have already selected Starlink for backhaul in remote locations.

Pro #5 of Starlink: Easy Set-Up

The Starlink dish installation is very easy. Once your order is confirmed, SpaceX will ship a Starlink package that includes a dish, WiFi router, mounting brackets (optional), and necessary cables. When turned on, the dish changes direction to obtain an optimal signal. Users report that the equipment typically takes around five minutes to set up but can extend to an hour if the product needs to be placed on the roof.

Pro #6 of Starlink: Environmentally Friendly

Many enterprises with Environmental, Social, and Governance (ESG) goals will find Starlink’s eco-friendliness to be the strongest pro the company possesses. Starlink’s goal is to make the satellites generally invisible to the naked eye within a week of launch. This is because Starlink is looking to minimize the impact on astronomy by darkening satellites, so they do not saturate observatory detectors. Starlink is on the leading edge of on-orbit debris mitigation, meeting or exceeding all regulatory and industry standards. At end of life, the satellites will utilize their onboard propulsion system to deorbit over a few months, which is a great circularity program solution. In the unlikely event the propulsion system becomes inoperable, the satellites will burn up in the Earth’s atmosphere within 1-5 years, significantly less than the hundreds or thousands of years at higher altitudes.

Now, here are some of the downsides to Starlink.

Con #1 of Starlink: Small Coverage Area

While LEO satellites can boast better latency and throughput due to proximity to the Earth, this also means that the surface area a single satellite covers is smaller. This requires LEO satellites to often work together with other satellites as a constellation to ensure continuity of service. This means coverage and connectivity can fluctuate as satellite beams quickly pass overhead, unlike GEO, where a large beam is always covering the same geographical area.

Con #2 of Starlink: High Orbit Speeds

LEO satellites orbit the Earth in approximately 90 minutes. This means that services provided by a single orbiting LEO satellite will last for a relatively short time and will require a higher frequency of data hand-offs to other satellites. Alongside this, traveling at these speeds makes it more difficult to coordinate with terrestrial equipment.

Con #3 of Starlink: Short Lifespan and High Capital Expenditure (CAPEX)

Atmospheric drag gradually deteriorates the satellite's orbit and shortens the lifespan of the LEO satellite. This means operating satellites in LEO will require a higher frequency of maintenance and replacement. While typically satellites in LEO have an operational lifespan of 7-10 years, Starlink satellites have a lifespan of 5 years.

Con #4 of Starlink: Limited Coverage – Still Best Effort (For Now)

Currently, Starlink is available in over 60 countries with many still on a waitlist for the service. While many will have to wait for the service to enter their region, the constellation remains a contended or Best Effort service (i.e., shared bandwidth between users) as many wait for the activation of their Residential Service plan. With a million new subscribers added to the network, many regions, such as the United States and Canada are running at capacity and lack the bandwidth available to deliver its promised speeds. Therefore many users may have to contend with lower speeds as the network expands.

For regional availability, Starlink is working on expanding its availability in 2023 where many areas such as Northern Canada, Northern Australia, South America (excluding Venezuela), Alaska, Greenland, Iceland, Norway, Sweden, and Finland will receive Starlink availability by Q1. Additionally, there are plans for the continent of Africa, Turkey, India, Mongolia, and several other countries to also have coverage in 2023.

Con #5 of Starlink: Fiber and Fixed Wireless Access (FWA) Maybe Be Better for Most

Starlink’s speeds are slower compared to Fiber and FWA. FWA’s latency can be as low as 30ms with 5G, while Fiber’s latency is often even lower. Starlink has a higher latency of 43ms, which may critically affect activities, such as online gaming. Furthermore, the highest recorded Starlink download speed is a little more than 300 Mbps, and the average download speed in the United States is 105 Mbps. On the other end of the spectrum, Fiber and FWA produce consistent and symmetrical speeds of up to 1,000 Mbps.

While there are unknowns surrounding Starlink's resilience to interference like solar flares, weather events, and space junk, Fiber and FWA have already proven to be quite reliable during common weather events. This is because fiber cables are buried deep within the Earth and FWA is built on top of existing cellular infrastructure.

Con #6 of Starlink: Not Suitable for High-Density Areas

As mentioned earlier, Starlink can only provide a finite amount of bandwidth; therefore, internet speeds may slow down as the number of users increase. Furthermore, higher density urban environments will almost always have access to fiber, which is superior in price and performance compared to satellite communications. Thus it is not reasonable solution for high-density areas unless you are keeping your boat connected at a nearby marina.

Should Telco Operators Embrace LEO? |

RECOMMENDATIONS |

LEO constellations are estimated to be able to increase satellite internet capacity by more than 10-fold in just a few years and will distribute their service more evenly across the planet. The pros offered by LEO companies like Starlink, in terms of their ability to provide customers in rural areas with access to low latency broadband services with simpler setups would generally be more of a threat rather than a business opportunity for operators that desire to provide services to rural areas. That being said, it is very much possible for LEO companies and operators to co-exist by providing their respective services to separate markets that they are well-positioned to cater to. Terrestrial networks can maintain their foothold in delivering reliable connectivity in urban and suburban areas. LEO constellations, on the other hand, are highly specialized to serve markets that operators cannot/hesitate to serve; these markets include in-flight Internet, maritime services, agriculture, and the monitoring of non-static assets (e.g., vehicle fleets, heavy equipment), and arguably, rural connectivity.

The entry of LEO satellite broadband provisioning to rural areas would not necessarily equate to a severe negative impact on a mobile network’s revenue potential in rural areas. From an operator’s perspective, rural markets have already been historically challenging to deploy due to their low population density, low Average Revenue Per User (ARPU) potential, the high costs associated with establishing far-reaching fiber installations, and the propagation limitations of wireless solutions. The unfavourable business case of rural areas for operators can position LEO satellites as the de facto solution for a nation desiring to provide inclusive broadband services that can cover even its hardest-to-reach citizens.

Alternatively, partnerships with LEO companies can help operators overcome unfavorable business conditions in rural areas and provide them with tangible revenue opportunities. AST SpaceMobile, for example, is proposing to deliver broadband from space directly to mobile phones without the need for additional equipment such as satellite phones, terminals, or antennas. AST’s strategy is to help operators’ rural coverage by selling SpaceMobile airtime under a wholesale business model. This arrangement can help operators extend the coverage of terrestrial networks and provide network services to rural areas that are otherwise unreachable/unprofitable.

AST & Science addresses spectrum limitations of satellite communications by instead using the IMT frequencies (that they otherwise would not have) of its partnered mobile operators. This model is very similar to that of Lynk’s existing mobile phones through mobile operator partnerships and the company’s patented LEO satellite communication technology. Its solution relies on using LEO satellites with orbits of 400 km to accommodate the reach and power limitations of mobile phones. Its satellites have also been designed to use similar software-defined architectures to terrestrial cell towers and have specialized features that can compensate for the Doppler shift that occurs from the relative motion of the User Equipment (UE) and the orbital velocity needed to maintain the satellite in orbit (at around 7.8 km per second).

Given the rise in NTN-Mobile operators, like AST, it is no surprise then that Starlink is set to launch its services in the emerging segment and, eventually, position itself as the Satellite network partner for Telcos aiming to unlike 5G NTN and even 6G unified networks architectures.

Related Content: