Can the Consumer Devices Ecosystem Navigate a Path Back to Full Recovery While Battling Prevailing Macroeconomic and Geopolitical Conditions?

13 Sep 2022 | IN-6664

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

13 Sep 2022 | IN-6664

Despite Declining Pandemic Risks, Current Macroeconomic Headwinds Unsettle Consumer Devices Market Growth |

NEWS |

The global economy is still suffering from the aftershock effects of the COVID-19 pandemic, which from the outset caused mass disruption to production lines and supply chains, and it is still being felt by further lockdown measures being enforced in China. In addition, ongoing geopolitical trade wars and shortages of key components have suppressed growth in the consumer sector for the past 2 years, while markets have since deteriorated due to additional waves of disruption caused by the war in Ukraine, its impact on inflation rates, and the worsening global cost of living crisis. Such global risk factors, when combined, can suppress the rate of technological progress and 5G development, putting on hold promises of new consumer device advancements, features, innovation, and user experiences.

Moreover, inflationary pressures caused by prevailing economic conditions and the geopolitical environment have significantly influenced variables, such as raw material prices, wages, and interest rates, limiting consumer spending and decelerating demand for more discretionary purchase items, most notably consumer electronic goods. Ultimately, these issues have all combined to hit consumer confidence and make stakeholders more cautious, which has led to market uncertainties that are becoming a major impediment to the development of the devices ecosystem and vendor landscape. While market confidence is under such pressure, including the heightened risk of recession, it is proving difficult to predict the speed at which future demand will recover in the short- and mid-term across regions, as well as for the many product types contained within the consumer devices sector.

Differing Speeds of Recovery Expected for Major Consumer Device Sectors as Market Pressures Bite |

IMPACT |

Market pressure caused by macro uncertainties, geopolitical concerns, and supply issues are expected to persist into 2H 2022 and beyond, but demand for some consumer devices is forecast to remain solid. Indeed, despite the adverse impact of these multiple factors being felt mostly by the smartphones market, it has been remarkably resilient since 2020, notably for the high-end and 5G devices on which the effect of supply chains has been relatively minimal. This has coincided with the availability of 5G smartphone models becoming more diverse, brought to market quickly at a wide variety of price points, accelerating affordability and adoption.

Changes in consumer behavior caused by the pandemic have had a direct impact on some device sectors, creating spikes in demand for items like tablets, notebooks, wearables, and accessories, due mainly to the increase in home working, remote learning, and online entertainment consumption. Moreover, consumers have become more attuned to their own health tracking and wellbeing during this period, driving market growth for smartwatches, sport and fitness bands, and other health care devices, aided, in turn, by advances in sensors, power management, wireless communication, and Artificial Intelligence (AI). However, demand for devices like tablets, laptops, and Chromebooks contracted in 1H 2022. This was not only as a result of the hangover from pandemic lockdowns when consumers loaded up on such products, but also because these devices tend to be more discretionary, inflationary-sensitive purchases. There is also little to suggest what the replacement cycle is for such devices, but it is clearly nowhere near as fast as that for smartphones. Despite this expected continued decline, future demand (and replacement cycles) could be boosted by the launch of new smartwatch models and tablets that feature improvements in health tracking applications and high-resolution displays, respectively, providing richer multi-device experiences.

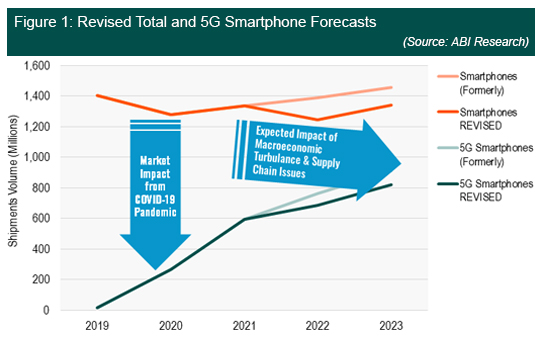

For the smartphone market, there is much to be optimistic about as countries finally start to emerge from the pandemic, leading to a better than expected appetite of consumers to upgrade their devices. So, the industry gradually witnesses supply chains, buyer behavior, and demand slowly return to some level of normalcy, led by 5G device affordability as a primary growth driver. Also, as visibility starts to clear around the market’s speed of recovery, consumer sentiment should return before the end of 2022, buoyed by a continuing eagerness to embrace new innovative mobile experiences and services, enhanced broadband speeds, leading-edge form factors, and greater processing power. However, the challenging headwinds and notable inventory corrections conspired to outweigh any growth potential in 1H 2022, which has tempered smartphone demand amid a period of weak seasonality. In response, ABI Research’s forecasts for global smartphone shipments in 2022 and 2023 have been adjusted downward from original estimates, in terms of both total market and 5G devices, with susceptibility to changes in the economic climate and geopolitical volatility reflected rationally in the revised data. The current expectation is that the total market will decline 7% Year-over-Year (YoY) in 2022 to reach 1.24 billion units, while 5G smartphones will grow 15% in 2022 to around 683 million versus a previously expected increase of 28%. By 2024, ABI Research anticipates that markets will be back on track to link with previous forecast trajectories.

Compared to the financial crisis of 2008, it is the mid-to-low smartphone tiers that have again been squeezed, related mainly to Android devices, while the premium and high end remained resilient, relatively unaffected by economic fluctuations. The scheduled release of new flagship products during the latter half of 2022, notably from Apple and Samsung, as well as high-end Android launches, mainly in China, should help redress the balance, particularly during the strong 4Q 2022 holiday season. This growth will be boosted further by pent-up demand, as the market continues its transition to 5G, notably in fledgling markets like India. Moreover, there are signs that softened demand in some markets, such as China, will rebound in 2H 2022 and into early 2023, reinforcing a sustainable path to recovery as confidence returns.

From the supply side, these macro issues have had an impact on raw materials and the supply of major components, such as Systems-on-Chip (SoCs) and image sensors, which have also suffered due to weak seasonality and inventory adjustments. As a consequence of the pandemic, many companies have been forced to revisit their production strategies and supply chain management to minimize disruption, while also building up inventory. Indeed, many companies have been careful with inventory, as they attempt to navigate their way through the current market environment.

Lasting Scarring Effects Expected as Markets Face a Challenging Path Back to Recovery |

RECOMMENDATIONS |

Under current, highly challenging market conditions, which have taken a massive toll on both demand and supply chain, it will take a few quarters moving into 2023 for markets to return to something resembling normalcy as consumer confidence makes its return and demand in the devices sector recovers. However, some countries and sectors could potentially face a much longer road back to economic recovery, while conventions and behaviors in the mobile devices ecosystem will inevitably be severely challenged in the longer term. Moreover, the effect of higher inflation and commodity prices is expected to lead to a decline in real disposable income and dampen consumption in the short term, while fundamental changes in consumer buying behavior may affect replacement cycles and levels of affordability. However, it will prove to be the strength of demand in the form of increasing economic growth and consumer confidence that will ultimately show that the market is responding and on the road to recovery.

For many across the value chain, it is a case of trying to reconcile demand with an ability to supply, notably as they work through inventory balances. Also, despite the level of caution exercised, company earnings are expected to be more volatile in 2022 due to these numerous “difficult to predict” external factors. However, for the moment, it does appear as if the main consumer device market drivers are aligning, as demand signals in many sectors are strengthening and the supply side is rallying, buoyed by the improved availability of key components and expanded sales of 5G models, helping to fuel growth.

Aside from the identified demand drivers to recovery and vectors for growth, ABI Research has outlined the following crucial tactics that companies should employ to navigate during the next 12 to 18 months and beyond:

Short to Medium Term:

- Reconciliation of Demand and Supply: Secure sufficient supply in advance to ensure demand can be met, while trying to reduce exposure to flagging tiers and device sectors. Safeguard competitive value propositions to target larger growth portions of the market, thereby offsetting potential losses and maintaining solid profitability by enhancing operational efficiency and improving product mix, either through regulating exposure to certain price tiers or availability in particular regions/countries.

- Minimize the Impacts of Macro Uncertainties: Deepening market uncertainty is an immense challenge to forecast, both in terms of duration and market ripple effects, which will require continuous and careful monitoring to minimize its impact.

- Forecast Consumer Behavior: Future inflationary risks are closely tied to fiscal and monetary policy frameworks. Therefore, supply and demand of the consumer market will be significantly impacted by the current economic and political environment, especially in regions where the fiscal regime dominates. Also, shifts in consumer purchasing patterns may result in longer replacement cycles, migration to lower device price points, or a growing need for increasing customer satisfaction and loyalty.

- Maintain Stable Prices and Meet Market Demand: Firms are likely to be less able to generate increased demand through price cuts, as consumers become less able and willing to spend. External cost pressures, such as movements in the exchange rate and commodity prices, will also influence inflation and, therefore, production costs. Disruptions in device distribution channels will undoubtedly amplify the impact.

- Embrace the Transition from 4G to 5G, but Don’t Forget about 4G: The market has some way to go to reach full 5G penetration, so opportunities will appear in 5G mid- and low-end tiers, as most of the premium market is fully penetrated. Also, markets like India that start deploying 5G later in 2022 will be ripe for growth. However, 4G chipset costs continue to be far lower than their 5G counterparts, which is still keeping demand strong in developing markets.

- Provide Richer Experiences through Increased Device Capabilities: Moving beyond 5G, the amount of compute processing of content being demanded by smartphones is increasing. As these enhanced capabilities are added, aiding component suppliers and vendors alike, it can fuel product differentiation and optimize user experiences.

- Strengthen Cooperation with Suppliers and Partners: Respond by strengthening cooperation with partners and use long-term contracts to resolve supply issues of key components.

Longer Term:

- Minimize Future Supply Chain Risks: It is becoming increasingly incumbent on vendors and suppliers to put in place robust contingency planning to mitigate future market disruptions for manufacture and component supply. Strategies must be re-evaluated to decrease dependency on a single nation, manufacturer, or technology supplier. Market players need to fully understand their risk and exposure from all those along the chain, identifying and evaluating all risks points.

- Outperform the Competitors: Ensuring sustainable growth requires solid support for Research and Development (R&D), an awareness of strategic industries, and tailored approaches to entering markets. While price points are key, continual innovation and creation of differentiation in product lines are still needed.

- Embrace New Technologies and Network Evolution: As the market moves toward 5G-Advanced, there is still much to be done to fully expose the value of the 5G ecosystem and realize its full potential. This evolution could effectively explode the numbers of connected mobile products, addressing devices destined for the consumer, industrial, and enterprise markets.

- Investigate Diversification Plans: Look to grow design pipelines and leverage R&D in markets adjacent to consumer technologies, such as the Internet of Things (IoT), enterprise, and automotive. There is a tremendous amount of digital transformation still expected in the market, and companies will benefit if they can expand their presence and participation in this evolution.

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions