3Q 2024 | IN-7464

Registered users can unlock up to five pieces of premium content each month.

Open Banking and A2A Wallets Driving the Instant Payments Trend |

NEWS |

Instant payments are continuing to expand the financial infrastructure of economies around the world, while providing a pivotal technology to areas of lessened financial inclusivity. ABI Research understands the demand for instant payments is growing due to an increase in Peer-to-Peer (P2P) payments, alongside a European Union (EU)-led expansion of open banking.

It is clear that, in 2024, Account-to-Account (A2A) wallets, which have seen widespread use in P2P transfers, are experiencing increased usage, given their use in daily smaller-scale convenient payments between users, while open banking is widening the available market for prospective users by providing the market with access to payments without the need for bank partnerships, which is serving to open the market up to net-new customers and drive inclusion.

How to Ensure Success and Best Practice in Instant Payments |

IMPACT |

As it relates to ensuring that an instant payment platform finds success and swift uptake among its target market, it is critical to achieve interoperability, with each country requiring a customized and nuanced approach, tailored to market context. In some cases, countries will opt to launch brand new platforms, while another option is to expand additional services onto already pre-existing solutions. Furthermore, some instant payment platforms will be driven by initiatives coming from the industry itself, while others will be regulator-led.

There are many reasons why an instant payment solution will be launched, some of which include financial inclusion, innovation in the payments space, and competition among market players. When these solutions are being driven by market competition, it tends to be the government or regulator that acts as the driving force, as seen in the Philippines, Australia, and the United Kingdom. In the United Kingdom, Faster Payments development was driven by a report published on competition in the banking sector, while in Tanzania, interoperability was identified as needed to streamline the flow of payments in the country. It is important to be aware of the market dynamics on a country-level basis to ensure that an instant payment solution caters to the ecosystem and addresses the needs of the industry:

- Interoperability Requirements: Identify and analyze customer needs and market demand to ensure seamless interoperability between different payment systems.

- Market Analysis: Investigate the current landscape of digital payment solutions, assess how providers collaborate, and determine whether the existing infrastructure can be upgraded or if a new approach is needed to resolve any existing issues.

- Define Market Priorities: Determine the key players in the market and their motivations, including the roles of existing financial institutions, and analyze their competitive positions based on customer demographics and geographical reach to evaluate their potential for partnering in the instant payment ecosystem.

- Understand Regulatory Environments: Investigate how existing laws and regulations affect the market and pinpoint any possible limitations or challenges in implementing instant payment solutions.

Evidently, to successfully launch an instant payment solution, there is a need to understand and address country-specific market dynamics. By focusing on interoperability and regulatory environments, these solutions can be tailored to effectively meet industry needs. Ultimately, this ensures that the instant payment infrastructure aligns with local demands, which will serve to promote faster uptake in the platform.

Instant Payment Regulation Challenges |

RECOMMENDATIONS |

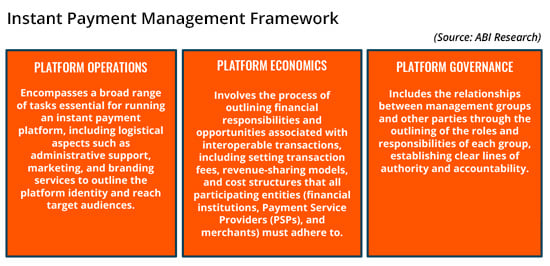

For instant payment projects to succeed, they need clear governance, as well as strong economic incentives and reliable operational frameworks. While it may be the case that payment regulation and oversight establish foundational guidelines for system operations, the decisions made by scheme managers regarding these factors are still crucial to the success of instant payment platforms.

Instant payment platforms must have a solution in place to tackle consumer protection issues, pertinent to both industry stakeholders and regulatory authorities responsible for enforcing consumer protection laws. Three components are critical to understand the consumer protection landscape around instant payments: 1) the legislative and regulatory framework, 2) service agreements between PSPs and customers, and 3) the standardization governing the instant payment scheme.

The rapid completion of instant payments with funds available in near-real time to the payee poses challenges regarding consumer protection against malicious activity or transaction issues. Specific features of an instant payment solution, including payment type, payer authentication, and parameters for potential payments outlined by the end user, such as authorized payees, will limit the risk in unsanctioned payments.

Furthermore, introducing features such as transaction limits can help lower the impacts of fraudulent or erroneous activity in the event that such an event occurs, with payment status notifications providing data to end users about their fast payment activities, helping them promptly detect and resolve issues such as fraud or transactions in error.

There is also an incentive for the instant payment providers and operators. While consumer protection is critical to ensure regulatory compliance, it will also establish a root of trust from the end user and encourage adoption and growth rates with the confidence established in the system and ensure a positive user experience.

To ensure consumer protection is achieved, it is essential to have a comprehensive understanding of the legislative framework and standardization protocols, with key features such as payer authentication and transaction limits becoming crucial for mitigating fraud and unauthorized payments. By enhancing consumer protection measures, instant payment providers not only comply with regulations, but also build trust and foster growth in their user bases through a positive user experience.