SEA Telcos Must Harness their Data Center Assets and Build Mobile AI as a Service Expertise to Boost Enterprise Revenues: Insights from Singtel’s RE:AI and Nxera GoToMarket Strategy

By Jake Saunders |

23 Dec 2024 |

IN-7651

By Jake Saunders |

23 Dec 2024 |

IN-7651

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

By Jake Saunders |

22 Dec 2024 |

IN-7651

By Jake Saunders |

22 Dec 2024 |

IN-7651

The Singtel28 Game Plan |

NEWS |

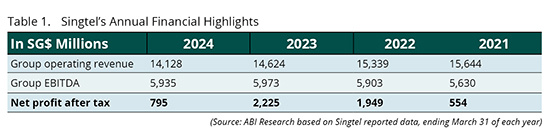

Singtel, Singapore’s major Communications Service Provider (CSP), has seen the “writing on the wall” for some time. Its annual revenue across the group has steadily declined from US$11.6 billion (SG$15.64 billion) in 2021 to US$10.5 billion (SG$14.12 billion) for the financial year ending March 2024. Group Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) has held at over US$4.4 billion (SG$5.9 billion) for the past 3 years, which demonstrates Singtel can run a “tight ship” and keep the underlying costs (Capital Expenditure (CAPEX) and Operational Expenditure (OPEX)) in good order to ensure a healthy EBITDA, but net profits dropped substantially to US$592 million (SG$795 million) for the financial year ending in March 2024.

Saturating consumer and business mobile user adoption combined with intense competition have whittled away revenue growth and put a strain on profitability. However, Singtel’s senior management have been proactive. They have developed a game plan, Singtel28, to expand the CSP’s operational focus to embrace the potential opportunities of digital transformation, as well as Artificial Intelligence (AI). The Singtel28 game plan incorporates a capital recycling program that has raised US$5.9 billion (SG$8 billion) as well as lined up a pipeline of an additional US$4.4 billion (SG$6 billion) in monetizable assets. Crucially, Singtel’s management have set up its subsidiaries: NCS (information solutions vendor) and Nxera (data centers) to play vital roles in Singtel’s operational pivot. In mid-November 2024, Singtel provided a mid-year update that demonstrates where the operator sees additional value creation for the company and its investors.

Creating Synergy with AI |

IMPACT |

Singtel is putting particular emphasis on boosting its expertise and resources in AI and data centers. NCS and Nxera have been investing in AI infrastructure and capabilities to address the needs of enterprise and governments. AI and digital transformation initiatives include:

- Launch of RE:AI: In mid-October, Singtel announced the launch of RE:AI, its new Artificial Intelligence Cloud Service (AI Cloud) offering for academic institutions, enterprises, and governments. These organizations can leverage a turnkey AI development and deployment platform that combines AI compute infrastructure such as Graphics Processing Units (GPUs), data storage, AI workspaces and tools, and embedded 5G connectivity, as well as fixed or quantum-safe network architectures. The whole service is enabled by Singtel’s orchestration platform, Paragon. Singtel believes it can, “democratize AI by working with strategic partners in five ways – through the creation of a research and development AI Cloud platform, facilitation of AI adoption for the advanced manufacturing sector, ecosystem development to accelerate the deployment of AI solutions, curation of tech incubation and acceleration program for promising tech companies and AI skills training to empowering its workforce.”

- Partnership with Scale AI: In early November, Singtel and Scale AI (United States) announced a partnership to deliver advanced Generative Artificial Intelligence (Gen AI) solutions targeting the telecommunications, finance, healthcare, advanced manufacturing, and logistics enterprise sectors. Scale AI specializes in providing high-quality labeled data for developing and training AI models. Scale AI’s models combine human expertise with advanced AI algorithms to efficiently label large datasets (i.e., objects in the environment around us) and/or specialized datasets (e.g., components and parts that go into a custom assembly line or an oil rig installation).

- Nxera Expands Data Center Investment Across Asia: Singtel’s data center subsidiary will provide the backbone for Singtel’s digital transformation and AI aspirations. Nxera plans to expand data center capacity from 62 Megawatts (MW) in 2023 to 155 MW in 2026 across Singapore, Indonesia, and Thailand. In the subsequent 3 years, Nxera intends to extend capacity to 200 MW to address the needs of other Southeast Asian markets such as Malaysia and others. Singtel believes Southeast Asia to be one of the fastest growing markets for data centers as data sovereignty, AI compute, and data analytics drive enterprise demand. Global investment fund KKR has taken a 20% stake (US$1.1 billion) in Nxera that should ensure the data center expansion program is effectively funded.

Singtel's Digital Transformation Vision Comes Into Focus |

RECOMMENDATIONS |

Singtel has been putting in place essential solutions and resources to address the needs of a number of enterprise verticals. The rollout of data centers will support the data storage and analytics of businesses across the region. The collaboration between Singtel’s RE:AI and Scale AI will provide data labeling, analysis, and modeling expertise that could provide enterprises new application development scenarios, as well as process acceleration that should lead to expanded market opportunities. But crucially, ABI Research believes that Singtel’s orchestration platform, Paragon, provides a vital role. The “all-in-one” platform is intended to simplify 5G private cellular, edge computing, and cloud services integration for the customer that should be greatly appreciated by the enterprise community.

Singtel has had a tough 4 to 5 years as the CSP has embraced the challenge of pivoting from being a “telco” to being a “techco.” There was some speculation that Singtel had overreached itself with its development of its Paragon platform. ABI Research does believe that the investment in the development of Paragon will pay off—especially as the solution can provide an “on ramp” for edge compute/AI compute processing and other value-added services that the CSP can also provide. From ABI Research’s own research into Southeast Asia’s digital transformation market opportunity, we estimate that 5G-to-Business (5GtoB) equipment spending will grow to US$13.5 billion by 2028 (see Asia-Pacific 5G-to-Business Developments and Outlook (AN-5713)).

Written by Jake Saunders

Related Service

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions