Hyundai’s New Software Brand, Pleos, and Li Auto’s Open-Source OS: A New Age for Automotive In-House Development

By Abu Miah |

07 Apr 2025 |

IN-7781

By Abu Miah |

07 Apr 2025 |

IN-7781

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

By Abu Miah |

07 Apr 2025 |

IN-7781

By Abu Miah |

07 Apr 2025 |

IN-7781

Hyundai Motor Group's In-House Pleos Software Brand Is Targeting Complete "Cloud Mobility," While Li Auto Open-Sources Its In-House Vehicles OS |

NEWS |

In-house software divisions have taken several forms over the years, with brands like CARIAD or Woven by Toyota going through several hurdles to arrive at their current forms, as detailed in ABI Insight “Car Companies Can’t Take on Software Alone: Lessons from Tesla, Toyota, and Volkswagen.” Two significant developments occurred in March—Hyundai’s announcement of the Pleos platform and Li Auto’s open-sourcing of its in-house Halo Operating System (OS).

The Pleos mobility software platform was announced at the inaugural Pleos 25 developer conference, and is positioned as a complete end-to-end software platform that integrates high-end Systems-on-Chip (SoCs), a vehicle OS, infotainment system, cloud infrastructure, fleet management, and mobility/logistics optimization solutions. These components are designed in-house with an open development platform, Pleos Playground, established to enable third-party developers with quicker app development processes for Hyundai’s planned in-vehicle app store ecosystem. The announcement included 26 partners showcasing apps and services based on Pleos Connect (In-Vehicle Infotainment (IVI) system based on Android Automotive OS (AAOS)), which is scheduled to debut in vehicles in 2Q 2026 with expansion to 20 million vehicles by 2030.

In the same week, Li Auto announced that its in-house developed automotive OS, Halo OS, will be open-sourced, in order to rival AUTomotive Open System ARchitecture (AUTOSAR) as the industry leader in automotive OSs. This marks an industry first when it comes to safety-critical Electronic Control Units’ (ECUs) OSs, and it is alleged to shorten response times by a factor of two and improve response stability 5X. Li Auto uses the example of active safety, stating that Halo OS can shorten automatic emergency braking distance by 7 Meters (m) at 120 Kilometer per Hour (km/h). Halo OS is scheduled to be made available to the open-source community at the end of April, with open-source modules that include a vehicle control OS, smart driving OS, communication middleware, and a virtualization platform.

Hyundai and Li Auto's Diverging Approaches Can Improve Their SDV Transitions |

IMPACT |

While open-sourcing an automotive OS and announcing an in-house software brand for, among other things, proprietary OS development are opposite approaches for in-house development projects, both have strong potential to improve Hyundai and Li Auto’s operations. For Hyundai, the Pleos platform does have optimistic goals for deployment, but there is already a comprehensive partner ecosystem in place that includes Samsung Electronics (for integration of Hyundai’s SDVs with smart homes and mobile devices), Google (for integration of AAOS with Google services, AI-based navigation, and infotainment collaboration), Naver (for personalized voice search and destination recommendations by connecting smartphones and vehicles), SOCAR (enhancing car-sharing convenience with personalized door opening and seat positioning, based on cloud and user profile integration), and Unity (for in-vehicle gaming and content experiences). Engagement in tightly integrated partnerships was a key lesson outlined in the ABI Insight mentioned above, and Hyundai has exemplified this stance through the group’s Next Urban Mobility Alliance (NUMA) announcement alongside Pleos—a collaboration of public-private partnerships to tackle mobility issues. This includes social issues like mobility rights, but also technology-specific goals like an autonomous vehicle ecosystem, which Uber has already joined, and an in-vehicle app ecosystem, which the previously mentioned partners have engaged in. Hyundai also has a key advantage over Volkswagen when it comes to implementing the innovations of its software brands—while Volkswagen is made up of several vehicle brands, often with differing goals, processes, and timelines, Hyundai is much more focused, consisting of Hyundai, Kia, and the luxury brand Genesis. It will benefit from greater agility because of this reduced internal complexity—managing software development for 3 core brands will certainly be less complex than 10 brands. This theme can be seen from Hyundai Kia’s unified Electric Vehicle (EV) platform (the Hyundai Electric Global Modular Platform, used by all three car brands), in comparison to Volkswagen Group brands’ pursuit of too many different platforms simultaneously (including the Modularer E-Antriebs Baukasten (MEB) platform used by Audi, Cupra, Škoda, and Volkswagen; the Premium Platform Electric (PPE) developed by Audi and Porsche; and now the Scalable Systems Platform (SSP), which is positioned as a second-generation EV platform that can serve the needs of all the Volkswagen brands, but organizational frictions have delayed this platform until 2030).

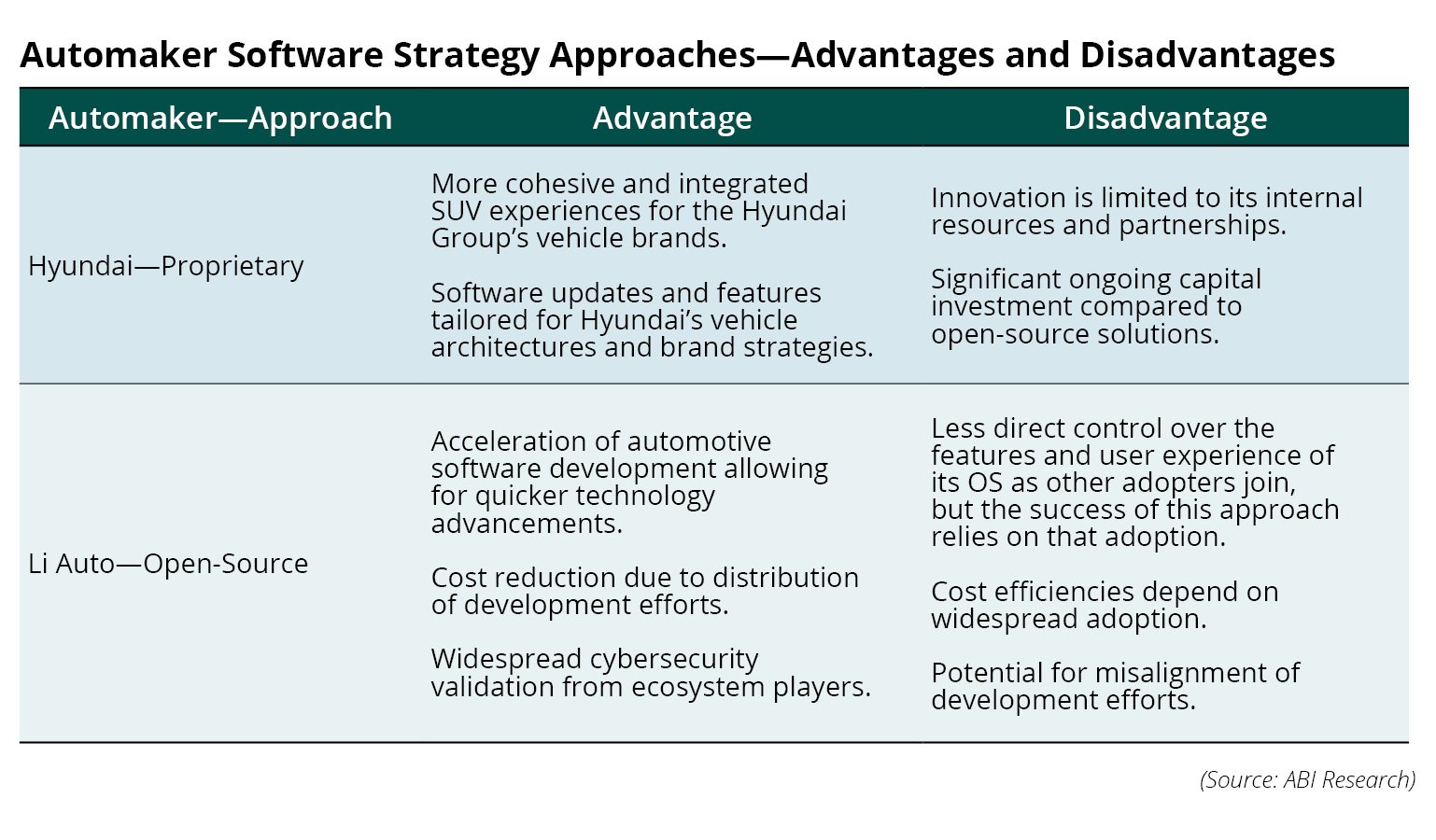

Li Auto will experience a different set of benefits with its open-source approach. Rapid innovation is a notable advantage of open-source models due to diverse innovation from the global community of developers, but this depends significantly on uptake among the industry. Li Auto is already manufacturing vehicles with Halo OS, as of 2024, but widespread adoption is needed to rival AUTOSAR. The increased transparency of open-source software also allows for wider security scrutinization, which can address cybersecurity vulnerabilities at a higher cadence than proprietary software is capable of—this is an especially important consideration as reported vulnerabilities continue to increase year-over-year. Another consideration is the cost reduction potential of open-source OS; however this potential is not yet realized for Li Auto, but can be by other adopters, and in the future as collaboration on the OS continues, the entire ecosystem will experience the economies of scale from pooled innovation. A summary of advantages and disadvantages for both approaches is found below.

Patching the Holes of Both In-House Development Approaches |

RECOMMENDATIONS |

Going forward, Hyundai and Li Auto have several strategies they can adopt to maximize the potential of their approaches to software.

For Hyundai:

- Doubling down on Pleos Playground to best enable third-party development contributions to its vehicle ecosystem. This will require offering comprehensive Software Development Kits (SDKs) and actively soliciting and engaging with developers from other verticals, which can enhance the user experience in vehicles, from navigation to productivity to gaming or video streaming.

- Exploring strategic collaborations that go beyond partnerships for particular components of Pleos, to truly move toward co-developing specialized software. Its current partnerships position Pleos well for breaking into vehicles in the near future, but for the SDVs of 5 years from now, keeping up with emerging technologies with tailor-made software will be the differentiator, as other competitors will have access to the same partnerships that Hyundai has engaged in with Google or Unity, for example.

- Utilize the open-source community where possible, while maintaining its proprietary Intellectual Property (IP) in differentiating domains. Open-source development is a trend that is not going away in the automotive industry, and Hyundai can benefit from some of its cost-streamlining potential by utilizing open-source alternatives for specific components, such as a Linux-based hypervisor for its zonal or domain controller architectures.

- Tightly integrate Hyundai Group leadership into the direction of Pleos development efforts. One of the downfalls of CARIAD and Woven by Toyota was the misalignment between the software spin-offs and the Original Equipment Manufacturers (OEMs) themselves, to ensure the timely integration of Pleos’ innovations into vehicle shipments, Group leadership engagement is key. This is much simpler for Hyundai Group than it is for Volkswagen, and Pleos has outlined several clear goals and components for its software platform so far, positioning it well for the near future. For example, implementing L2+ autonomous driving by the end of 2027, with continuous optimization of AI models through lightweighting and leveraging vehicle-optimized neural processing units. However, it still has some broad goals that need segmentation and group-wide alignment, such as the implementation of Electrical/Electronic (E/E) architecture with zone controllers and high-performance computers, or continuous updates with decoupling of hardware and software.

For Li Auto:

- Foster a strong open-source community is essential to realizing the potential of Halo OS. This requires a clear governance structure and documentation that outlines the development contribution procedure. Active engagement through a formal forum of contributors or stakeholders will maximize contributions from existing partners, while targeted outreach to OEMs and automotive suppliers can expand this partner base. Targets can be prioritized to Li Auto’s current Asian market presence, but also more widely to other OEMs that are already engaged in open-source development, such as those utilizing Automotive Grade Linux (AGL).

- Establish a clear roadmap, and foundation or consortium led by Li Auto, to guide the development resources of the partners in Halo OS. An overseer of the long-term development for Halo OS allows the open-source project to respond collectively to industry priorities, and ensures that development efforts aren’t duplicated across stakeholders.

- Cater to the core strengths of Halo OS, rather than trying to dominate the automotive OS market. The real-time performance and adaptation to chip architectures, with several stated improvements over AUTOSAR, are key differentiators that make tangible differences to driving experience.