United States Announces Tariffs Globally

|

NEWS

|

Last week, the current U.S. administration levied tariffs on all imports. The 10% baseline tariffs imposed by the administration came into effect this past weekend, whereas the country-specific rates, which are higher, go live on April 9. Additionally, higher reciprocal tariffs were introduced for specific trading partners, calculated based on the trade deficits with each country to reduce trade imbalances – although these reciprocal tariffs have been paused for all countries except China. In response to the U.S. tariffs, China announced a 35% tariff on all U.S. imports, effective April 10. This escalation intensified trade relations between the two largest economies, with potential implications for global trade dynamics and manufacturers’ outlook on their supply chains.

Potential Acceleration of Reshoring and Its Benefits

|

IMPACT

|

In the long term, the decision to impose tariffs worldwide can lead to large pay-offs in the form of a manufacturing boom. Apart from reducing trade imbalances, the current administration also wants to narrow the cost gap between foreign and domestic production, and create jobs domestically. For enterprises previously offshoring to benefit from lower labor or material costs, tariffs can tip the scales back in favor of U.S.-based manufacturing, especially when factoring in shipping lead times and inventory carrying costs. There is an opportunity to double down on reshoring efforts and look into U.S.-based suppliers and carriers. Manufacturers looking to maintain or grow their hold in the U.S. consumer market will have to look into how reshoring could potentially lower their Total Cost of Ownership (TCO). As mentioned in ABI Insight “As More Manufacturers Look into Reshoring, Efficient Supply Chains to Lower Overall Costs Will Be Important,” lowering the TCO and using TCO estimators will be crucial to make the call on reshoring decisions. Inputs such as suppliers, transportation modalities used, etc., are accounted for in TCO estimators and are being assessed by manufacturers before investment.

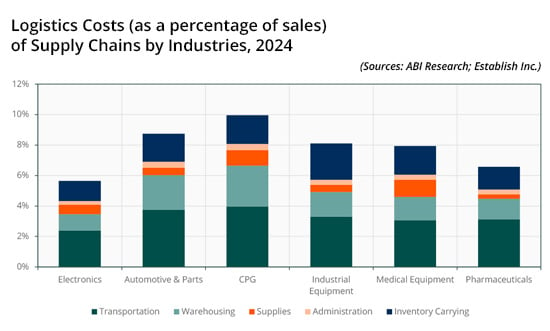

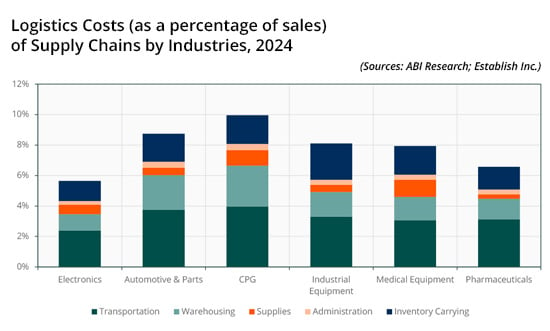

One of the clear advantages of reliance on U.S.-based suppliers would be the benefits it can gain from reduced days to market, which is 45 days for U.S.-based versus 120+ days for China-based production, on average. Beyond shorter lead times and reduced days to markets, localized supply chains can also present opportunities for greater resilience and agility. Local production can allow for faster adjustments to design changes or market shifts—this is crucial in fast-moving industries like apparel or consumer electronics. The chart below shows logistics costs (as a percentage of sales) by industry, signifying high logistics costs for non-localized supply chains.

Companies looking to reshore should also assess the blueprint laid out by manufacturers that have been successful with their reshoring efforts in the past. Even this month, Fast-Moving Consumer Goods (FMCG) giant Johnson & Johnson (J&J) announced that it will be investing US$55 billion in new U.S. manufacturing facilities over the next 4 years, in response to the tariffs. J&J’s reshoring strategy is based on building four new facilities. A notable one that shows the benefits of reshoring is in Wilson, North Carolina, a city with 21% unemployment at present. Undoubtedly, there are socioeconomic upsides to such reshoring if strategic opportunities for job creation are factored in.

Opportunities for Procurement Management and Supply Chain Optimization Platforms

|

RECOMMENDATIONS

|

As manufacturers looking to reshore will be reconfiguring their operations, identifying new partners, and reworking their sourcing strategies, there are opportunities for solution providers to make the most of it. Since digitalization can be a great enabler to streamlined reshoring, network redesign and optimization tools could start to address a lot of pain points and desires of manufacturers. Coupa’s Supply Chain Design & Planning platform, for example, can run multiple reshoring simulations using optimization algorithms and help manufacturers redesign their networks post-tariff change. Kinaxis’ platform Maestro, has end-to-end supply chain orchestration capabilities that can help manufacturers concurrently plan, monitor, and respond to changing conditions. Similarly, Siemens’ SupplyFrame, which is a sourcing and procurement intelligence platform, also has very targeted capabilities like scenario analysis, alternate selection, and risk assessment capabilities that help manufacturers with their sourcing and procurement decisions. What makes SupplyFrame stand out is the fact that it can also digitalize and automate Bill of Materials (BOM) and unlock capabilities like automated quoting and sourcing updates directly to various business units within the organization.

There are other providers like E2open, Blue Yonder, and Sophus Technology that also have supply chain optimization solutions. Their go-to-market framework should consider a use case-driven segmented focus where they seek to provide network restructuring, risk mitigation, and resilience planning capabilities. Reshoring opportunities can prove to be a needle mover for these solution providers, and there is a need to lead with this as a business case. Emphasizing time-to-value will be a crucial part of market messaging, as well as reshoring having changed from a long-term consideration to a mission-critical step for some manufacturers. In addition, there is also a large chunk of the middle market that is relatively untapped. As these medium-sized manufacturers make up a large portion of the country’s manufacturing economy, addressing their needs by offering low-risk pilot projects and “Design-as-a-Service” by partnering with consultants and integrators can be a game changer as well. There are numerous ways to approach manufacturers looking to bring manufacturing back home—solution providers in this space must act sooner, rather than later.