4Q 2021 | IN-6364

Registered users can unlock up to five pieces of premium content each month.

V2X Industry Landscape |

NEWS |

The Vehicle-to-Everything (V2X) market potential is subdued because authorities remain slow to reach a consensus toward a preferred V2X communication standard, and this is hindering deployments by car Original Equipment Manufacturers (OEMs) and city operators. Nevertheless, the fast deployments by not only Chinese but also Western OEMs (e.g., Ford, Audi, GM), the inclusion of V2X on New Car Assessment Program (NCAP) scores in China in 2024 and in Europe in 2025, the potential launch of Cellular Vehicle to Everything (C-V2X) by Ford in the United States in 2022, and the proliferation of dual-mode hardware will finally push the industry forward.

Dual-mode radio hardware has been auspicious to infrastructure players because it removes the burden of betting on a protocol. However, this is not as favorable for automakers due to the increased financial burden of the technology. Therefore, market traction will be dependent on the resolution of regulatory impasses. Alternatively, carmakers can attempt to shape regional protocol preference with large-scale deployment of their preferred V2X technology in volume models, as exemplified by VW’s Dedicated Short-Range Communication (DSRC) launch in its European Golf model. Meanwhile, markets with higher certainty, such as Europe and China, will continue to see gradual growth. Moving forward, spectrum limitations will be the main obstacle in deploying advanced V2X use cases.

Regional V2X Standard Preferences |

IMPACT |

Today, China and Europe are leading V2X deployments. China is a latecomer, launching its first vehicle with V2X in 2019. However, with the clear preference for the C-V2X protocol, spectrum allocation to LTE-V2X, and several Chinese indexes promoting V2X adoption (e.g., C-NCAP, i-VISTA, C-IASI), the country saw at least 11 automakers launching vehicles with C-V2X Onboard Units (OBUs) between 2019 and 2011.

Europe has adopted a technology-neutral spectrum allocation requiring different technologies to coexist in the same channel. Channel coexisting is exceptionally challenging and on the verge of impossible, and Europe already has large-scale DSRC vehicle deployments (VW’s Golf Mk8, ID.3, ID.4, and the forthcoming ID.5) and infrastructure deployments (2,300 operational roadside units). Considering this, DSRC is the preferred standard in the region. Unlike China—where several automakers have included V2X in production vehicles—Europe has only seen VW launching V2X. OEMs have likely been waiting for the outcome of the request to segregate the band for different radio technologies (DSRC and C-V2X), and the European Union has recently declined this request on the basis of neutrality (the announcement was made in the Intelligent Transportation Systems [ITS] World Congress 2021). Nevertheless, with the inclusion of V2X in the Euro NCAP in 2025, more deployments are expected in the coming years.

The United States is among the countries with high uncertainty. In 2020 the Federal Communications Commission (FCC) adopted a Notice of Proposed Rulemaking that proposes the reallocation of 45 MHz from 75 MHz to unlicensed devices and adopts C-V2X technology as the ITS delivery system. However, the rule was only effective in July 2021 when the FCC also permitted (through its waiver process) the deployment of C-V2X during the transition period to accelerate the changeover from DSRC to C-V2X. The waiver will allow Ford to move forward with its plan to launch C-V2X in the United States in 2022. Nevertheless, an ongoing appeal to FCC‘s decision, also filed in July 2021, is adding uncertainty to the industry. ABI Research expects Ford deployments to take place but on a much lower scale than previously envisioned.

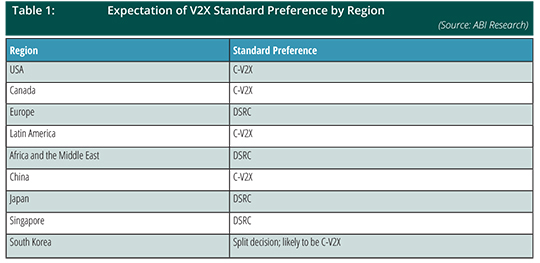

Other countries still facing V2X protocol uncertainly include Japan, Australia, Singapore, and South Korea. Below is ABI Research’s expectation of the standard preference by region based on commercial deployments, official announcements, and qualitative input from industry players. For more information, see ABI Research’s V2X Market Data (MD-V2X-101) and Semiannual Update: V2X (PT-2557).

Achieving Mass Adoption |

RECOMMENDATIONS |

Dual-radio solutions capable of broadcasting using C-V2X or DSRC are expected to accelerate V2X infrastructure deployments. These solutions provide infrastructure operators with the safety of complying with the selected communication protocol once an official decision has been made and adding a marginal capital expenditure of a second chip (approximately US$15) as compared with the installation costs. However, it is unlikely that these solutions will have the same effect on vehicles.

Considering the high production volume, dual-radio OBUs require a high investment and significantly increase the vehicle’s price per unit, making it unpractical for car OEMs, which are highly cost-sensitive. Therefore, automakers will have to either engage in large-scale deployments capable of shaping the country or region protocol preference—as done by VW in Europe—or wait for an official decision and risk losing a first-mover advantage. According to ABI Research’s interviews with vendors in the V2X supply chain, all OEMs’ next-generation platform requests for quotation feature V2X, and automakers such as Audi, GM, Stellantis, and Honda are likely to follow VW’s example. Unlike other players, Audi does not have the scale to shape the industry, but it could however enjoy a second-mover advantage in the United States after Ford’s deployment, for example.

While selecting a protocol is the main barrier for deploying informational/basic V2X uses cases, spectrum allocation will be the main challenge for deploying cooperative perception applications that are supported by next-generation V2X standards (Release 16 and 802.11bd) as a second channel is needed to carry large amounts of data. Europe is in a comfortable position as 10 MHZ channels are available, and there is also the possibility of releasing 20 MHz channels. China currently only has 20 MHz for Release 14, but the government plans to release another 40 MHz for Release 16 and to begin testing 5G new radio–V2X technology in 2025. The United States, however, has the most worrying situation; with the FCC’s reduction from 75 MHz to 30 MHz, if 20 MHz is used for Release 14, Release 16 will have only 10 MHz, and that will be insufficient. Thus, if the FCC’s decision is maintained, the country risks lagging behind others in the V2X race.