Next-Generation Automotive HMI

As carmakers look for new ways to attract customers and retain existing ones, a lot of attention is being paid to the automotive Human Machine Interface (HMI). Most car owners are already used to standard connectivity options and traditional displays. However, recent software developments are setting the stage for the driver User Experience (UX) to take a giant leap forward. These new technologies are exclusive to the premium consumer, but in a few years, they will catch on in the mid-level market.

In the automotive context, an HMI is what bridges the gap between driver and vehicle. This solution enables drivers or even passengers to communicate and engage with their vehicles in a more personalized way. Voice assistants, Head-Up Displays (HUDs), and sensors are just a few of the hardware and software that enables an HMI to work its magic. Not only does HMI software help keep drivers safe, but it also changes the way we interact with the outside world.

Historically, voice assistants in cars have been limited in terms of performance due to the limited capabilities of legacy automotive HMIs. Although most voice assistants can detect natural language, accents, and different languages, the full context of input isn’t always identified. But with new advancements in multimodal approaches, next-generation “personal assistants,” as they will be called, will leverage in-vehicle sensors that account for an individual's gesture, posture, gaze, and facial expression. In tandem with location intelligence, personal assistants will deliver a driver UX that traditional voice assistants lack.

Safety was initially the primary use case for vehicle voice control, such as avoiding hazards and monitoring drowsiness. But thanks to newer automotive HMIs, next-gen car assistants will go beyond safety and aims to enable drivers to learn more about their surroundings. Mercedes MBUX, leveraging Cerence’s software, allows drivers to simply look at a nearby Point of Interest (POI) and ask questions like “tell me more about that castle” or “what is that café on my left?” The technology powering this new feature uses environmental reconstruction, car sensor data like cameras and speakers, and existing hardware to identify the POI. There is also work being done to make it possible for drivers to make a payment from the POI, book reservations, buy tickets, and perform other transactions.

The downside to adding voice command to an automotive HMI is the high computing and memory requirements. Carmakers can use local edge computing for small tasks like turning on the radio or Air Conditioning (AC) and send computation-heavy tasks like searching for a nearby mall to the cloud. This balance keeps production costs down (for advanced edge hardware capabilities) while maintaining adequate local computing when needed. If a vehicle has a long life span, the automaker may choose to invest in edge computing because it ensures that customers can always use add-on services.

In the face of a new generation of HMI software, carmakers must decide whether to develop an in-house solution or use an existing solution. Some car brands like BMW, Volkswagen, and Mercedes prefer to develop their own car voice assistants, while other players like Volvo/Polestar and Stellantis are happy to use Google and Amazon, respectively. On the upside, leveraging existing automotive software reduces both development and time-to-market costs. But on the downside, these brands lose a sense of vehicle differentiation and control over UX/user data, which is highly sought after by carmakers.

In-vehicle displays are a key component of the new generation of automotive HMIs and are evolving rapidly. Not only has the size of in-vehicle displays increased, but the graphics power has too. This allows for the deployment of new features that have never been possible. For example, the Genesis GV80 uses input from an internal camera to issue a warning when a driver gazes at the cluster display for too long. HUDs, popular among French manufacturers, show all of a vehicle’s information on the windshield to prevent drivers from looking down at the cluster display. Both the advanced cluster display solution from Genesis and HUDs are still relatively rare technologies due to expensive implementation costs.

Augmented Reality (AR) is a very promising next-gen solution that completely changes the way drivers perceive external threats. With an AR HUD, the vehicle feeds information about the surrounding environment in real time straight to the windshield. Some of the use cases include vehicle distance warnings, lane departure warnings, and blind-spot detection warnings.

In addition to supporting Advanced Driver Assistance Systems (ADAS), AR HUDs can also display information about music playing or calendar reminders. The two primary challenges of AR HUDs are finding a solution that doesn’t seem obtrusive or overwhelms the driver with too much information, and the high costs. It won’t be until 2025 that this next-generation feature becomes available in mid-range cars.

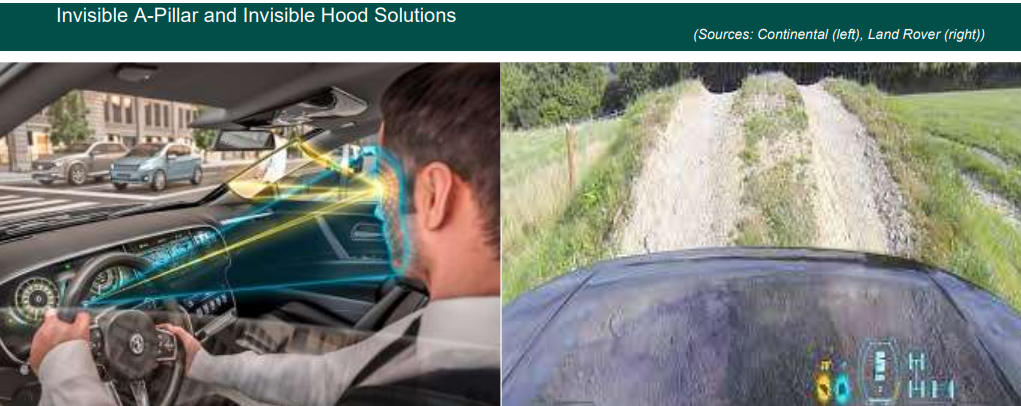

Transparent surfaces are another new component that will be integral to future automotive HMIs. Continental’s technology turns the A-pillars into Organic Light-Emitting Diode (OLED) displays and shows a live image feed of the exterior, in combination with tracking the diver’s head movements. What this does is create a dynamic extension of the surrounding environment that can help drivers make safer maneuvers. Range Rover launched the ClearSight Ground View technology alongside its 2018 Evoque. This new generation solution makes the hood transparent, allowing the driver to see the terrain below the vehicle when off-road.

The automotive industry, like so many other industries, is trading the product-first approach for a user-first approach. Moreover, growing consumer expectations and government safety regulations are also key catalysts to the new generation of automotive HMIs, which are the foundation of vehicular UX.

Going forward, silicon players must focus on providing flexible and affordable vehicle HMI solutions to gain a greater share in an ever-evolving automotive industry. And vehicle software providers must be aware that carmakers are constantly increasing the gap between hardware and software, and seeking more third-party data and software. This is in contrast to seeking a complete package. It’s also advisable for new software players in the automotive space to consider white labeling their technology if they want to penetrate greater market share. Finally, for carmakers, it’s imperative to design automotive HMIs that can pull data from multiple points, such as voice, sensors, and cameras, to realize a truly next-gen driver experience.

This Spotlight Includes: