Huawei Ratchets Up RAN Results in Q2 2013

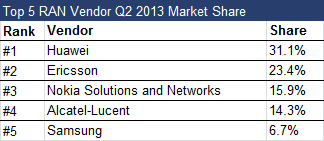

For the first half of 2013 Huawei reported RAN revenues of CNY 25.6 billion, representing an estimated sequential increase of 37.7% and 14.1% YoY for the second quarter of 2013. ABI Research estimates this to represent a 2Q 2013 market share of 31.1%, up 7.2 points from 1Q 2013 and up 2.5 points from the year-ago quarter, with an improvement in rank to #1 in 2Q 2013 from #2 in 1Q 2013. Huawei's QoQ growth in RAN revenue this quarter is well ahead of average seasonality for the quarter.

The only other vendor reporting a sequential growth in RAN revenue was Alcatel-Lucent whose RAN equipment revenue increased 3.4% QoQ to match average seasonality for Q2, and decreased 0.8% YoY to reach a value of $1,102 million, representing a RAN market share of 14.3%, a decrease of 0.3 points QoQ and 0.8% YoY. The company's market share rank position remains unchanged at #4.

“The Huawei 7.2 points gain in RAN share in the second quarter of 2013 came at the expense of the remaining 6 vendors we track,” says Nick Marshall, principal analyst at ABI Research. “The share gain was enough to return Huawei to the #1 position (which it held in 2012) with 31.1% and relegate Ericsson to the #2 spot - now trailing Huawei at 23.4% for the quarter.”

ABI Research has estimated the market share for the top 5 vendors and this is shown in the table below:

Mobile infrastructure RAN revenues grew 5.9% sequentially in the second quarter of 2013 to reach almost $7.7 billion; 4.8% higher than the same quarter a year ago and ahead of average seasonality for the second quarter thanks to strong LTE sales in many regions including North America and Latin America with industry-wide declines in GSM and CDMA sales.

Vendor revenues and market shares are tracked by ABI Research’s ”Mobile Infrastructure RAN Market Shares” Market Data that tracks base station deployments by technology, region, and country. The data also includes forecasts for new deployments, upgrades, and replacements annually through 2018, as well as operator base station spend estimates.

These findings are part of ABI Research’s Macro Basestations Research Service.

ABI Research provides in-depth analysis and quantitative forecasting of trends in global connectivity and other emerging technologies. From offices in North America, Europe and Asia, ABI Research’s worldwide team of experts advises thousands of decision makers through 70+ research and advisory services. Est. 1990. For more information visit www.abiresearch.com, or call +1.516.624.2500.

Contact ABI Research

Media Contacts

Americas: +1.516.624.2542

Europe: +44.(0).203.326.0142

Asia: +65 6950.5670

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions