Market Overview

The embedded Subscriber Identity Module (eSIM) market is gaining momentum, traditionally led by select mobile handset makers in the consumer space and specific industries like automotive in the Internet of Things (IoT) sector. According to ABI Research’s latest findings, published in February 2025, this market is diversifying. The rise of eSIM-capable and eSIM-exclusive devices in consumer markets, alongside the introduction of the SGP.32 standard boosting IoT applications, is broadening its scope. This creates a range of niches for providers to target. At the same time, the technology is evolving with new converged form factors and varied profile provisioning methods, adding complexity for vendors in product offerings and support.

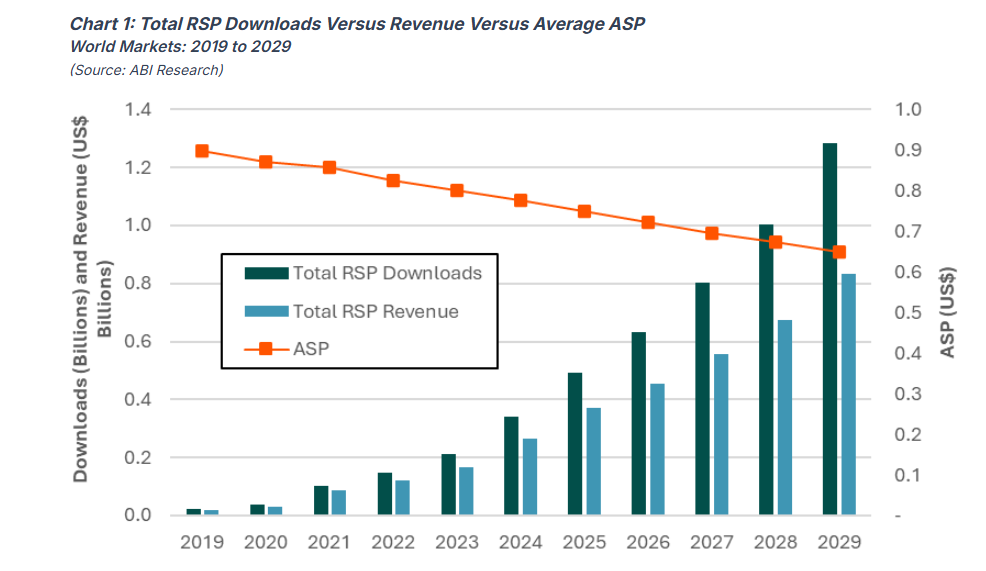

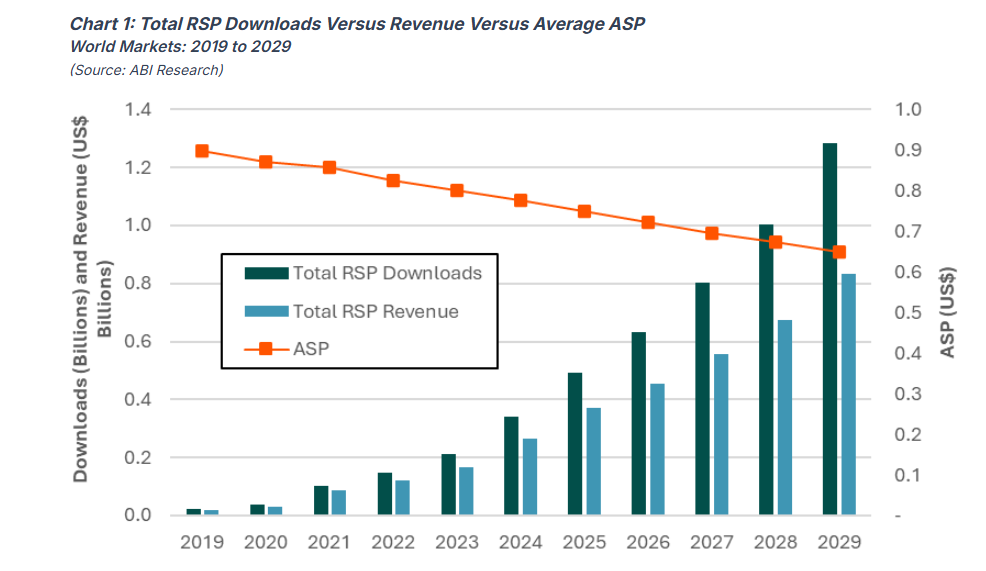

Business models are also shifting, with demand growing for scalable “as-a-Service” platforms and flexible billing to serve large-volume markets and specialized IoT use cases. A few dominant players such as Giesecke+Devrient (G+D) and Thales currently lead, but their adaptability will be critical as the market matures. Remote SIM Provisioning (RSP) revenue, a major segment, is set for strong double-digit Year-over-Year (YoY) growth, even as Average Selling Prices (ASPs) decline gradually due to pricing pressures tied to removable SIM cards and IoT competition. The rest of this Highlight outlines trends from the report and steps for eSIM industry players to stay competitive.

“As a substantial portion of the market, Remote SIM Provisioning (RSP) revenue is expected to achieve strong double-digit Year-over-Year (YoY) growth as adoption continues to increase, reflecting the overall trends of strong adoption. While the Average Selling Price (ASP) will decline gradually, the total opportunity for platform providers is high to capture the provisioning requirements of hundreds of millions of new profiles.” – Georgia Cooke, Research Analyst

Target Growth with SGP.32 Adoption

A major trend is the upcoming SGP.32 standard, expected to roll out in full swing in 1Q 2026. The report predicts that this will improve the eSIM framework, boosting profile downloads, especially in IoT areas like automotive. While consumer devices lead RSP downloads now and will through 2029, SGP.32 will shrink this lead by lifting IoT uptake and phasing down older SGP.02 profiles.

Vendors should design products that work with SGP.32, targeting IoT growth in sectors like automotive. Providers can build ties with industries set to adopt this standard heavily. Getting ready for 2026 positions companies to ride the wave of increased adoption.

Adapt to Diverse Technology Options

The findings point to a widening array of eSIM technologies, with mixed form factors and various profile setup methods offering users more options. This variety makes it trickier for vendors to decide what to produce and complicates support as eSIMs spread across consumer and IoT markets.

Tech companies should craft adaptable eSIM solutions that handle different designs and setup processes. Providers can bolster support systems to manage this growing complexity for customers in both consumer and IoT fields. Adjusting to these options keeps vendors competitive as the tech landscape broadens.

Meet Demand for Scalable Business Models

The report notes a shift in business approaches, with more demand for “as-a-Service” platforms and systems that support multiple clients at once. Flexible billing is becoming vital as eSIMs penetrate big markets and reach lower-tier operators and specific IoT uses, like manufacturing setups.

This change pushes providers to rethink how they operate. For example, Valid uses a managed service model to ensure rapid eSIM deployment for customers and the flexibility needed to scale in line with evolving industry trends.

Vendors should create platforms that scale easily and offer billing that bends to different needs. Operators can tweak services to fit smaller players and niche IoT demands, making eSIMs more accessible. Building these models now meets the market’s push for flexibility through 2029.

Leverage Partnerships for Market Leadership

The eSIM space is currently ruled by a few big names, but the report suggests their dominance hinges on adapting and teaming up effectively as the market evolves. Close partnerships will help these leaders hold their ground, especially as profile downloads surge from consumer handset trends and industrial standards.

Top providers should link up with handset makers and IoT sectors like automotive to keep their edge. Smaller players can partner with these giants to tap into their strengths. Forming these alliances now aligns with the report’s call for collaboration to maintain market leadership.

Key Companies

Access the Full Findings

For a deeper dive into the eSIM market and strategies to lead its growth, download the full report.