What State-Of-The-Art Technologies Enhance Indoor Cellular Networks?

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

Market Overview

- As many traditional Distributed Antenna Systems (DASs) struggle with indoor cellular network capacity issues and can’t support frequencies above 3 Gigahertz (GHz), Digital Indoor Systems (DISs) or Distributed Radio Systems (DRSs) have been developed to address these challenges.

- Several innovative technologies, as will be defined in the following sections, are being explored to further enhance indoor cellular connectivity.

- While new technologies are being implemented or undergoing development, the traditional DAS will still be on the market for the years ahead.

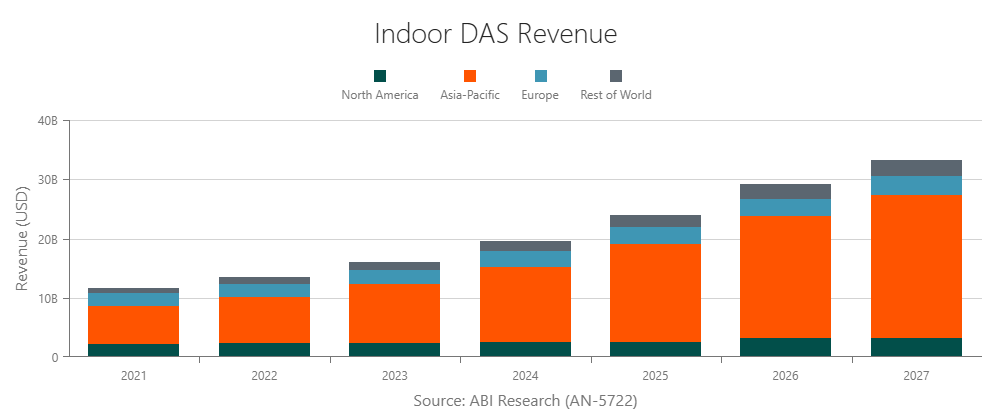

- Worldwide revenue for indoor DAS will grow at a Compound Annual Growth Rate (CAGR) of 19%, from US$11.7 billion in 2021 to US$33.3 billion in 2027.

- Asia-Pacific makes up the bulk of indoor DAS revenue—US$24 billion by 2027. That is a 3.73X increase from 2021.

- North American and European DAS markets will grow similarly, by 1.5X between 2021 and 2027, reaching US$3.3 billion.

- For the rest of the world, indoor DAS market revenue will increase by 2.9X—from a little less than US$1 billion in 2021 to US$2.7 billion by 2027.

- Active DAS/DRSs will continue to dominate the overall market, accounting for more than US$27 billion (out of US$33.3 billion total) in revenue in 2027. Passive DAS and repeaters will have revenue totals of US$3.9 billion and US$2.4 billion, respectively.

“Many traditional DASs are unable to support frequencies above 3 GHz and major reconstructive engineering work is needed to increase network capacity. Financially, overlaying a DRS is a cost-efficient solution compared to upgrading the entire DAS.” – Fei Liu

Key Decision Items

Network Operators Should Start Adopting Distributed mMIMO Technology

Network operators should view distributed Massive Multiple Input, Multiple Output (mMIMO) as an effective technological solution for enhancing indoor network performance, not to mention the improvement to an operator’s market competitiveness. Distributed mMIMO, which integrates mMIMO into indoor systems, provides gigabit connectivity and enables sustainable network capacity extension. In this scenario, the system has a geographically distributed set of arrays that can offer higher spectral efficiency and a broader coverage area.

Distributed mMIMO technology has been deployed at scale in several Chinese cities, as well as by LG U+ in South Korea. Due to its ability to deliver gigabit connectivity anywhere anytime, distributed mMIMO is an excellent match for hotspots and enterprise production systems, including the following:

- Airports

- Train stations

- Subways

- Shopping malls

- Stadiums

- Hospitals

- Exhibition centers

To ensure 5G success and assist vendors in improving the next generation of distributed mMIMO for 5.5G and 6G, network operators should begin adopting the technology sooner rather than later.

Equipment Vendors Dabbling in pCell Technology Should Test Using mmWave

pCell is a technology that works to exploit interference in wireless networks through large-scale coordination among distributed transceivers and synthesizes a cell for each user. All users use the entire spectrum capacity regardless of location, and there is no handover when users move within the coverage area. In other words, pCell multiplies the spectrum capacity with uniform and high data rates in the entire coverage area.

Although pCell has been commercialized (first by Artemis), it’s not entirely clear if the technology will be deployed at scale. Those network operators not inclined to engage with a small company are choosing to wait for major equipment vendors to deliver pCell solutions.

For vendors that are focused on pCell technology, it’s vital that you start testing solutions using Millimeter Wave (mmWave). Sub-6 Gigahertz (GHz) bands are likely to become congested by around 2025—meaning there will be a need for alternative options like mmWave. In the future, network operators will favor equipment vendors that offer products with both sub-6 GHz and mmWave.

Vendors and Operators Need to Play a More Influential Role in RIS Development

Reconfigurable Intelligent Surfaces (RISs), at least in the longer term, are going to be a key technology for enhancing indoor cellular network coverage. An RIS is a software-controlled solution that uses smart radio surfaces with a massive number of metamaterial elements to dynamically control and shape the radio signal. The technology is nearly passive, does not have power amplifiers, and does not transmit new waves, significantly lowering power consumption. RIS is expected to be implemented for 6G deployments, still some ways off. But that doesn’t mean research shouldn’t be carried out on the network technology.

Over the last several years, there has been considerable academic research on RIS. Organizations like the International Conference on Communications (ICC), the Global Communications Conference (GLOBECOM), European Telecommunications Standards Institute (ETSI), and China Communications Standards Association (CCSA) are just four major contributors to RIS research. Moreover, some vendors and network operators have shown curiosity about RIS, with some even conducting trials. As a RIS takes time and extensive experience to turn into a transformational technology, ABI Research believes industry players should start doing more to get involved. Vendors and network operators must provide clear feedback on where priorities should lie in terms of RIS direction.

Understand the Role of Holographic Beam Forming

Imagine if network service providers could reuse the same spectrum band everlastingly within a given spatial region. Well, with Holographic Beam Forming (HBF), this is possible. HBF narrow beamforming allows for a more refined communications protocol between the user and the base station. Moreover, the technology makes it possible for there to be multiple simultaneous transmissions under the same frequency band without any interference. The end result is a stronger signal delivered to mobile and stationary users.

It should be noted that HBF solutions are tailored for mmWave and software-defined antennas to employ the lowest possible architecture in terms of Size, Weight, Power, and Cost (SWaP-C). As mmWave spectrum is only available in a few countries, more countries need to acquire the mmWave spectrum if HBF is to expand. If mmWave spectrum isn’t released in more countries in the next 2 to 3 years, HBF will be restricted primarily to the United States.

Key Market Players to Watch

- Airspan

- Artemis

- China Telecom

- Ericsson

- Huawei

- Mavenir

- Orange

- Picocom

- Pivotal Commcare

- Qualcomm

- Radisys

- ZTE

Dig Deeper for the Full Picture

To learn more about the cruciality of indoor cellular networks for 5G—and later 6G—and the related technological advancements, download ABI Research’s Revolutionary Technologies for Indoor Cellular Networks research report.

Not ready for the report yet? Check out our following Research Highlights:

- Indoor 5G Energy Efficiency: Creating Greener, More Sustainable Buildings

- The Ultimate Gameplan for Advancing Public Safety Network Infrastructure

- Evaluating the Business Case for 5G FWA

This content is part of the company’s 5G & Mobile Network Infrastructure Research Service.

Related Research

Report | 1Q 2023 | AN-5722