Snapshot of the Vehicle-to-Everything (V2X) Market in 2022

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

Market Overview

Vehicle-to-Everything (V2X) is still very much in its early days and the technology is currently elusive in the mid- to low-tier car models. However, there will be considerable growth for the remainder of the decade and beyond, with regulation being a powerful catalyst toward adoption. Some of the market forecasts to know about include:

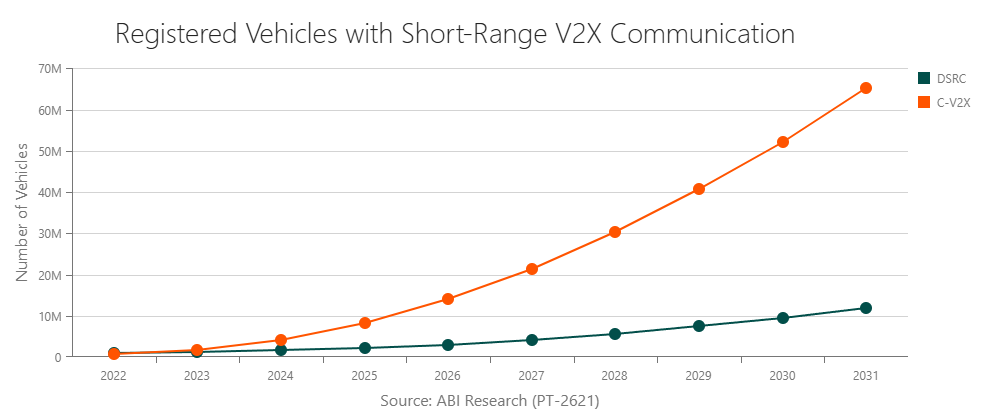

- The number of vehicles with Cellular V2X (C-V2X)/PC5 is expected to reach 65.2 million by 2031, growing at a Compound Annual Growth Rate (CAGR) of 65% between 2022 and 2031.

- On the other hand, there will be just 12 million registered vehicles with Dedicated Short-Range Communication (DSRC) in 2031, highlighting the industry preference for cellular V2X solutions.

- Although adoption rates for both technologies will be on par through 2023, C-V2X will begin to distance itself from DSRC in 2024, and the trend will only continue to exacerbate adoption.

- The prevalence of DSRC for V2X is almost entirely exclusive to European and Japanese Original Equipment Manufacturers (OEMs), with the 802.11p variety covering more than 99% of all DSRC deployments. Japan will be the only region where OEMs leverage 802.11bd, albeit to a small degree (18,420 shipments in 2031).

- By 2031, the installed base for operational Roadside Units (RSUs) will be 107 million worldwide, which is significantly up from the 12.4 million installed base in 2022. The United States and China account for three-quarters of the installed base.

- The V2X chipset supplier market share is as follows: Qualcomm (44%), NXP (35%), Huawei (13%), and Renesas (8%).

- 5G, which enables a host of brand new V2X use cases, will be available in 136.2 million of the 643.3 million total vehicles with cellular connectivity by 2030. Further, the biggest markets in the V2X space are China, the United States, and Western Europe.

“Regardless of the side that the industry players stand on, there is a consensus that 2027 is the new turning point for V2X, when a complete range of use cases, including Day Two use cases, will become part of the Euro NCAP scoring.”

Key Decision Items

Planning for the New Euro NCAP V2X Rating Scheme

As of right now, the plan is for V2X to be included in The European New Car Assessment Programme (Euro NCAP) rating scheme in 2025. Be that as it may, there are whispers that this could be pushed back to 2027, partly because there are concerns about time constraints in relation to testing protocol development, establishing a plentiful number of labs, and authenticating the capabilities of new vehicles.

In the Volkswagen Local Hazard Warning test in 2020, Euro NCAP only used the short-range communication technology ETSI Intelligent Transport System (ITS)-G5, raising doubts from OEMs about the organization’s commitment to tech neutrality. While the European Union (EU) will want its investment in ITS-G5 to bear fruit, OEMs should be confident that Euro NCAP will require vehicles to function with other technologies like Vehicle-to-Network (V2N)/long-range communication and Long Term Evolution (LTE)-V2X PC5 radios.

In Europe, one truck OEM and a private vehicle OEM, rumored to be Scania and Volvo, plan to deploy ITS-G5 in 2023. For European OEMs, it’s optimal to be patient and wait until Euro NCAP announces which V2X use cases its protocol will include. Then, the most applicable technologies (V2N, PC5, ITS-G5) can be selected for production.

U.S. Automotive Players Need the Backing of the Government

Unlike in Europe, U.S. OEMs have not had the benefit of a proactive governing body that’s excited about the benefits of V2X. As expressed in a recent waiver submission to the Federal Communications Commission (FCC), there is clear interest from carmakers to bring widescale C-V2X to the United States. Jaguar Land Rover, Audi, and Ford, in conjunction with equipment makers and the departments of transportation of Utah and Virginia, seek to free up the 5.9 Gigahertz (GHz) spectrum to make C-V2X safety services possible. To prepare for a hypothetical waiver, OEMs in the region should capitalize on the benefits of being a first-mover by gathering/allocating the resources for rapid deployment. However, it’s important to see how C-V2X deployments play out for the carmaker that applied for an FCC waiver before allocating significant financial investment to vehicle and infrastructure deployments.

For U.S. companies and local governments that focus on infrastructure (Roadside Units (RSUs), sensors, etc.), V2X funding can be justified in the 5-year US$5 billion Safe Streets and Roads for All (SS4A) discretionary program, brought about by the Bipartisan Infrastructure Law (BIL). Part of the Action Plan includes eliminating roadway fatalities and serious injuries, two issues that C-V2X helps solve. Forward-thinking infrastructure players will start devising ways to implement V2X strategies that take advantage of the funding.

Making Use of Long-Range Communication

In a world where short-range communication occupies most of the attention in V2X, the role of C-Roads cannot be understated. The organization works closely with the European Member States to test and deploy Cooperative Intelligent Transport System (C-ITS) services in V2X adoption, most notably with a key focus on long-range communication. C-Roads aims to find new use cases for V2X technologies, such as communicating with emergency services or public transport passengers. Without a doubt, the work being carried out by C-Roads will be a key enabler of long-range communication V2X applications, so it’s worth keeping an eye on ongoing projects.

The following are some of the Day One projects that C-Roads focuses on:

- Alert wrong-way driving

- In-vehicle signage

- Slippery road warning

- Weather conditions

- In-vehicle speed limits

- Time to green

- Smart routing

- Public transport priority

Settling the Compatibility Issues between New Radio and Legacy Radio

With the automotive industry’s eyes on New Radio (NR)-V2X PC5 for the future of V2X radio, this presents a potential challenge. As pointed out inpresentation, NR-V2X PC5 is not backward compatible with legacy LTE-V2X PC5. This necessitates carmakers to install an additional radio by the time NR-V2X PC5 becomes commercially available if the vehicle will be able to communicate with existing vehicles on the road.

Furthermore, NR-V2X PC5, like all PC5 technologies, does not work with 11p. As a result, automakers that plan on migrating to NR-V2X PC5—but use 11p for Day One V2X use cases today and for the next few years—will need to install an additional 802.11p/ITS-G5 radio for continued communication with their older vehicle models.

One way to simplify these compatibility issues is by deploying a hybrid solution like the TEKTON3 product from Autodesk. This 5G C-V2X sensor chipset comes packed with both Day One and Day Two radios that operate simultaneously. While the Day One radio supports either LTE-V2X PC5 or 11p/ITS-G5, the Day Two radio supports either NR-V2X PC5 or 802.11bd. However, don’t expect this solution to be available until at least 2026.

Looking into the Situation in China and Japan

To comply with the 2024 China NCAP standard, OEMs must work toward making C-V2X the new norm. Once 2024 and 2025 come around, large-scale deployments will begin to take place in China. 5G integration with V2X is more prevalent in China than anywhere else, with carmakers like MG, Great Wall Motors, Human Horizons, and Ford already deploying it commercially.

In Japan, there is serious discussion about launching V2X in the 5.9 GHz band. The reason for doing so is that 5.9 GHz is well suited to handle the rapid traffic increase the country is experiencing. In June 2022, a Japanese delegation visited Europe to observe several C-ITS deployments in the region. On that account, there’s an expectation that Japan will proceed with V2X deployment in a comparable way to Europe.

Using 5G to Enhance V2X

As carmakers start gearing up for the software-defined vehicle, about 80% to 99% of new Requests for Quotes (RFQs) from car OEMs are based on 5G. Compared to other countries, China is far ahead of the pack in 5G V2X deployment—with numerous car models sporting the cellular technology. With that said, BMW already offers 5G connectivity to European and U.S. consumers via its iX and i4 vehicles. Moreover, Audi and General Motors (GM) have plans for large-scale 5G deployment in the United States by 2024.

5G is also a key enabler of NR-V2X PC5, a next-generation radio that will be in production in 2026 to 2027. NR-V2X PC5 will bring with it advanced V2X capabilities, especially for autonomous driving use cases, all thanks to its Ultra-Reliable Low Latency Communication (URLLC) and Sidelink communication. The industry is anticipated to push toward NR-V2X for mission-critical Day Two use cases.

Key Market Players to Watch

- Autotalks

- Cohda Wireless

- Commsignia

- Ericsson’s Connected Vehicle Cloud (CVC)

- HARMAN

- MicroSec

- Minima

- Modus Condito

- Nokia

- NXP

- Qualcomm Technologies

Dig Deeper for the Full Picture

To take a more in-depth look at the world of V2X and the key trends that are reshaping the automotive industry, download ABI Research’s V2X Semiannual Update: 1H 2022 presentation.

Not ready for the report yet? Check out our Electric Vehicle Smart Charging: Preventing the Dreaded Grid Blackout Research Highlight. This content is part of the company’s Smart Mobility & Automotive Research Service.

- Competitive & Market Intelligence

- Executive & C-Suite

- Marketing

- Product Strategy

- Startup Leader & Founder

- Users & Implementers

Job Role

- Telco & Communications

- Hyperscalers

- Industrial & Manufacturing

- Semiconductor

- Supply Chain

- Industry & Trade Organizations

Industry

Services

Spotlights

5G, Cloud & Networks

- 5G Devices, Smartphones & Wearables

- 5G, 6G & Open RAN

- Cellular Standards & Intellectual Property Rights

- Cloud

- Enterprise Connectivity

- Space Technologies & Innovation

- Telco AI

AI & Robotics

Automotive

Bluetooth, Wi-Fi & Short Range Wireless

Cyber & Digital Security

- Citizen Digital Identity

- Digital Payment Technologies

- eSIM & SIM Solutions

- Quantum Safe Technologies

- Trusted Device Solutions