Several new mobile trends have emerged recently, such as the advent of Generative Artificial Intelligence (Gen AI), foldable devices, satellite connectivity, Embedded Subscriber Identity Module (eSIM), and Ultra-Wideband (UWB). Will these innovations find success in the mobile device markets? ABI Research’s Emergent Mobile Device Technology Tracker Market Data Overview: 3Q 2024 reviewed these five market-defining mobile trends in 2024 and beyond. This post will summarize our findings from the report, providing a data-supported outlook for these promising mobile technologies.

Table of Contents

- Generative AI

- Foldable Displays

- Satellite-Enabled Smartphones

- eSIM in Mobile Devices

- Ultra-Wideband Connectivity

1. Generative AI

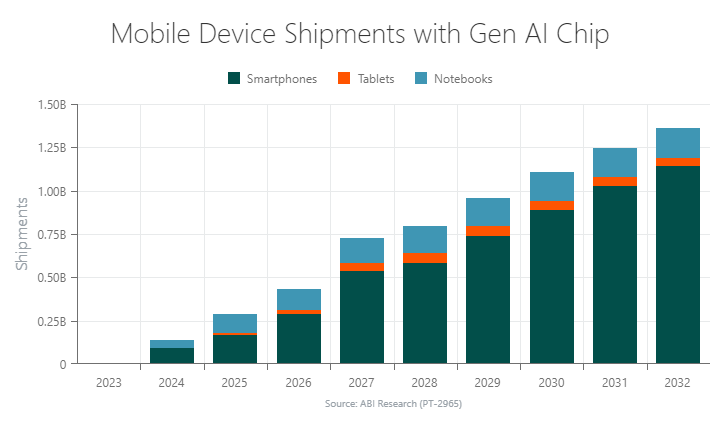

Gen AI is a key driver for restimulating the mobile market. Smartphones embedded with Gen AI can support numerous applications that conventional devices cannot access. The use of Gen AI chips in tablets is expected to see some traction from 2025, while embedded AI in personal computers will witness a profound sea change in 2024.

For example, on-device AI can help users manage their smart home appliances to save money on energy usage. It can also automate the tedious process of filing taxes. Gen AI is also used for advanced voice assistants and smart photo use cases. These productivity applications and user experiences powered by Gen AI will help reduce mobile device replacement cycles. Chipsets from Apple, Google, MediaTek, AMD, Intel, and Qualcomm account for the bulk of Gen AI-enabled devices, including smartphones, tablets, and laptops. The availability and choice of chipsets driving embedded AI in Personal Computers (PCs) will help grow the market extensively. This is coupled with Microsoft also looking at launching Windows 12 with AI at the fore in 2025.

ABI Research forecasts that 90 million smartphones will ship with Gen AI chips in 2024, representing 7% of total shipments for the year. Gen AI will reach a smartphone penetration rate of 79% by 2032, reflecting the rapid growth in AI-based mobile devices.

2. Foldable Displays

Foldable devices are still trying to find footing in the mobile market, accounting for just 3% of total shipments in 2024 (24.3 million smartphone shipments). By 2032, that number will only increase by two percentage points to 5%.

Despite user experience upgrades such as thinner designs, better hinges, and improved durability, consumers still hesitate to purchase foldable mobile devices. This is due to high costs and smartphone manufacturers' inability to create a compelling reason to actually purchase a foldable product. Companies must demonstrate key use cases, noticeable benefits, and added functionalities of a foldable device. Concurrently, they must also drive down price points if the sector is to improve market share.

3. Satellite-Enabled Smartphones

The next mobile trend our analysts identified is the integration of satellite connectivity into devices. Satellite connectivity has the potential to bridge the digital divide for millions of mobile device users. These Non-Terrestrial Networks (NTNs) are not bound by the geographical barriers that terrestrial networks face. Seeing this opportunity, many smartphone manufacturers and connectivity providers have developed NTN mobile solutions.

Apple and Huawei launched their first satellite-enabled smartphones in September 2022. This kickstarted a trend for other companies supporting satellite-based mobile device connections, including T-Mobile, AT&T, ZTE, Motorola, OPPO, Xiaomi, HONOR, SpaceX, and Vivo. Chipset suppliers such as Qualcomm and MediaTek have also been active in NTN smartphone support.

ABI Research expects satellite connectivity to hold a massive opportunity in the mobile space. The number of mobile devices shipping with NTN capabilities will increase by 38% in 2024, reaching 72 million shipments. By 2032, our analysts expect 42% of total mobile device sales to support satellite communications technology— equating to 612 million units.

4. eSIM in Mobile Devices

Embedded Subscriber Identify Module (eSIM) is increasingly used in consumer devices. In 2023, 308 million mobile devices shipped with eSIM capabilities, with a 24.2% penetration rate. This year, we expect further growth for eSIM, although manufacturers primarily focus on eSIM for flagship devices.

Apple is at the forefront of the eSIM market, with its entire range of smartphones supporting eSIM-only in the United States. Samsung has also shown intent to use eSIM across its range of smartphones—not just flagship devices.

eSIM is expected to be introduced to other mobile markets, such as Europe and Asia. China is rumored to support the technology in 2025, significantly expanding the addressable market for eSIM in mobile products. By 2032, ABI Research forecasts eSIM shipments to eclipse the 1 billion mark.

A trend worth watching is the use of 3-in-1 converged eSIM solutions—combining eSIM with Near Field Communication (NFC) and Secure Element (SE) functionality. This convergence enables a mobile device to leverage close proximation authentication while maintaining eSIM functionality.

The 3-in-1 convergence makes perfect sense for Apple and Samsung, given their dominance in mobile payments—a key use case for NFC. Apple is expected to launch 3-in-1 integration into its smartphones, tablets, and smartwatches in 4Q 2025.

5. Ultra-Wideband Connectivity

Ultra-Wideband (UWB) connectivity was first introduced to mobile devices in 2019. Its adoption has grown substantially, with roughly 300 million device shipments supporting UWB in 2023. Like other mobile device sectors, Apple is a key player in the UWB space via its own UWB chip. Other solution providers include Qorvo, NXO, and chipset suppliers Infineon, STMicroelectronics, and Qualcomm.

The appeal of mobile UWB is its multi-functional nature. It can support use cases across secure ranging, sensing and radar, and low-latency networking/data capabilities. The added benefits of using 6 Nanometer (nm) process nodes for UWB chips will also help propel the technology’s growth rate across the mobile market.

While UWB has clear potential in smartphones, its use in other devices such as PCs, notebooks, tablets, smartwatches, and other areas will be key to help it kick-start a new ecosystem of UWB-connected devices. These UWB-enabled devices should provide unique benefits over alternative technologies, such as high-performance positioning, sensing, and data communications. UWB will be supported by more than 1 billion mobile devices by 2032, with an attach rate of 81% and 50% for wearables and smartphones, respectively.

Learn More

Visit ABI Research’s 5G Devices, Smartphones & Wearables Research Service page to identify more mobile trends that can help your organization optimally plan product rollouts.